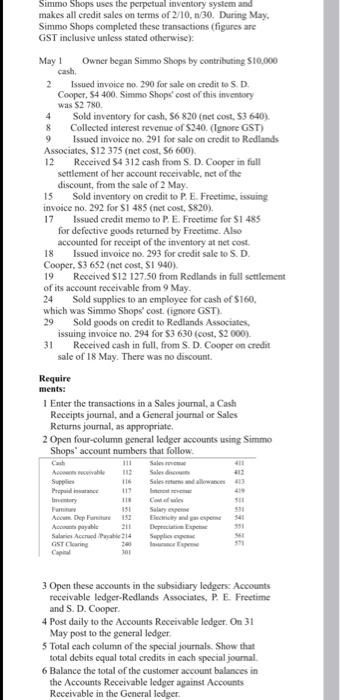

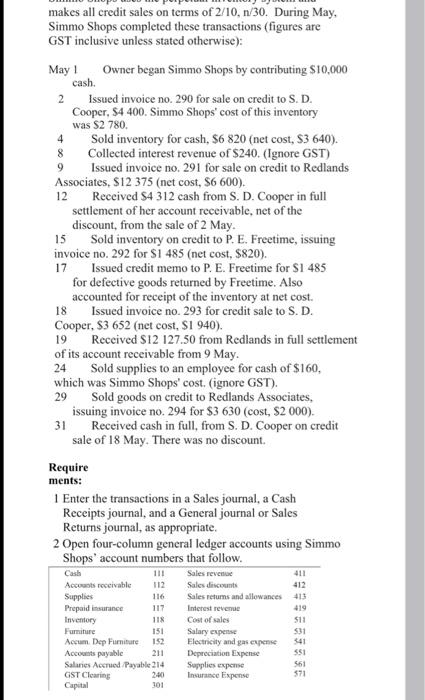

Simmo Shops uses the perpetual inventory system and makes all credit sales on terms of 2/10, 1/30. During May. Simmo Shops completed these transactions (figures are GST inclusive unless stated otherwise): May 1 Owner began Simmo Shops by contributing $10,000 2 Issued invoice no 290 for sale on credit to SD Cooper, 54 400. Simmo Shops' cost of this inventory was 52 780 4 Sold inventory for cash, 86820 (net cost, $3 640). 8 Collected interest revenue of $240. (Ignore GST) 9 Issued invoice no. 291 for sale on credit to Redlands Associates, S12 375 (nct cost, 56 600). 12 Received 54 312 cash from S. D. Cooper in full settlement of her account receivable, nct of the discount, from the sale of 2 May. 15 Sold inventory on credit to P. E Freetime, issuing invoice no. 292 for $1 485 (net cost, 5820). 17 Issued credit memo to P. E. Freetime for S1 485 for defective goods returned by Freetime. Also accounted for receipt of the inventory at netcost. 18 Issued invoice no. 293 for credit sal to S.D. Cooper, S3 652 (net cost, SI 940) 19 Received $12 127.50 from Redlands in full settlement of its account receivable from 9 May 24 Sold supplies to an employee for cash of $160, which was Simmo Shops' cost. (ignore GST). 29 Sold goods on credit to Redlands Associates, issuing invoice no. 294 for $3 630 (cost, S2000). 31 Received cash in full, from S. D. Cooper on credit sale of 18 May. There was no discount Require ments: Enter the transactions in a Sales journal, a Cash Receipts journal, and a General journal or Sales Returns journal, as appropriate 2 Open four-column general ledger accounts using Simmo Shops' account numbers that follow. M Salem 112 Salesom 413 Supp Prepaid 131 Salty expert Cart | Aco. Departure 15 Electrexpemes Acorts payable 211 Depp Sari Accrude 14 Slip GST C 101 Cach 571 Cap 3 Open these accounts in the subsidiary lodgers: Accounts receivable ledger-Redlands Associates, P. E Freetime and S. D. Cooper 4 Post daily to the Accounts Receivable ledger. On 31 May post to the general ledger 5 Total cach column of the special journals. Show that total debits equal total credits in each special journal 6 Balance the total of the customer account balances in the Accounts Receivable ledger against Accounts Receivable in the General ledger makes all credit sales on terms of 2/10,n/30. During May, Simmo Shops completed these transactions (figures are GST inclusive unless stated otherwise): May 1 Owner began Simmo Shops by contributing $10,000 cash. 2 Issued invoice no. 290 for sale on credit to S.D. Cooper, $4 400. Simmo Shops' cost of this inventory was $2 780 4 Sold inventory for cash, $6 820 (net cost, S3 640). 8 Collected interest revenue of $240. (Ignore GST) 9 Issued invoice no. 291 for sale on credit to Redlands Associates, S12 375 (net cost, $6 600). 12 Received $4 312 cash from S. D. Cooper in full settlement of her account receivable, net of the discount, from the sale of 2 May. 15 Sold inventory on credit to P. E. Freetime, issuing invoice no. 292 for $1 485 (net cost, $820). 17 Issued credit memo to P. E. Freetime for $1 485 for defective goods returned by Freetime. Also accounted for receipt of the inventory at net cost. 18 Issued invoice no. 293 for credit sale to S.D. Cooper, $3 652 (net cost, SI 940). 19 Received $12 127.50 from Redlands in full settlement of its account receivable from 9 May. 24 Sold supplies to an employee for cash of $160, which was Simmo Shops' cost. (ignore GST). 29 Sold goods on credit to Redlands Associates, issuing invoice no. 294 for $3 630 (cost, S2 000). 31 Received cash in full, from S. D. Cooper on credit sale of 18 May. There was no discount. Require ments: 1 Enter the transactions in a Sales journal, a Cash Receipts journal, and a General journal or Sales Returns journal, as appropriate 2 Open four-column general ledger accounts using Simmo Shops' account numbers that follow. Cash Sales reven 411 Accounts receivable Sales discounts Supplies Sales retums and allowances 413 Prepaid insurance 117 Interest revenue 419 Inventory 118 Cost of sales Furniture 151 Salary experte 531 Accum Dep Furniture 152 Electricity and expense Accounts payable 211 Depreciation Expense 551 Salaries Accrued Payable 214 Supplies experie 561 GST Clearing 2.40 Insurance Expense 571 Capital 301 112 511