Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Simba and Nala were in partnership trading as Hakuna Matata, sharing profits and losses in the ratio of 3:2. The draft statement of financial

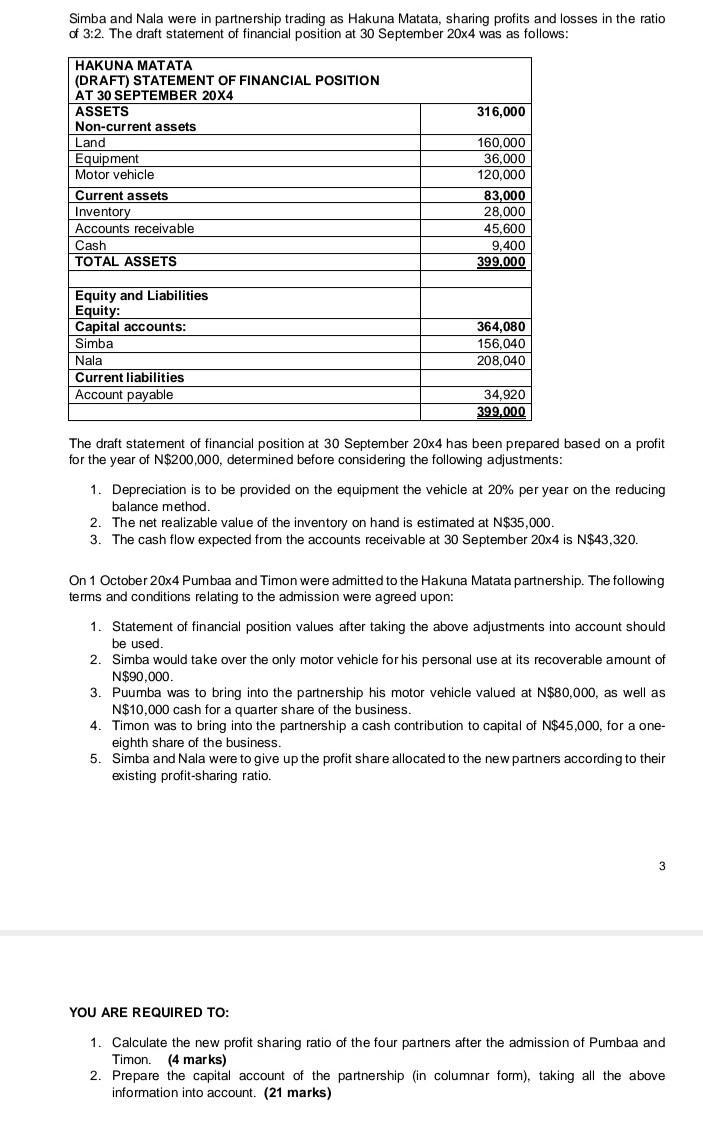

Simba and Nala were in partnership trading as Hakuna Matata, sharing profits and losses in the ratio of 3:2. The draft statement of financial position at 30 September 20x4 was as follows: HAKUNA MATATA (DRAFT) STATEMENT OF FINANCIAL POSITION AT 30 SPTEMBER 20X4 ASSETS Non-current assets Land Equipment Motor vehicle 316,000 160,000 36,000 120,000 83,000 28.000 Current assets Inventory Accounts receivable Cash TOTAL ASSETS 45,600 9,400 399.000 Equity and Liabilities Equity: Capital accounts: Simba 364,080 156,040 Nala 208,040 Current liabilities Account payable 34,920 399,000 The draft statement of financial position at 30 September 20x4 has been prepared based on a profit for the year of N$200,000, determined before considering the following adjustments: 1. Depreciation is to be provided on the equipment the vehicle at 20% per year on the reducing balance method. 2. The net realizable value of the inventory on hand is estimated at N$35,000. 3. The cash flow expected from the accounts receivable at 30 September 20x4 is N$43,320. On 1 October 20x4 Pumbaa and Timon were admitted to the Hakuna Matata partnership. The following terms and conditions relating to the admission were agreed upon: 1. Statement of financial position values after taking the above adjustments into account should be used. 2. Simba would take over the only motor vehicle for his personal use at its recoverable amount of N$90,000. 3. Puumba was to bring into the partnership his motor vehicle valued at N$80,000, as well as N$10,000 cash for a quarter share of the business. 4. Timon was to bring into the partnership a cash contribution to capital of N$45,000, for a one- eighth share of the business. 5. Simba and Nala were to give up the profit share allocated to the new partners according to their existing profit-sharing ratio. 3 YOU ARE REQUIRED TO: 1. Calculate the new profit sharing ratio of the four partners after the admission of Pumbaa and Timon. (4 marks) 2. Prepare the capital account of the partnership (in columnar form), taking all the above information into account. (21 marks)

Step by Step Solution

★★★★★

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

1st Part Calculation of new partner sharing ratio among Simba nala Pumba and Timon Old Ration betwee...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started