Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Silverline Freight Company started construction of a combination office and warehouse building for its own use at an estimated cost of $3,540,000 on January 1,

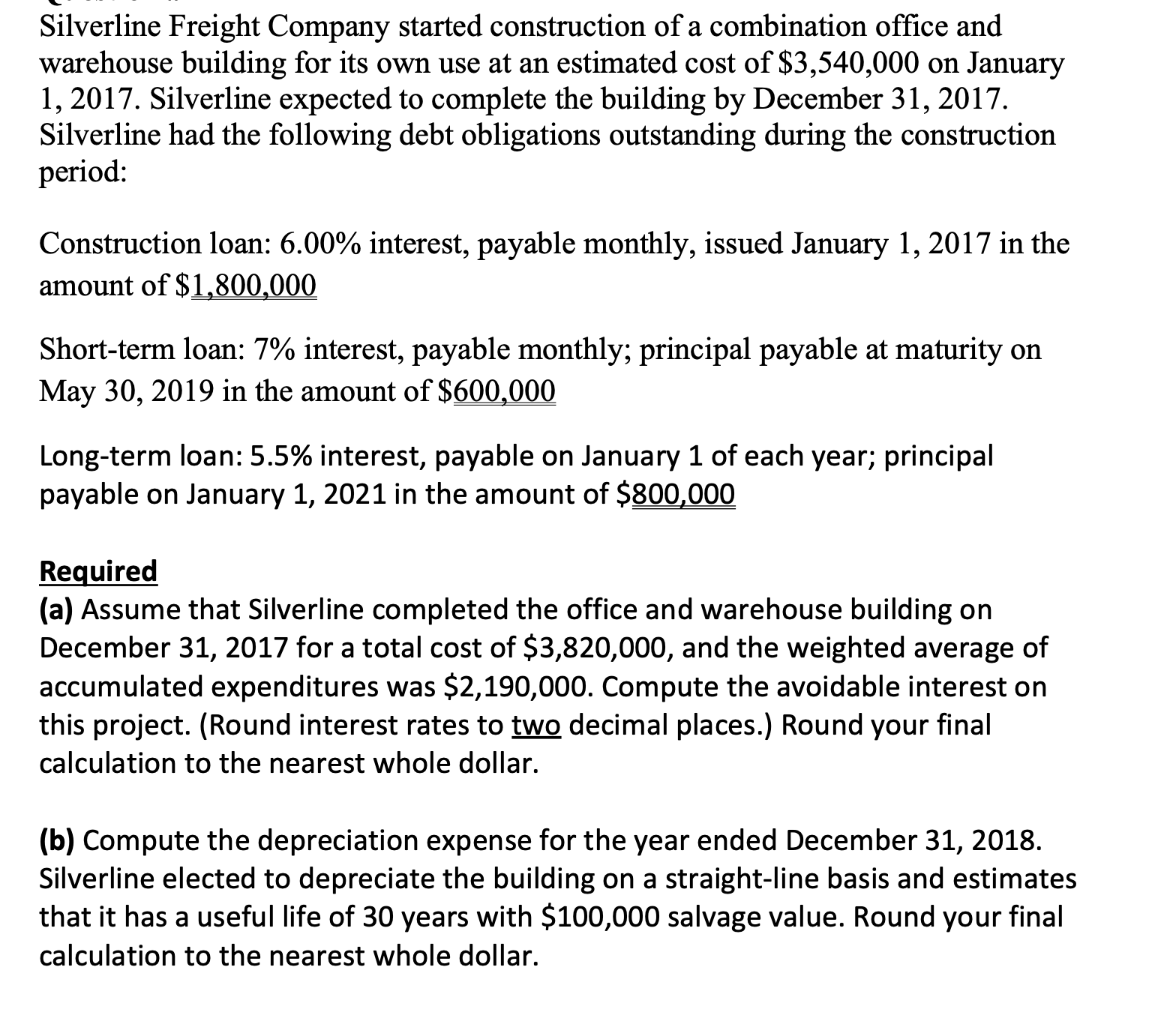

Silverline Freight Company started construction of a combination office and warehouse building for its own use at an estimated cost of $3,540,000 on January 1, 2017. Silverline expected to complete the building by December 31, 2017. Silverline had the following debt obligations outstanding during the construction period: Construction loan: 6.00% interest, payable monthly, issued January 1, 2017 in the amount of $1,800,000 Short-term loan: 7% interest, payable monthly; principal payable at maturity on May 30, 2019 in the amount of $600,000 Long-term loan: 5.5% interest, payable on January 1 of each year; principal payable on January 1, 2021 in the amount of $800,000 Required (a) Assume that Silverline completed the office and warehouse building on December 31, 2017 for a total cost of $3,820,000, and the weighted average of accumulated expenditures was $2,190,000. Compute the avoidable interest on this project. (Round interest rates to two decimal places.) Round your final calculation to the nearest whole dollar. (b) Compute the depreciation expense for the year ended December 31, 2018. Silverline elected to depreciate the building on a straight-line basis and estimates that it has a useful life of 30 years with $100,000 salvage value. Round your final calculation to the nearest whole dollar

Silverline Freight Company started construction of a combination office and warehouse building for its own use at an estimated cost of $3,540,000 on January 1, 2017. Silverline expected to complete the building by December 31, 2017. Silverline had the following debt obligations outstanding during the construction period: Construction loan: 6.00% interest, payable monthly, issued January 1, 2017 in the amount of $1,800,000 Short-term loan: 7% interest, payable monthly; principal payable at maturity on May 30, 2019 in the amount of $600,000 Long-term loan: 5.5% interest, payable on January 1 of each year; principal payable on January 1, 2021 in the amount of $800,000 Required (a) Assume that Silverline completed the office and warehouse building on December 31, 2017 for a total cost of $3,820,000, and the weighted average of accumulated expenditures was $2,190,000. Compute the avoidable interest on this project. (Round interest rates to two decimal places.) Round your final calculation to the nearest whole dollar. (b) Compute the depreciation expense for the year ended December 31, 2018. Silverline elected to depreciate the building on a straight-line basis and estimates that it has a useful life of 30 years with $100,000 salvage value. Round your final calculation to the nearest whole dollar Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started