Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Simon Companys year-end balance sheets follow. At December 31 2017 2016 2015 Assets Cash $ 35,784 $ 41,410 $ 41,854 Accounts receivable, net 103,714 73,200

Simon Companys year-end balance sheets follow.

| At December 31 | 2017 | 2016 | 2015 | ||||||

| Assets | |||||||||

| Cash | $ | 35,784 | $ | 41,410 | $ | 41,854 | |||

| Accounts receivable, net | 103,714 | 73,200 | 57,514 | ||||||

| Merchandise inventory | 131,705 | 98,663 | 61,871 | ||||||

| Prepaid expenses | 11,178 | 10,870 | 4,650 | ||||||

| Plant assets, net | 324,133 | 298,714 | 265,511 | ||||||

| Total assets | $ | 606,514 | $ | 522,857 | $ | 431,400 | |||

| Liabilities and Equity | |||||||||

| Accounts payable | $ | 148,002 | $ | 86,596 | $ | 55,236 | |||

| Long-term notes payable secured by mortgages on plant assets | 111,744 | 120,257 | 93,433 | ||||||

| Common stock, $10 par value | 162,500 | 162,500 | 162,500 | ||||||

| Retained earnings | 184,268 | 153,504 | 120,231 | ||||||

| Total liabilities and equity | $ | 606,514 | $ | 522,857 | $ | 431,400 | |||

The companys income statements for the years ended December 31, 2017 and 2016, follow.

| For Year Ended December 31 | 2017 | 2016 | ||||||||||

| Sales | $ | 788,468 | $ | 622,200 | ||||||||

| Cost of goods sold | $ | 480,965 | $ | 404,430 | ||||||||

| Other operating expenses | 244,425 | 157,417 | ||||||||||

| Interest expense | 13,404 | 14,311 | ||||||||||

| Income taxes | 10,250 | 9,333 | ||||||||||

| Total costs and expenses | 749,044 | 585,491 | ||||||||||

| Net income | $ | 39,424 | $ | 36,709 | ||||||||

| Earnings per share | $ | 2.43 | $ | 2.26 | ||||||||

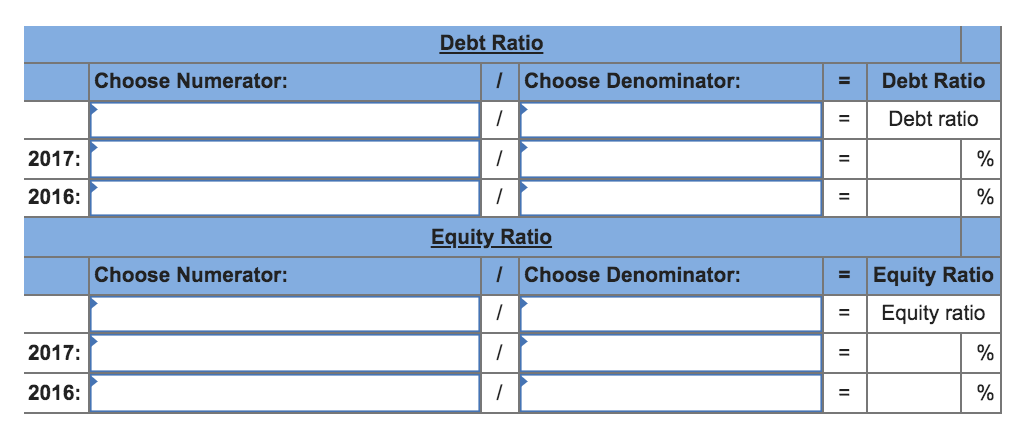

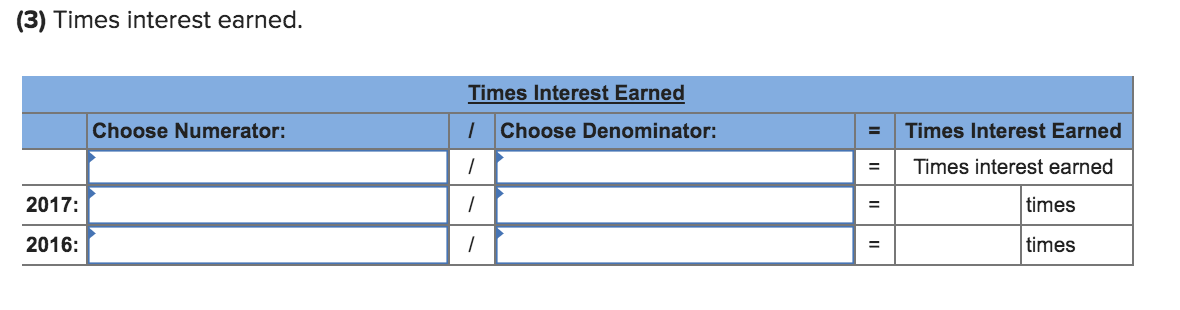

Calculate the companys long-term risk and capital structure positions at the end of 2017 and 2016 by computing the following ratios.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started