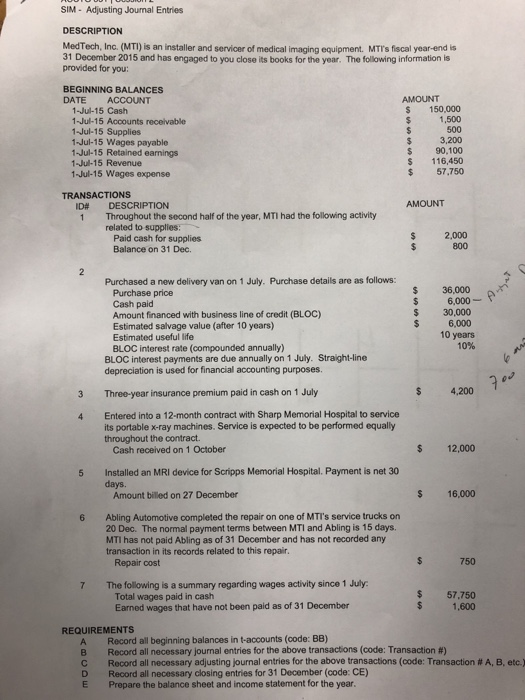

SIM Adjusting Jounal Entries DESCRIPTION MedTech, Inc. (MTI) is an installer and servicer of medical imaging equipment. MTI's fiscal year-end is 31 December 2015 and has engaged to you close its books for the year. The following information is provided for you: BEGINNING BALANCES DATE ACCOUNT AMOUNT 1-Jul-15 Cash 1-Jul-15 Accounts receivable 1-Jul-15 Supplies 1-Jul-15 Wages payable 1-Jul-15 Retained earnings 1-Jul-15 Revenue 1-Jul-15 Wages expense S 150,000 1,500 500 3,200 S 90,100 $ 116,450 $57,750 TRANSACTIONS AMOUNT ID# DESCRIPTION Throughout the second half of the year, MTI had the following activity related to supplies: 1 Paid cash for supplies Balance on 31 Dec. 2,000 800 Purchased a new delivery van on 1 July. Purchase details are as follows: $ 36,000 Purchase price Cash paid Amount financed with business line of credit (BLOC) Estimated salvage value (after 10 years) Estimated useful life BLOC interest rate (compounded annually) 6,000-p $ 30,000 6,000 10 years 10% BLOC interest payments are due annually on 1 July. Straight-ine depreciation is used for financial accounting purposes. 3 Three-year insurance premium paid in cash on 1 July 4,200 Entered into a 12-month contract with Sharp Memorial Hospital to service its portable x-ray machines. Service is expected to be performed equally throughout the contract 4 Cash received on 1 October $ 12,000 Installed an MRI device for Scripps Memorial Hospital. Payment is net 30 days. 5 Amount billed on 27 December $ 16,000 Abling Automotive completed the repair on one of MTI's service trucks on 20 Dec. The normal payment terms between MTI and Abling is 15 days. MTI has not paid Abling as of 31 December and has not recorded any transaction in its records related to this repair. 6 Repair cost 750 7 The following is a summary regarding wages activity since 1 July Total wages paid in cash Earned wages that have not been paid as of 31 December 57.750 1,600 REQUIREMENTS A Record all beginning balances in t-accounts (code: BB) B Record all necessary journal entries for the above transactions (code: Transaction #) C D E Record all necessary adjusting journal entries for the above transactions (code: Transaction # A, B, et Record all necessary closing entries for 31 December (code: CE) Prepare the balance sheet and income statement for the year