Answered step by step

Verified Expert Solution

Question

1 Approved Answer

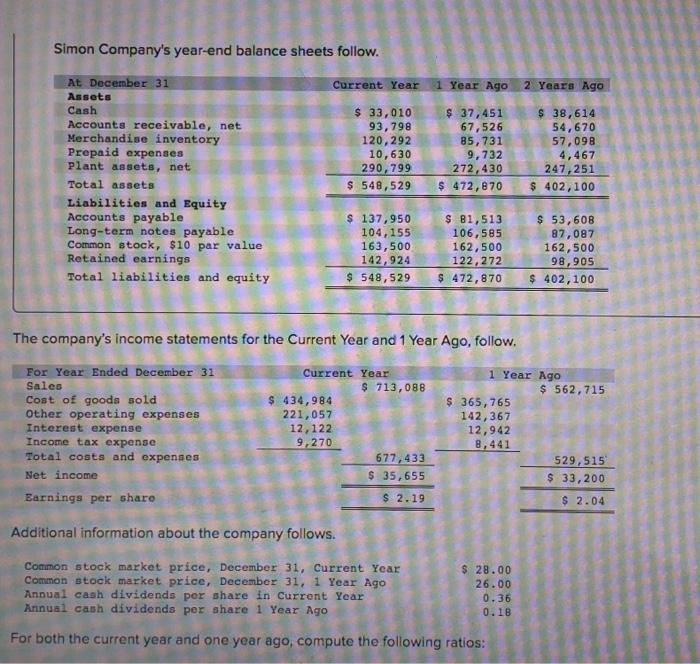

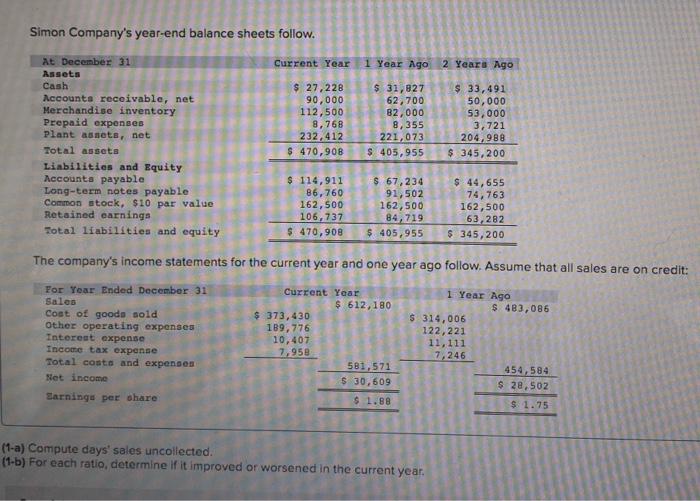

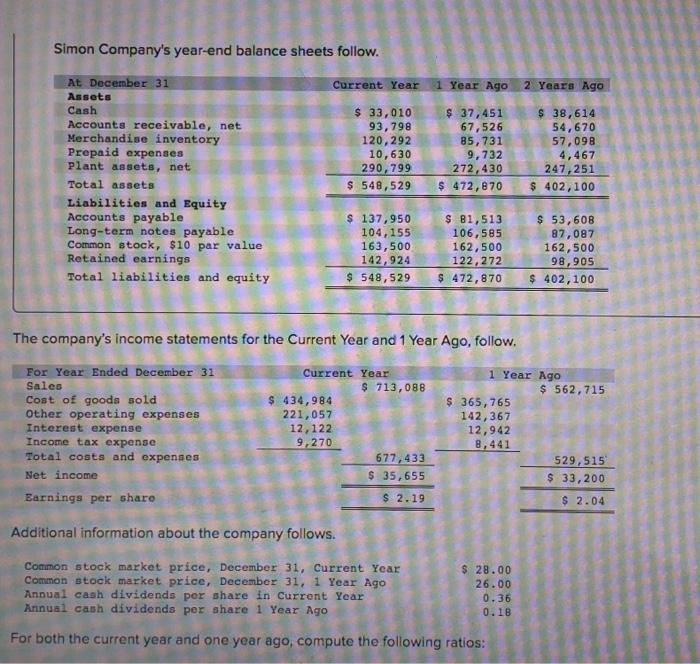

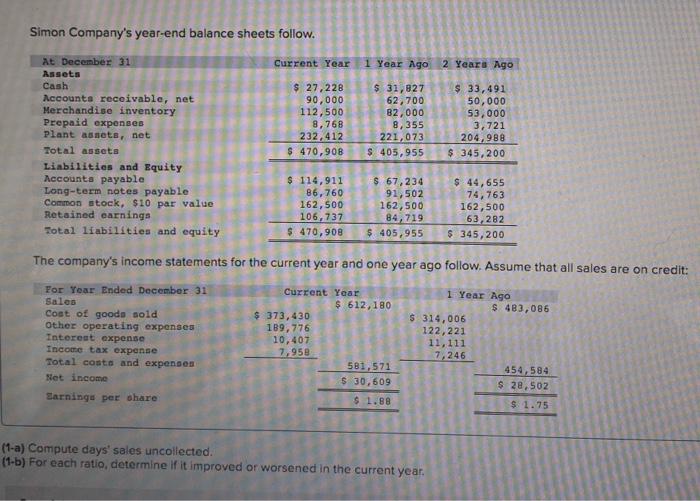

Simon Company's year-end balance sheets follow. Current Year 1 Year Ago 2 Years Ago At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid

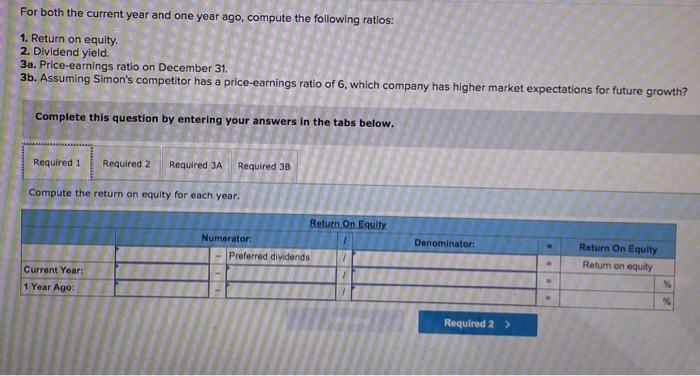

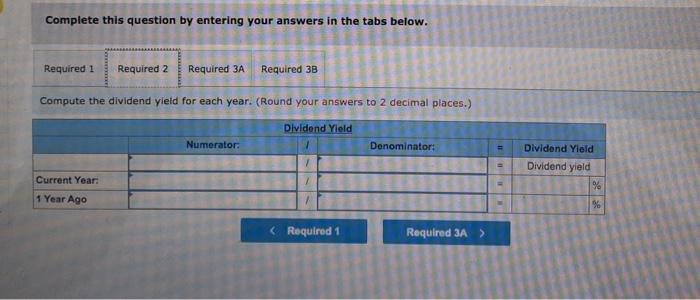

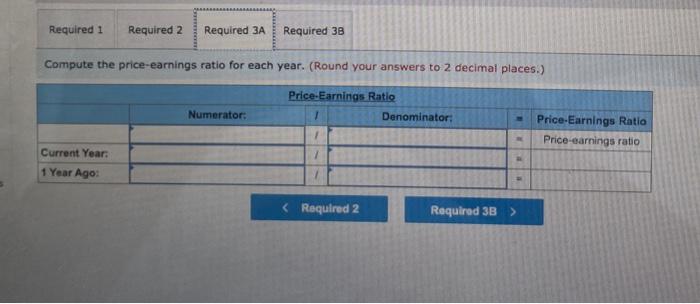

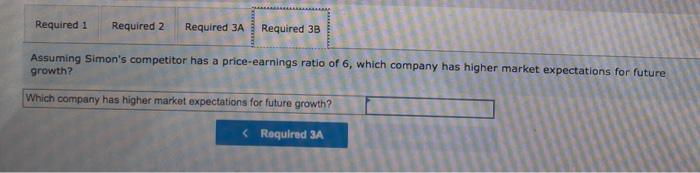

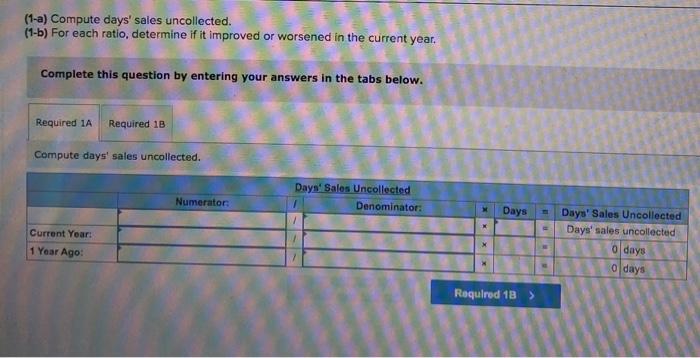

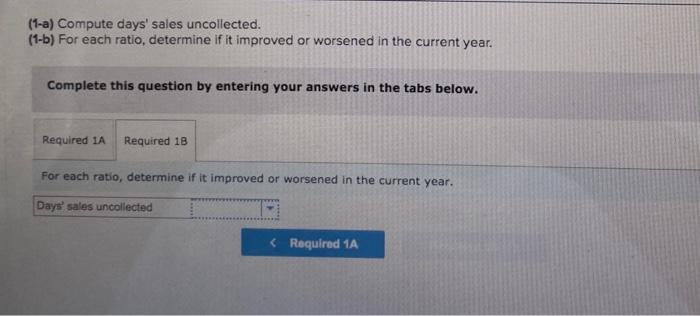

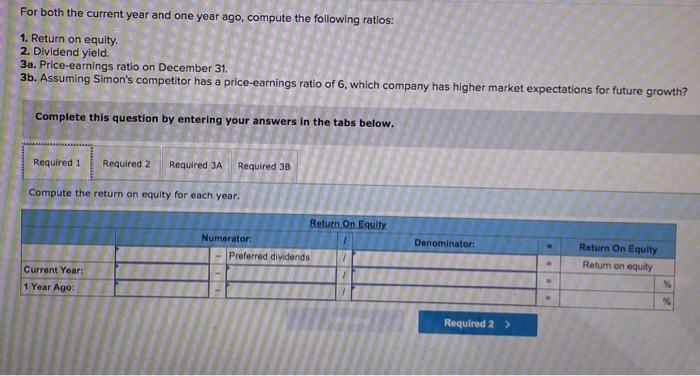

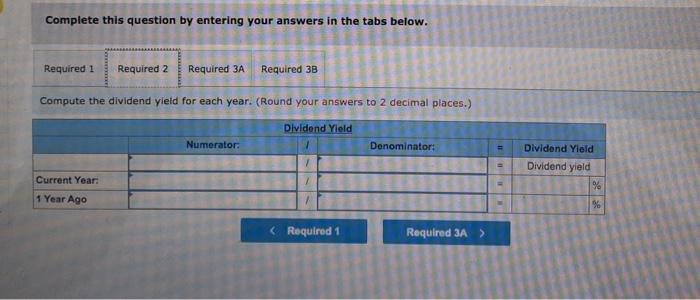

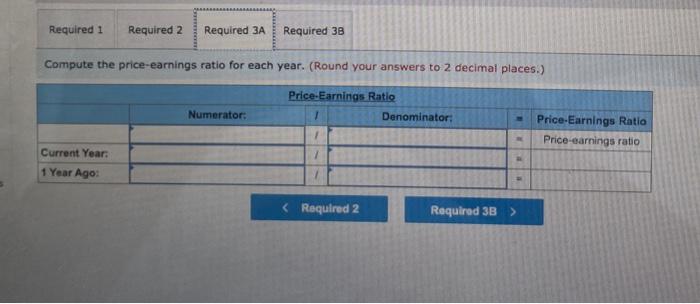

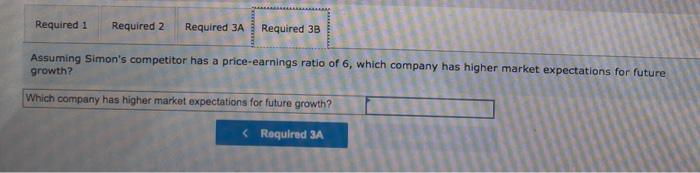

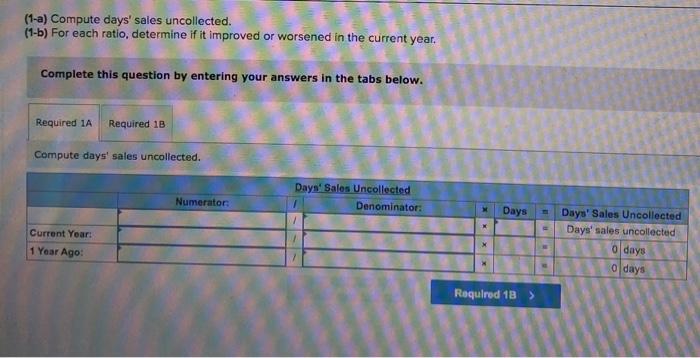

Simon Company's year-end balance sheets follow. Current Year 1 Year Ago 2 Years Ago At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable Common stock, $10 par value Retained earnings Total liabilities and equity $ 33,010 93,798 120,292 10,630 290, 799 $ 548,529 $ 37,451 67,526 85,731 9,732 272,430 $ 472,870 $ 38,614 54,670 57,098 4,467 247,251 $ 402,100 $ 137,950 104, 155 163,500 142,924 $ 548,529 $ 81,513 106,585 162,500 122,272 $ 472,870 $ 53,60B 87,087 162,500 98,905 $ 402,100 The company's income statements for the Current Year and 1 Year Ago, follow, For Year Ended December 31 Sales Cost of goods sold Other operating expenses Interest expense Income tax expense Total costs and expenses Net income Earnings per share Current Year $ 713,088 $ 434,984 221,057 12,122 9,270 677,433 $ 35,655 1 Year Ago $ 562,715 $ 365, 765 142,367 12,942 8,441 529,515 $ 33,200 $ 2.19 $ 2.04 Additional information about the company follows. Common stock market price, December 31, Current Year Common stock market price, December 31, 1 Year Ago Annual cash dividends por share in Current Year Annual cash dividends per share 1 Year Ago $ 28.00 26.00 0.36 0.18 For both the current year and one year ago, compute the following ratios: For both the current year and one year ago, compute the following ratios: 1. Return on equity 2. Dividend yield. 3a. Price-earnings ratio on December 31. 3b. Assuming Simon's competitor has a price-earnings ratio of 6, which company has higher market expectations for future growth? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3A Required 38 Compute the return on equity for each year. Return On Equity Numerator: Preferred dividends Denominator: Return On Equity Return on equity Current Year: 1 Year Ago: % % Required 2 > Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3A Required 3B Compute the dividend yield for each year. (Round your answers to 2 decimal places.) Dividend Yield Numerator Denominator: . 1 Dividend Yield Dividend yield % Current Year 1 Year Ago (Required Required 3A > Required 1 Required 2 Required 3A Required 38 Compute the price-earnings ratio for each year. (Round your answers to 2 decimal places.) Price-Earnings Ratio Denominator; Numerator: . Price-Earnings Ratio Price-earnings ratio Current Year: 1 Year Ago: Required 1 Required 2 Required 3A Required 3B Assuming Simon's competitor has a price-earnings ratio of 6, which company has higher market expectations for future growth? Which company has higher market expectations for future growth?

Simon Company's year-end balance sheets follow. Current Year 1 Year Ago 2 Years Ago At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable Common stock, $10 par value Retained earnings Total liabilities and equity $ 33,010 93,798 120,292 10,630 290, 799 $ 548,529 $ 37,451 67,526 85,731 9,732 272,430 $ 472,870 $ 38,614 54,670 57,098 4,467 247,251 $ 402,100 $ 137,950 104, 155 163,500 142,924 $ 548,529 $ 81,513 106,585 162,500 122,272 $ 472,870 $ 53,60B 87,087 162,500 98,905 $ 402,100 The company's income statements for the Current Year and 1 Year Ago, follow, For Year Ended December 31 Sales Cost of goods sold Other operating expenses Interest expense Income tax expense Total costs and expenses Net income Earnings per share Current Year $ 713,088 $ 434,984 221,057 12,122 9,270 677,433 $ 35,655 1 Year Ago $ 562,715 $ 365, 765 142,367 12,942 8,441 529,515 $ 33,200 $ 2.19 $ 2.04 Additional information about the company follows. Common stock market price, December 31, Current Year Common stock market price, December 31, 1 Year Ago Annual cash dividends por share in Current Year Annual cash dividends per share 1 Year Ago $ 28.00 26.00 0.36 0.18 For both the current year and one year ago, compute the following ratios: For both the current year and one year ago, compute the following ratios: 1. Return on equity 2. Dividend yield. 3a. Price-earnings ratio on December 31. 3b. Assuming Simon's competitor has a price-earnings ratio of 6, which company has higher market expectations for future growth? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3A Required 38 Compute the return on equity for each year. Return On Equity Numerator: Preferred dividends Denominator: Return On Equity Return on equity Current Year: 1 Year Ago: % % Required 2 > Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3A Required 3B Compute the dividend yield for each year. (Round your answers to 2 decimal places.) Dividend Yield Numerator Denominator: . 1 Dividend Yield Dividend yield % Current Year 1 Year Ago (Required Required 3A > Required 1 Required 2 Required 3A Required 38 Compute the price-earnings ratio for each year. (Round your answers to 2 decimal places.) Price-Earnings Ratio Denominator; Numerator: . Price-Earnings Ratio Price-earnings ratio Current Year: 1 Year Ago: Required 1 Required 2 Required 3A Required 3B Assuming Simon's competitor has a price-earnings ratio of 6, which company has higher market expectations for future growth? Which company has higher market expectations for future growth?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started