Answered step by step

Verified Expert Solution

Question

1 Approved Answer

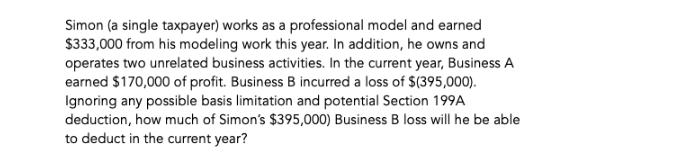

Simon (a single taxpayer) works as a professional model and earned $333,000 from his modeling work this year. In addition, he owns and operates

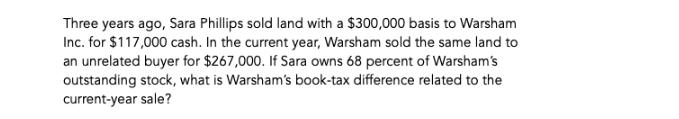

Simon (a single taxpayer) works as a professional model and earned $333,000 from his modeling work this year. In addition, he owns and operates two unrelated business activities. In the current year, Business A earned $170,000 of profit. Business B incurred a loss of $(395,000). Ignoring any possible basis limitation and potential Section 199A deduction, how much of Simon's $395,000) Business B loss will he be able to deduct in the current year? Three years ago, Sara Phillips sold land with a $300,000 basis to Warsham Inc. for $117,000 cash. In the current year, Warsham sold the same land to an unrelated buyer for $267,000. If Sara owns 68 percent of Warsham's outstanding stock, what is Warsham's book-tax difference related to the current-year sale?

Step by Step Solution

★★★★★

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Assuming that Simon materially participates in both Business A and Business B he can deduct up to the full amount of his Business B loss against his m...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started