Answered step by step

Verified Expert Solution

Question

1 Approved Answer

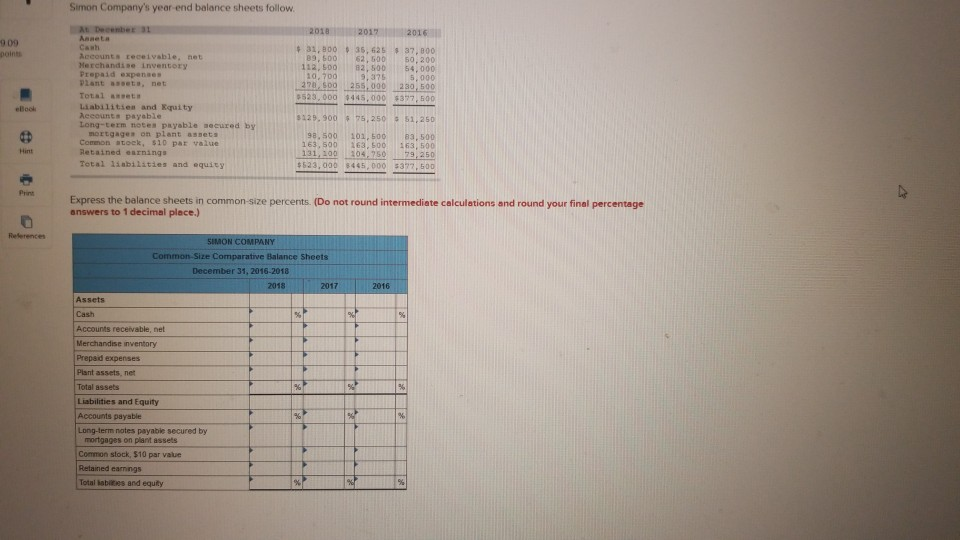

Simon Company's year-end balance sheets follow. 2018 2016 909 31,00 15,625 $ 37,000 39.100 2.500 50.200 112,500 12 ob 4.000 10, 700 9.325 5,000 27.500

Simon Company's year-end balance sheets follow. 2018 2016 909 31,00 15,625 $ 37,000 39.100 2.500 50.200 112,500 12 ob 4.000 10, 700 9.325 5,000 27.500 255,000 230, 500 3523.000 $445,000 $377,500 Canh accounts receivable, not Merchandise inventory Prepaid expenses Plantsstanet Total art Libilities and Equity Recounts payable Long-term notes payable secured by mortgages on plants Common stock 510 par value Retained ning Total liabilities and equity 3129.500 75,250 1,250 o iets 98.500 101,00 33,500 163,500 163,500 163,500 131, 100 104,950 79,250 23.0908465.000 37.500 Express the balance sheets in common size percents (Do not round intermediate calculations and round your final percentage answers to 1 decimal place.) References SIMON COMPANY Common Size Comparative Balance Sheets December 31, 2016-2018 2017 2016 Assets Accounts receivable, nel Merchandise inventory Prepaid expenses Plant assets net Total assets Liabilities and Equity Accounts payable Long-term nates payable secured by mortgages on plant assets Common stock 510 par value R ed earnings Totals and equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started