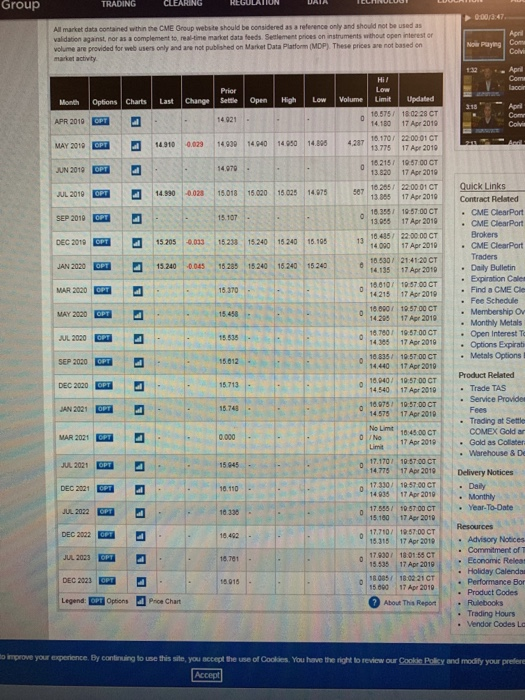

Silver long hedge using futures contracts Suppose that you are a silver fabricator. You will acquire 2,000,000 troy ounces of silver at the prevailing market price on the maturity date in December, 2017 from your long-time business partner. But, you worry about the uncertainty in the market price of silver in the future. Hence, you decide to use Globex ("online") silver futures contracts to hedge risk. You will place an order of silver futures contracts at the last closing price of July futures the date when you enter into the futures contracts. (1) Which type of hedge, between short and long, has to be used? (2) What is the contract size of the silver futures per one contract? How many contracts do you have to trade? the snapshot of the price listing. 2017 are $11 per ounce. Find out profits of the unhedged spot position, futures futures position) $26 per ounce. Find out profits of the unhedged spot position, futures position (3) State the December futures price (last closing price) that you determined. Attach (4) Assume that both the spot and futures prices on the December maturity date, position and hedged position. (Hedge position- unhedged spot position + (5) Assume that both the spot and futures prices on the December maturity date are and hedged position. (6) Discuss the effectiveness of your hedge. (7) Now, suppose that you don't have to acquire 2,000,000 ounces of silver from your business partner at the spot market in July. You will directly use the silver futures market to acquire silver and to hedge price risk. Determine the cost to acquire silver of 2,000,000 ounces in the futures market only. Explain this hedge and compare with the hedge in (1)~ (5). Direction Only hand written submission is allowed. Your answer shouldn't be longer than 2 pages. Get the relevant information from the CME Group: " http://www.cmegroup.com/trading/metals/precious/silver.html Use the date when you start this assignment to determine the closing price. Use two decimal values. For example if the closing price was 32.065, then use 32.07. . Group P000/3:47 All market data contained wthin the CME Group website should be considered as a reference only and should not be used as validation against, nor as a complement to, real-time market data feeds. Seelement prices on instruments without open interest or volume are provided for web users only and are not published on Market Data Platform (MDP) These prices ave not based on market activity Nowr Paying Com Colvi Month Options Charts Last Change Set Open HighLow Volume LimitUpdated PR 2019 CPT 16.575/ 18.0228 CT 4.180 17 Apr 2010 18.170 220001 CT 4,237| t1775|17A-r2010 16215/ 195700 CT 3.820 17 Apr 2010 11 910 1-0023 i 1493e 149sa | 14806 | :14g40 MAY 201e UN 2019 OPT JUL 2010 m SEP 2010 m DEC 2010 m JAN 2020 Em MAR 2020 OPT MAY 2020 OPT UL 2020 OPT 4.970 14.990 1-0028 | 15.018 | 15020 | 15025 | 14.975 567|13 | 17Apr 2010 .3551 19:57 00 CTCME ClearPort 10.435/ 22.00 00 CT 530/ 2141:20 CT 15.107 13.0 17 Apr 2019CMEClearPort 13 1400 | 17Apr 2010 | . ClearPort .CME ClearPort Brokers 15205 |4.033 115233 | 15240 i 15240 | 15.105 Traders . Dely Bulletin 13.240 0045- 15285 15240 15240 1524 1 Daily Buletin 14135 17Apr 2010 Ex ration Cale Fee Schedule Monthly Metals Options Expirab 10.57 00 CT 18010 Find a CME Cle " 14215 17Apr 2019 . 18.000 19.57 00 CT 14.298 17 Apr 2010 . Membership O 15.458 18 760 19 57 00 CT 14.305 17 Apr 2019 | * Open Interest Ta 15.535 5.012 5 713 15.74 * Metals Optionst Product Related . Trade TAS SEP 300 DEC 2020 OPT A 2021 OPT MAR 2021 CPT 18835 / 19:57.00 . 4.440 17 Apr 2016 940 1957 00 CT : 17 Apr 2010 : 14 540 Service Provides Fees 10.975 10:57.00 CT 14575 17 Apr 2019 No Lint | 45.00 CT Trading at Settle COMEX Gold an Gold as Collster 0 No 17 Apr 201 0.000 17.170 10:57 00 CT 14775 | 17 Apr 2019 . 5 945 Delivery Notices DEC 2021 14.935 17 Apr 2019 7.555 10 57.00 CT 15.180 17 Apr 201D 17,710/ 5700 CT 15.315 17 Apr 2019Advisory Notices 17S30 / 180158 CT 15.535 17 Apr 2019 ,soas/18 02 21 CTI . . Performance Bor 5 600 17 Ape 2010 Monthly Year-To-Date . 2022 OPT 16.338 18.402 18.701 1.915 DEC 2022 of T Economic Releas DEC 2023 OPT Legend: OPT Options Price Chart Product Codes About This RepTrading Hours A Fulebooks Vendor Codes Lo . o improve your experience. By continuing to use this site, you accept the use of Cookies You have the right to review our Cookie Policy and modify your prefere