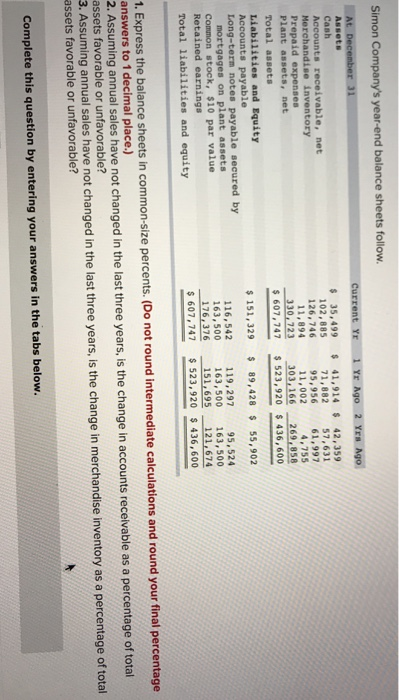

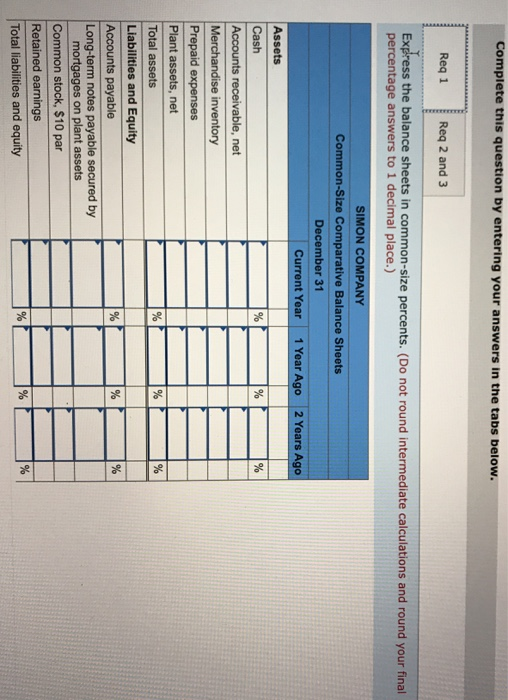

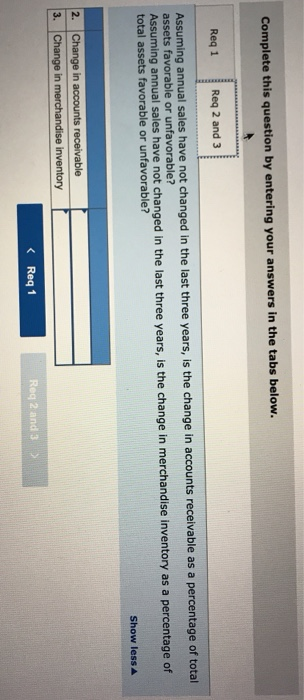

Simon Company's year-end balance sheets follow. Current Yr 1 Yr Ago 2 Yrs Ago $ 35,499 102,885 126,746 11,894 330,723 $ 607, 747 $ 41,914 $ 42,359 71,882 57,631 95,956 61,997 11,002 4,755 303, 166 269,858 $ 523,920 $ 436,600 At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable secured by mortgages on plant assets Comon stock, $10 par value Retained earnings Total liabilities and equity $ 151,329 $ 89,428 $ 55,902 116,542 163,500 176,376 $ 607,747 119,297 95,524 163,500 163,500 151,695 121,674 $ 523,920 $ 436,600 1. Express the balance sheets in common-size percents. (Do not round intermediate calculations and round your final percentage answers to 1 decimal place.) 2. Assuming annual sales have not changed in the last three years, is the change in accounts receivable as a percentage of total assets favorable or unfavorable? 3. Assuming annual sales have not changed in the last three years, is the change in merchandise inventory as a percentage of total assets favorable or unfavorable? Complete this question by entering your answers in the tabs below. Complete this question by entering your answers in the tabs below. Req 1 Req 2 and 3 Express the balance sheets in common-size percents. (Do not round intermediate calculations and round your final percentage answers to 1 decimal place.) 2 Years Ago % SIMON COMPANY Common-Size Comparative Balance Sheets December 31 Current Year 1 Year Ago Assets Cash % Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets % Liabilities and Equity Accounts payable % % Long-term notes payable secured by mortgages on plant assets Common stock, $10 par Retained earnings Total liabilities and equity % % % % Complete this question by entering your answers in the tabs below. Req 1 Req 2 and 3 Assuming annual sales have not changed in the last three years, is the change in accounts receivable as a percentage of total assets favorable or unfavorable? Assuming annual sales have not changed in the last three years, is the change in merchandise inventory as a percentage of total assets favorable or unfavorable? Show less 2. Change in accounts receivable 3. Change in merchandise inventory