Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Silver Cloud Computing is a company that provides cloud computing services. The company commenced operations on March 1, 2016. It acquired financing from the issuance

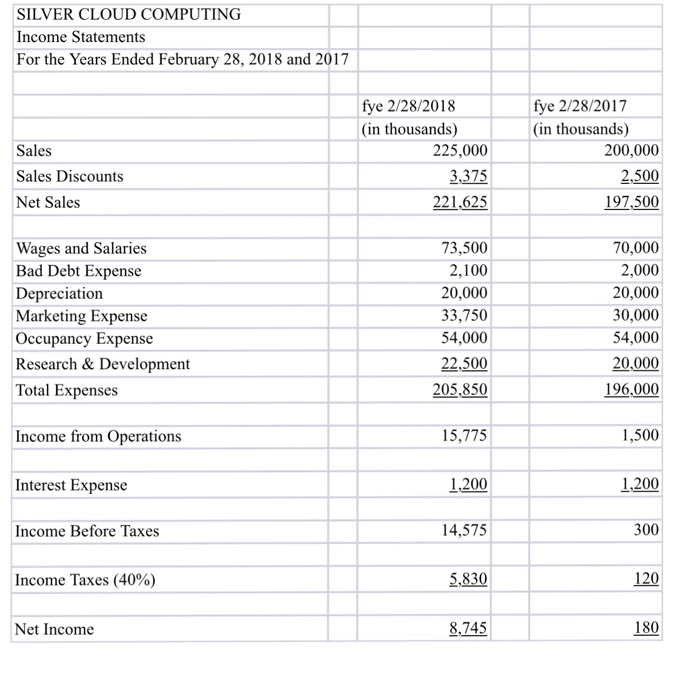

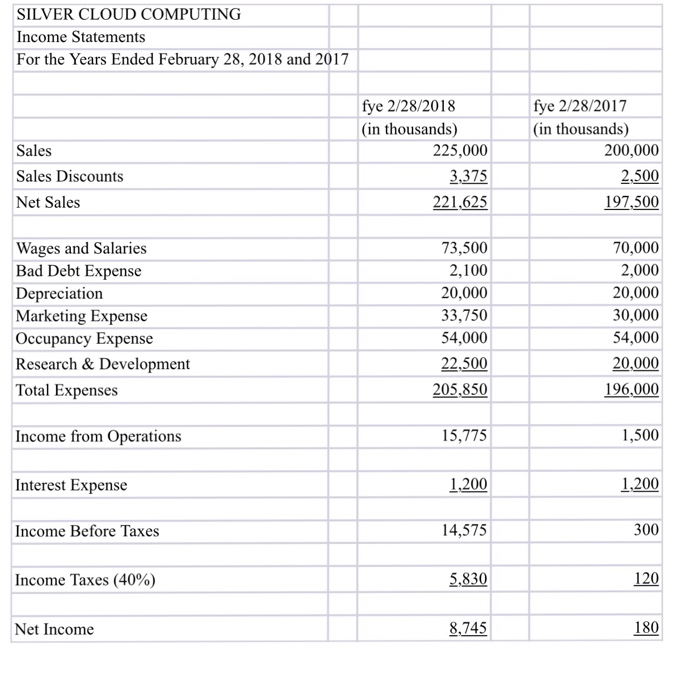

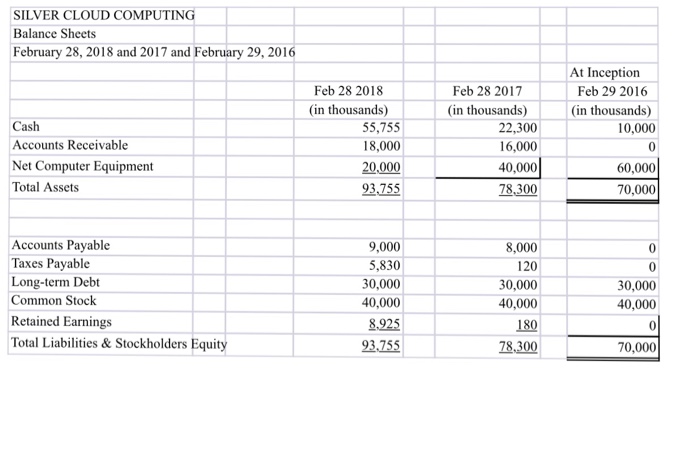

Silver Cloud Computing is a company that provides cloud computing services. The company commenced operations on March 1, 2016. It acquired financing from the issuance of common stock for $40,000,000 and issuance of 4% bonds that mature in 2026 for $30,000,000. The income statements and balance sheets for the first two years are provided in a separate Excel spreadsheet. All amounts are in thousands.

Required:

The Chief Executive Officer (CEO) is interested in increasing sales and decreasing expenses. You have been requested to prepare a report that provides analysis of the financial statements and recommendations to improve the financial performance of the company. Your report should include the following items:

1. Prepare common sized financial statements for both years and provide comments on the differences between the years. Are there any areas of concern?

2. Calculate the following ratios and provide an analysis of the company based on the ratios:

a. Days Sales Outstanding

b. Profit Margin

c. Asset Turnover

d. Return on Assets

e. Financial Leverage

f. Return on Equity

g. PPE Turnover

h. Total Liabilities to Equity

i. Times Interest Earned

3. Based on the financial statements provided, prepare a statement of cash flows for the year ended February 28, 2018.

4. The company is currently providing sales discounts of 2% if accounts receivable are paid within 10 days. The net amount is due in 30 days. The CEO is recommending discontinuing the sales discounts and changing payment terms to net 30. Comment on the potential impacts to the company of this change.

5. The computer equipment was acquired 2 years ago at the start of the business. Depreciation of the computers was calculated using straight-line depreciation over a 3 year period with no salvage value. The CEO is recommending that the computer equipment not be replaced for another 3 years and extending the lives of the current computer equipment to 5 years. Comment on the potential impacts to the company of this change.

6. The company was the victim of a cyber attack. It is not yet known the extent of information that was obtained. The company may be subject to lawsuits as a result of the security breach. Discuss the impacts this may have on the companys financial statements.

7. The CEO would like to pay dividends to the stockholders. Should the company pay dividends to the shareholders and how would this impact the companys financial statements?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started