Simon Company's year-end balance sheets follow. At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities

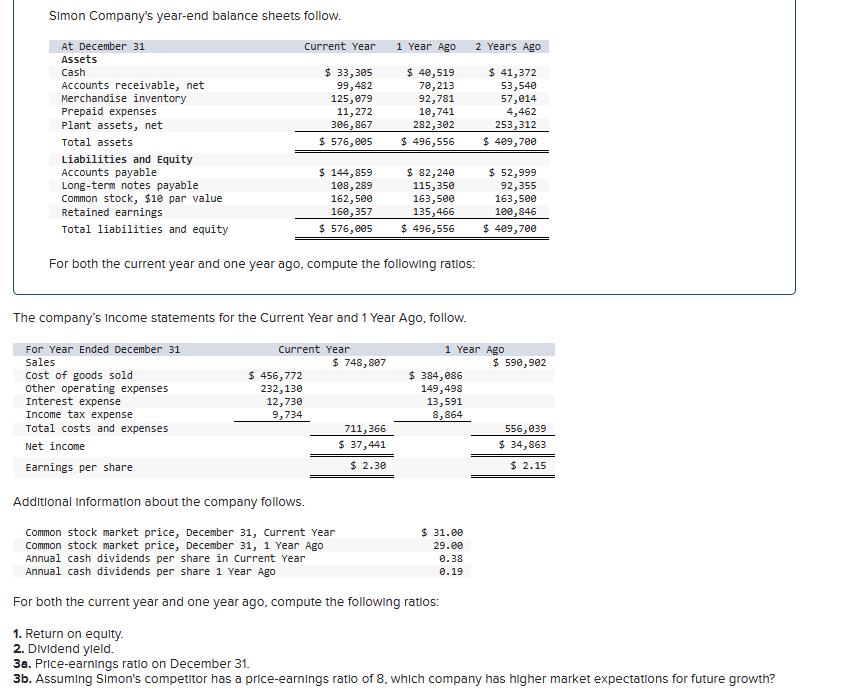

Simon Company's year-end balance sheets follow. At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Current Year 1 Year Ago 2 Years Ago $ 33,305 99,482 $ 40,519 $ 41,372 70,213 $ 576,005 $ 144,859 Long-term notes payable 108,289 Common stock, $10 par value 162,500 Retained earnings 160,357 Total liabilities and equity $ 576,005 $ 496,556 125,079 11,272 306,867 92,781 10,741 282,302 $ 496,556 $ 82,240 115,350 163,500 135,466 53,540 57,014 4,462 253,312 $ 409,700 $ 52,999 92,355 163,500 100,846 $ 409,700 For both the current year and one year ago, compute the following ratios: 1 Year Ago $ 590,902 The company's Income statements for the Current Year and 1 Year Ago, follow. For Year Ended December 31 Sales Cost of goods sold other operating expenses Interest expense Income tax expense Current Year $ 748,807 $ 456,772 232,130 12,730 9,734 Total costs and expenses Net income 711,366 $ 37,441 $ 2.30 $ 384,086 149,498 13,591 8,864 556,039 $ 34,863 $ 2.15 Earnings per share Additional Information about the company follows. Common stock market price, December 31, Current Year Common stock market price, December 31, 1 Year Ago Annual cash dividends per share in Current Year Annual cash dividends per share 1 Year Ago $ 31.00 29.00 For both the current year and one year ago, compute the following ratios: 1. Return on equity. 2. Dividend yield. 3a. Price-earnings ratio on December 31. 0.38 0.19 3b. Assuming Simon's competitor has a price-earnings ratio of 8, which company has higher market expectations for future growth?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started