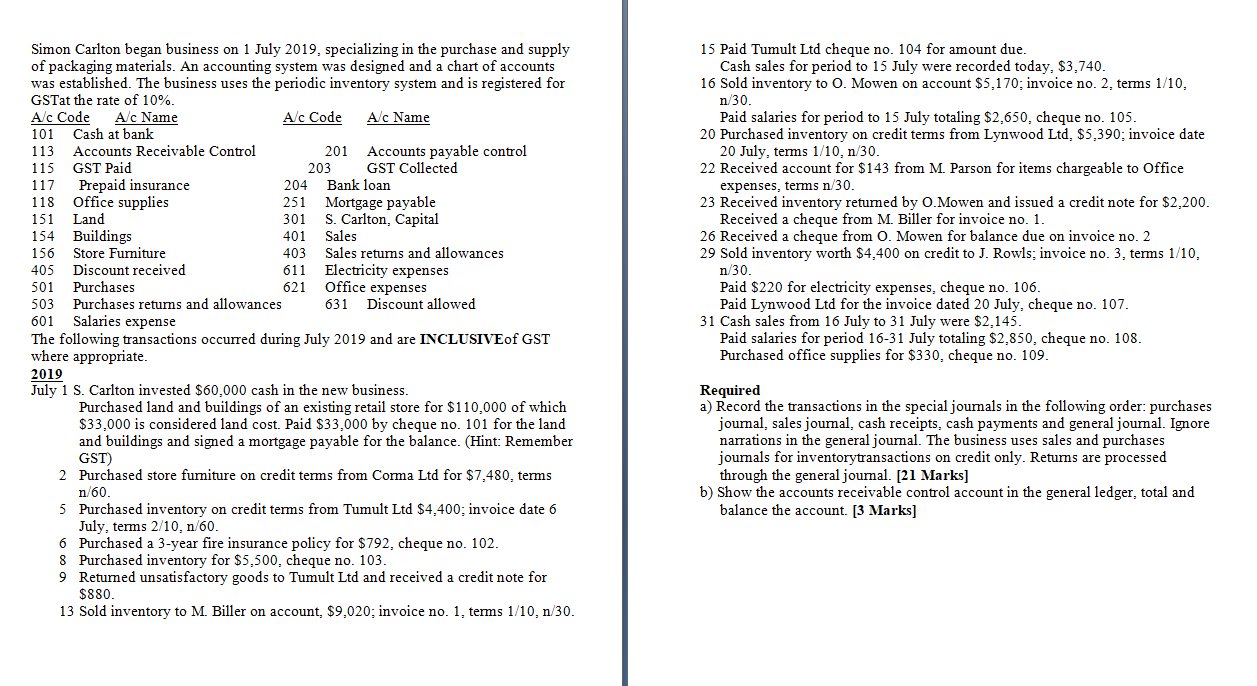

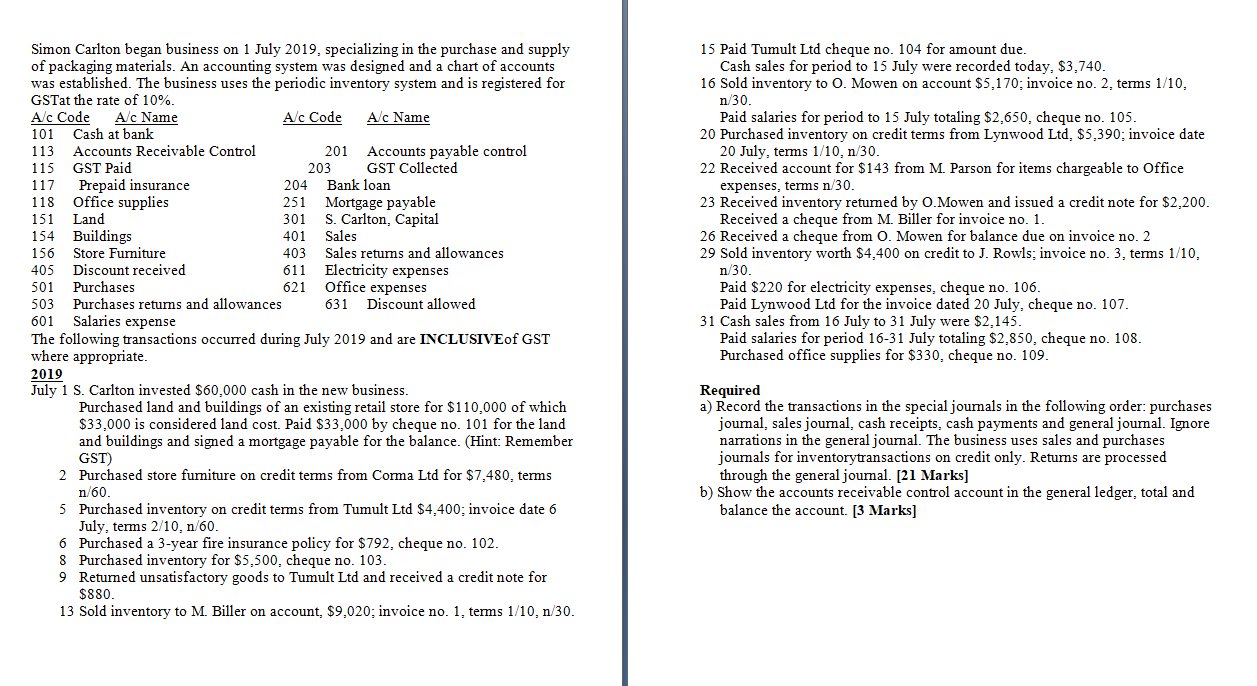

Simon Carlton began business on 1 July 2019, specializing in the purchase and supply of packaging materials. An accounting system was designed and a chart of accounts was established. The business uses the periodic inventory system and is registered for GSTat the rate of 10%. A/c Code A/c Name A/c Code A/c Name 101 Cash at bank 113 Accounts Receivable Control 201 Accounts payable control 115 GST Paid 203 GST Collected 117 Prepaid insurance 204 Bank loan 118 Office supplies 251 Mortgage payable 151 Land 301 S. Carlton, Capital 154 Buildings 401 Sales 156 Store Furniture 403 Sales retums and allowances 405 Discount received 611 Electricity expenses 501 Purchases 621 Office expenses 503 Purchases returns and allowances 631 Discount allowed 601 Salaries expense The following transactions occurred during July 2019 and are INCLUSIVEof GST where appropriate. 2019 July 1 S. Carlton invested $60,000 cash in the new business. Purchased land and buildings of an existing retail store for $110,000 of which $33,000 is considered land cost. Paid $33,000 by cheque no. 101 for the land and buildings and signed a mortgage payable for the balance. (Hint: Remember GST) 2 Purchased store furniture on credit terms from Corma Ltd for $7,480, terms n 60. 5 Purchased inventory on credit terms from Tumult Ltd $4,400; invoice date 6 July, terms 2/10, n/60. 6 Purchased a 3-year fire insurance policy for $792, cheque no. 102. 8 Purchased inventory for $5,500, cheque no. 103. 9 Returned unsatisfactory goods to Tumult Ltd and received a credit note for $880. 13 Sold inventory to M. Biller on account. $9.020: invoice no. 1, terms 1/10, n/30. 15 Paid Tumult Ltd cheque no. 104 for amount due. Cash sales for period to 15 July were recorded today, $3,740. 16 Sold inventory to O. Mowen on account $5,170; invoice no. 2, terms 1/10, n 30. Paid salaries for period to 15 July totaling $2,650, cheque no. 105. 20 Purchased inventory on credit terms from Lynwood Ltd, $5,390; invoice date 20 July, terms 1/10, n/30. 22 Received account for $143 from M. Parson for items chargeable to Office expenses, terms n/30. 23 Received inventory returned by O. Mowen and issued a credit note for $2,200. Received a cheque from M. Biller for invoice no. 1. 26 Received a cheque from O. Mowen for balance due on invoice no. 2 29 Sold inventory worth $4,400 on credit to J. Rowls: invoice no. 3, terms 1/10, n/30. Paid $220 for electricity expenses, cheque no. 106. Paid Lynwood Ltd for the invoice dated 20 July, cheque no. 107. 31 Cash sales from 16 July to 31 July were $2.145. Paid salaries for period 16-31 July totaling $2,850, cheque no. 108. Purchased office supplies for $330, cheque no. 109. Required a) Record the transactions in the special journals in the following order: purchases joumal, sales journal, cash receipts, cash payments and general journal. Ignore narrations in the general journal. The business uses sales and purchases journals for inventorytransactions on credit only. Returns are processed through the general joumal. [21 Marks) b) Show the accounts receivable control account in the general ledger, total and balance the account. [3 Marks]