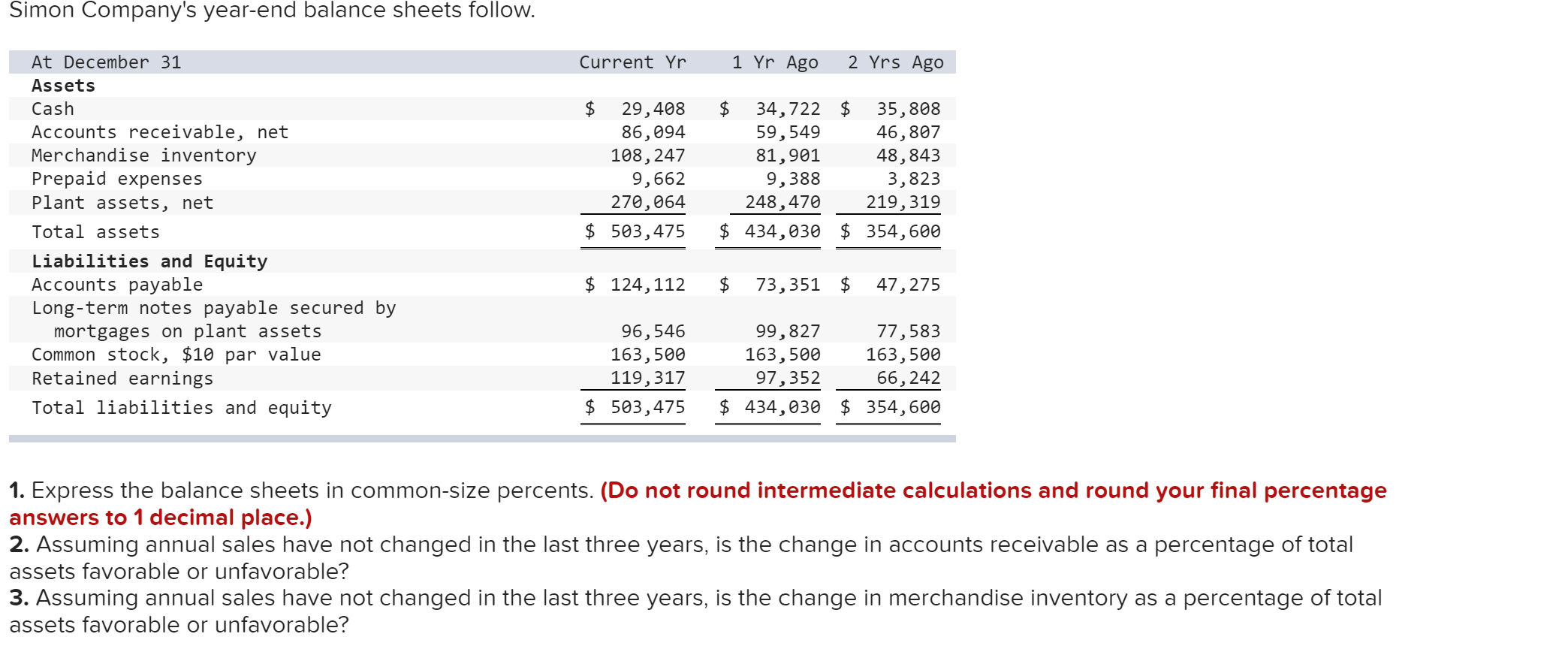

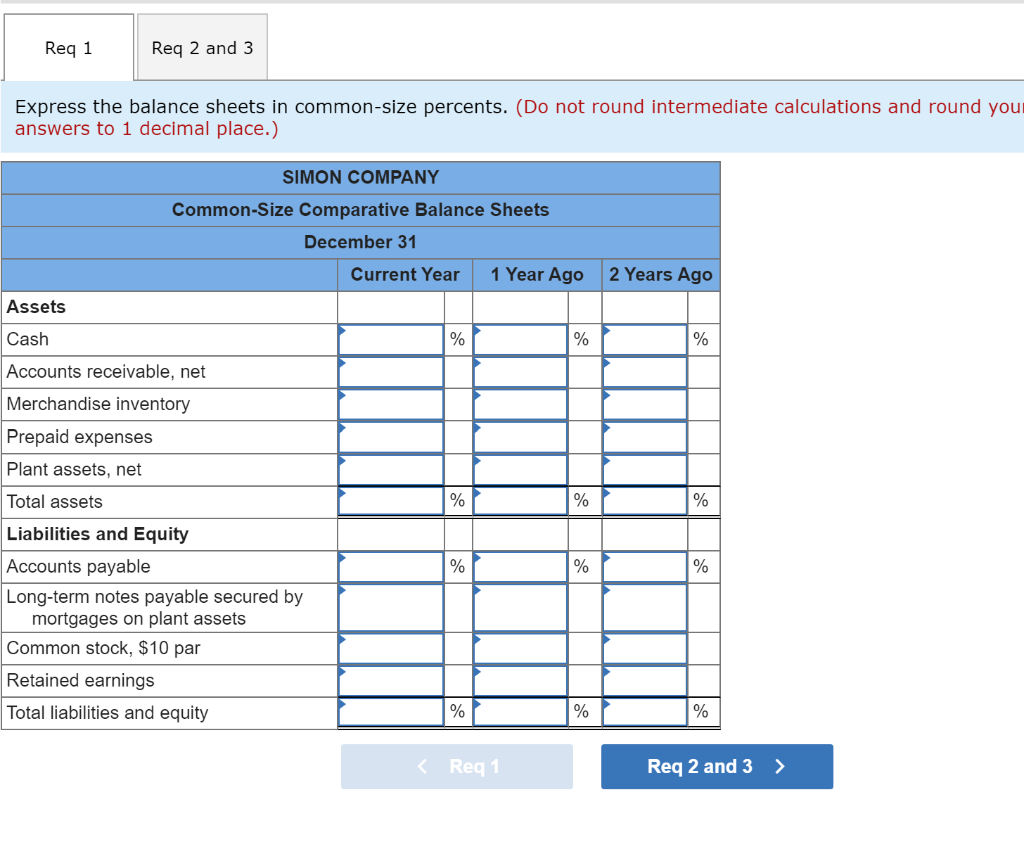

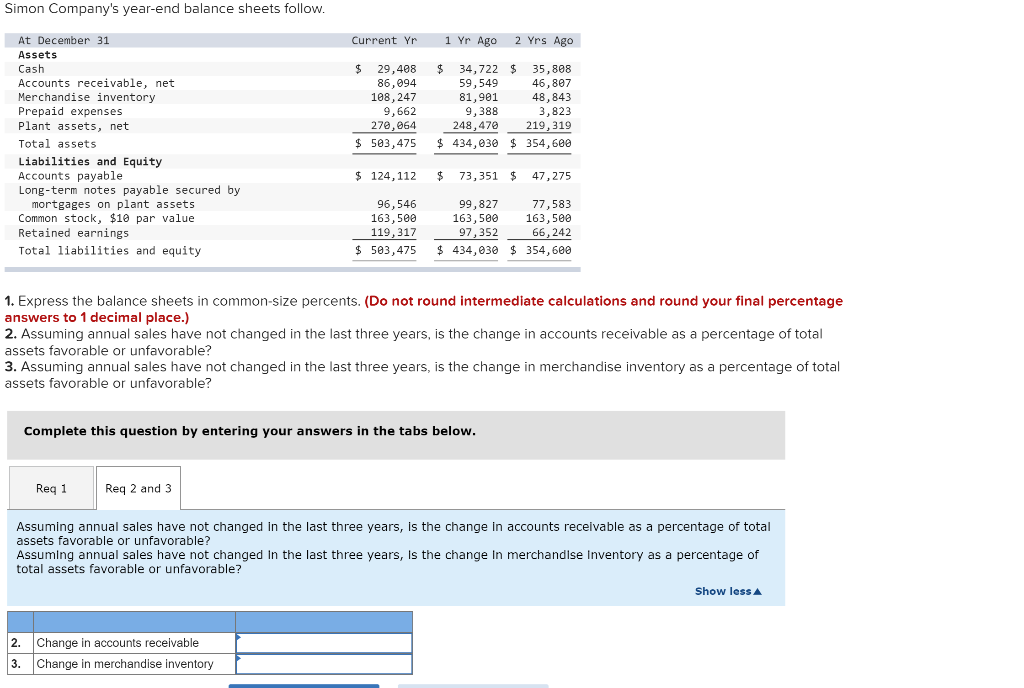

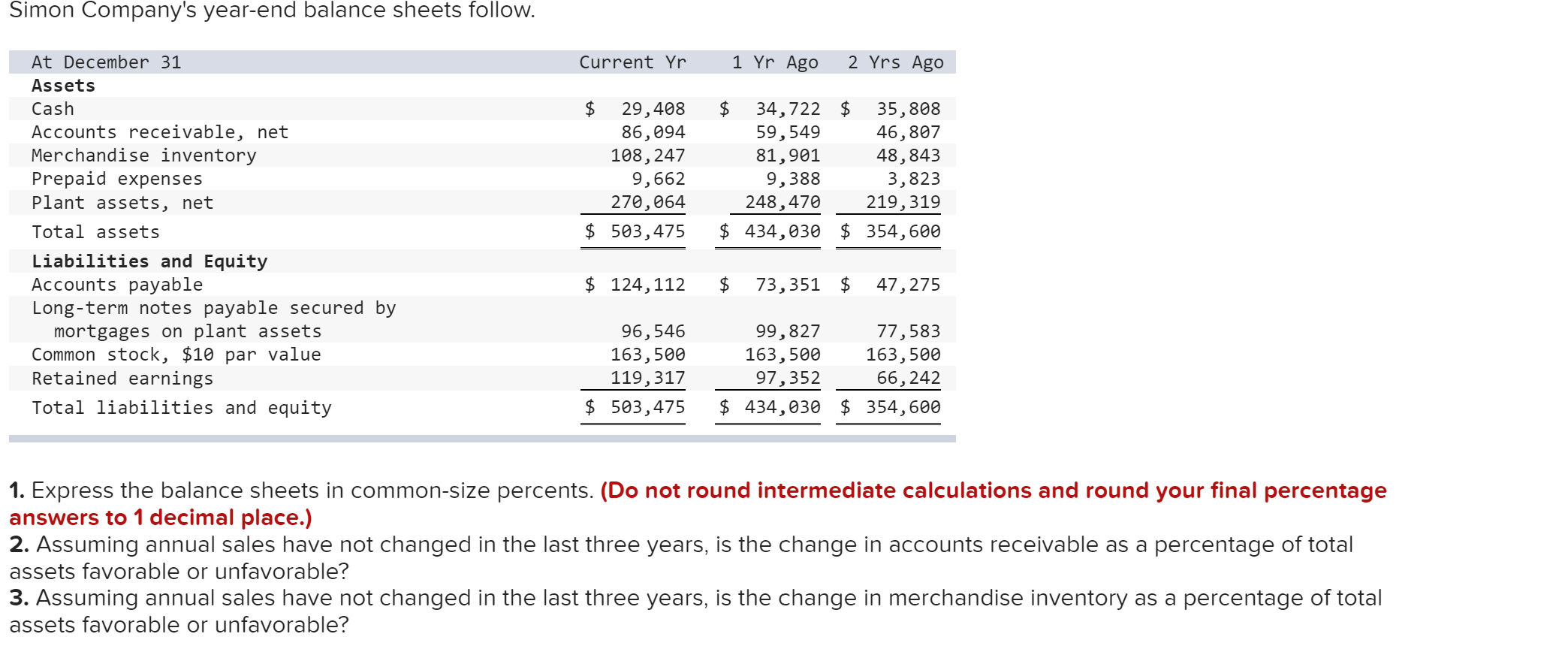

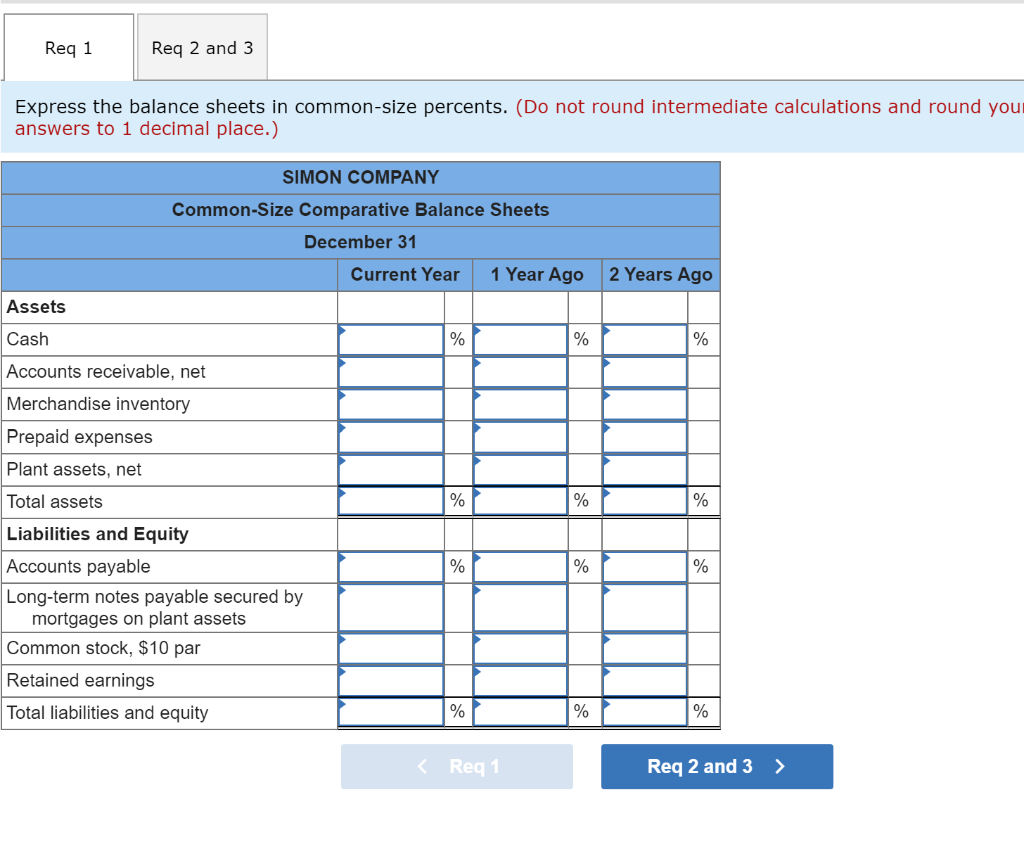

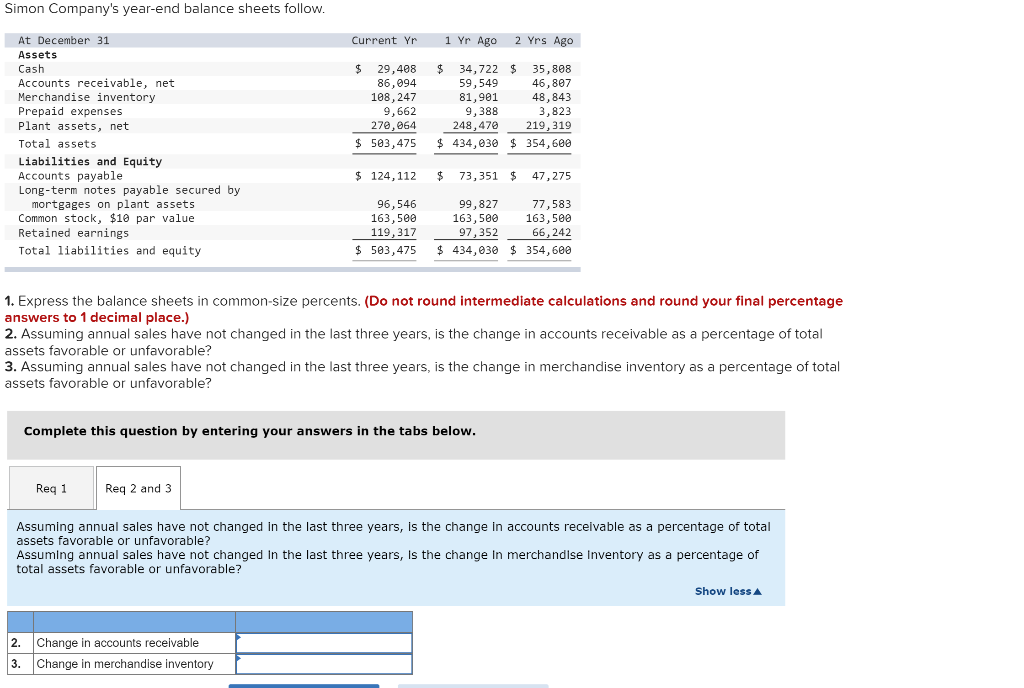

Simon Company's year-end balance sheets follow. Current Yr 1 Yr Ago 2 Yrs Ago At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable secured by mortgages on plant assets Common stock, $10 par value Retained earnings Total liabilities and equity 29,408 86,094 108,247 9,662 270,064 $ 503,475 $ 34,722 $ 35,808 59,549 46,807 81,901 48,843 9,388 3,823 248,470 219,319 $ 434,030 $ 354,600 $ 124, 112 $ 73,351 $ 47,275 96,546 163,500 119,317 $ 503,475 99,827 77,583 163,500 163,500 97,352 66,242 $ 434,030 $ 354,600 1. Express the balance sheets in common-size percents. (Do not round intermediate calculations and round your final percentage answers to 1 decimal place.) 2. Assuming annual sales have not changed in the last three years, is the change in accounts receivable as a percentage of total assets favorable or unfavorable? 3. Assuming annual sales have not changed in the last three years, is the change in merchandise inventory as a percentage of total assets favorable or unfavorable? Req 1 Req 2 and 3 Express the balance sheets in common-size percents. (Do not round intermediate calculations and round you answers to 1 decimal place.) SIMON COMPANY Common-Size Comparative Balance Sheets December 31 Current Year 1 Year Ago 2 Years Ago Assets Cash % % % % % % Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable secured by mortgages on plant assets Common stock, $10 par Retained earnings Total liabilities and equity % % % % % % Simon Company's year-end balance sheets follow. Current Yr 1 Yr Ago 2 Yrs Ago At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable secured by mortgages on plant assets Common stock, $10 par value Retained earnings Total liabilities and equity $ 29,408 86,094 108,247 9,662 270,964 $ 503, 475 $ 34,722 $ 35,808 59,549 46,807 81,901 48,843 9,388 3,823 248, 470 219,319 434,030 $ 354,600 $ 124,112 73,351 $ 47,275 96,546 163,500 119,317 $ 503, 475 99,827 77,583 163,500 163,500 97,352 66,242 $ 434,030 $ 354,600 1. Express the balance sheets in common-size percents. (Do not round intermediate calculations and round your final percentage answers to 1 decimal place.) 2. Assuming annual sales have not changed in the last three years, is the change in accounts receivable as a percentage of total assets favorable or unfavorable? 3. Assuming annual sales have not changed in the last three years, is the change in merchandise inventory as a percentage of total assets favorable or unfavorable? Complete this question by entering your answers in the tabs below. Reg 1 Req 2 and 3 Assuming annual sales have not changed in the last three years, is the change in accounts receivable as a percentage of total assets favorable or unfavorable? Assuming annual sales have not changed in the last three years, is the change in merchandise inventory as a percentage of total assets favorable or unfavorable? Show less 2. Change in accounts receivable 3. Change in merchandise inventory