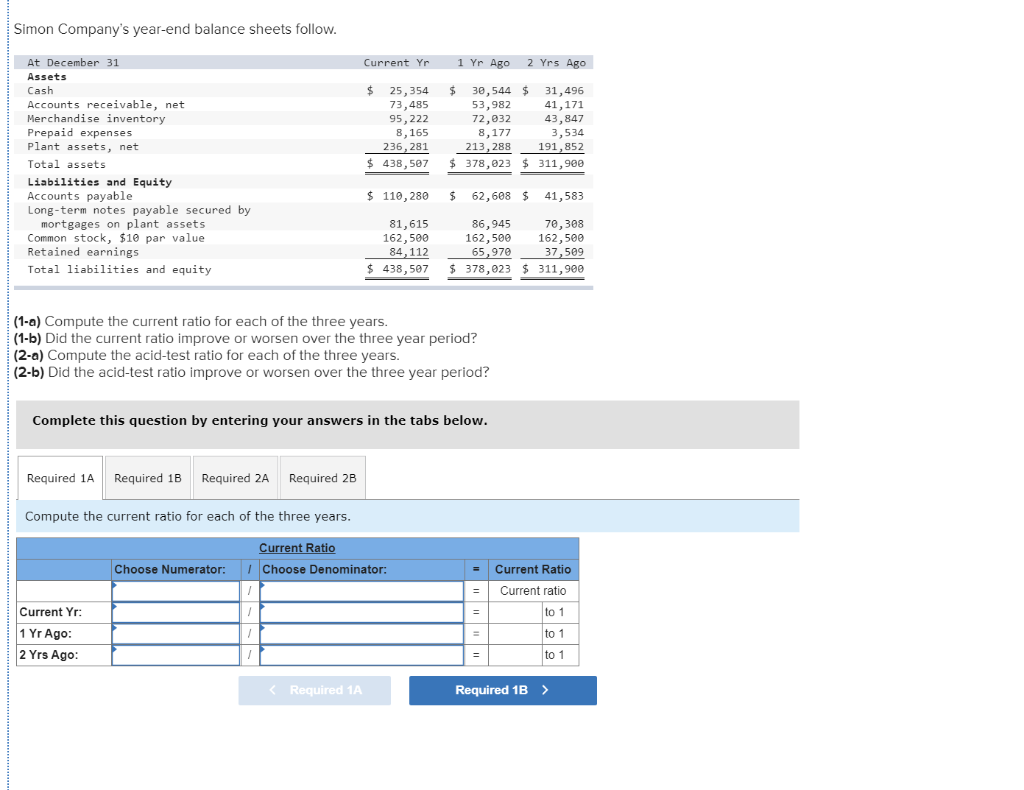

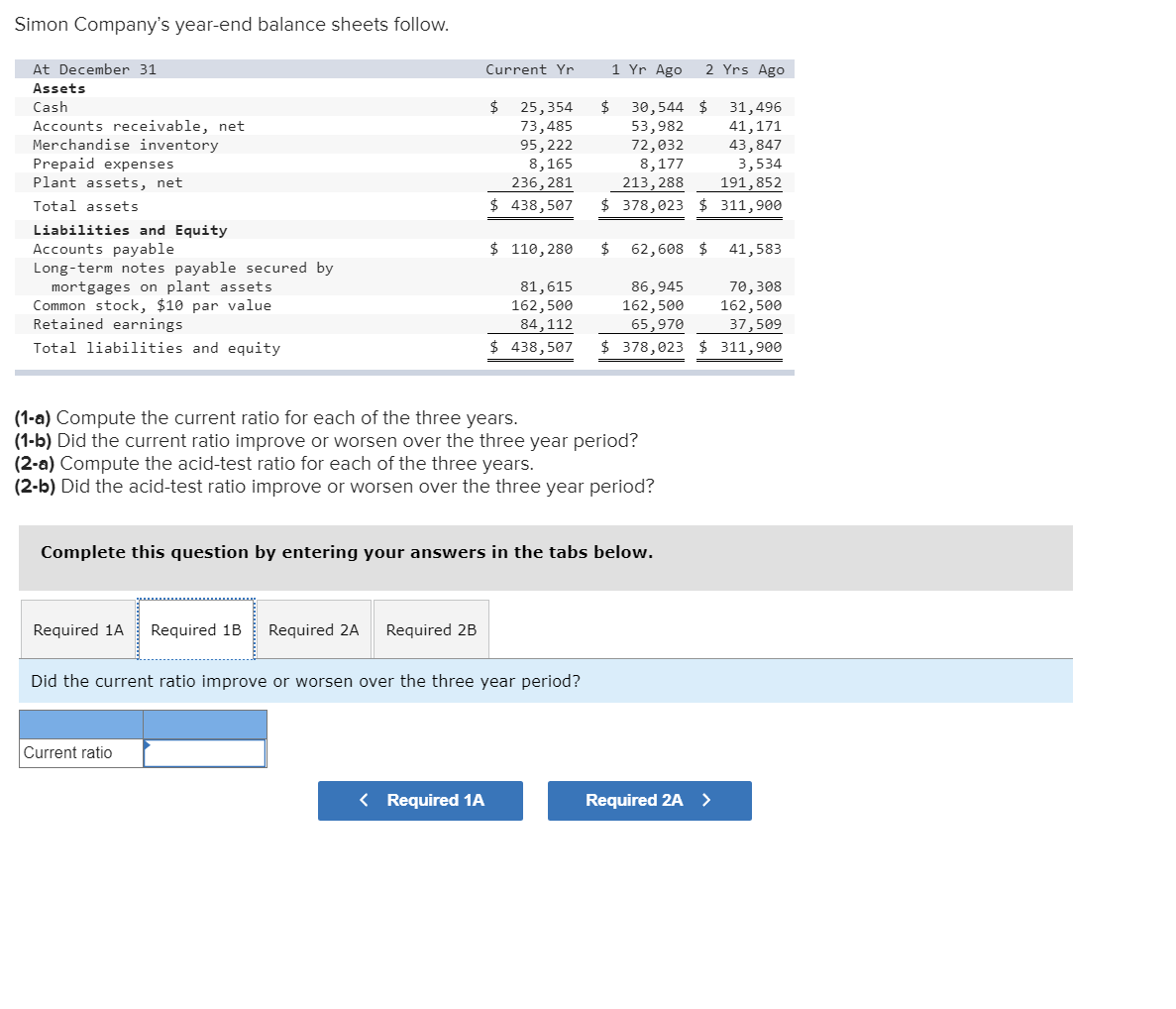

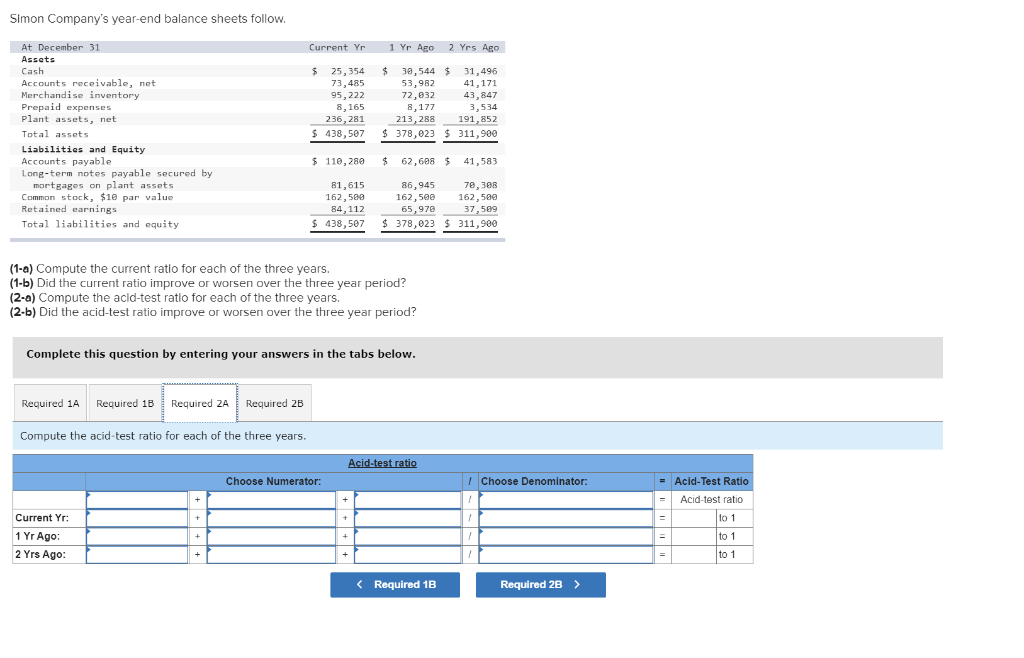

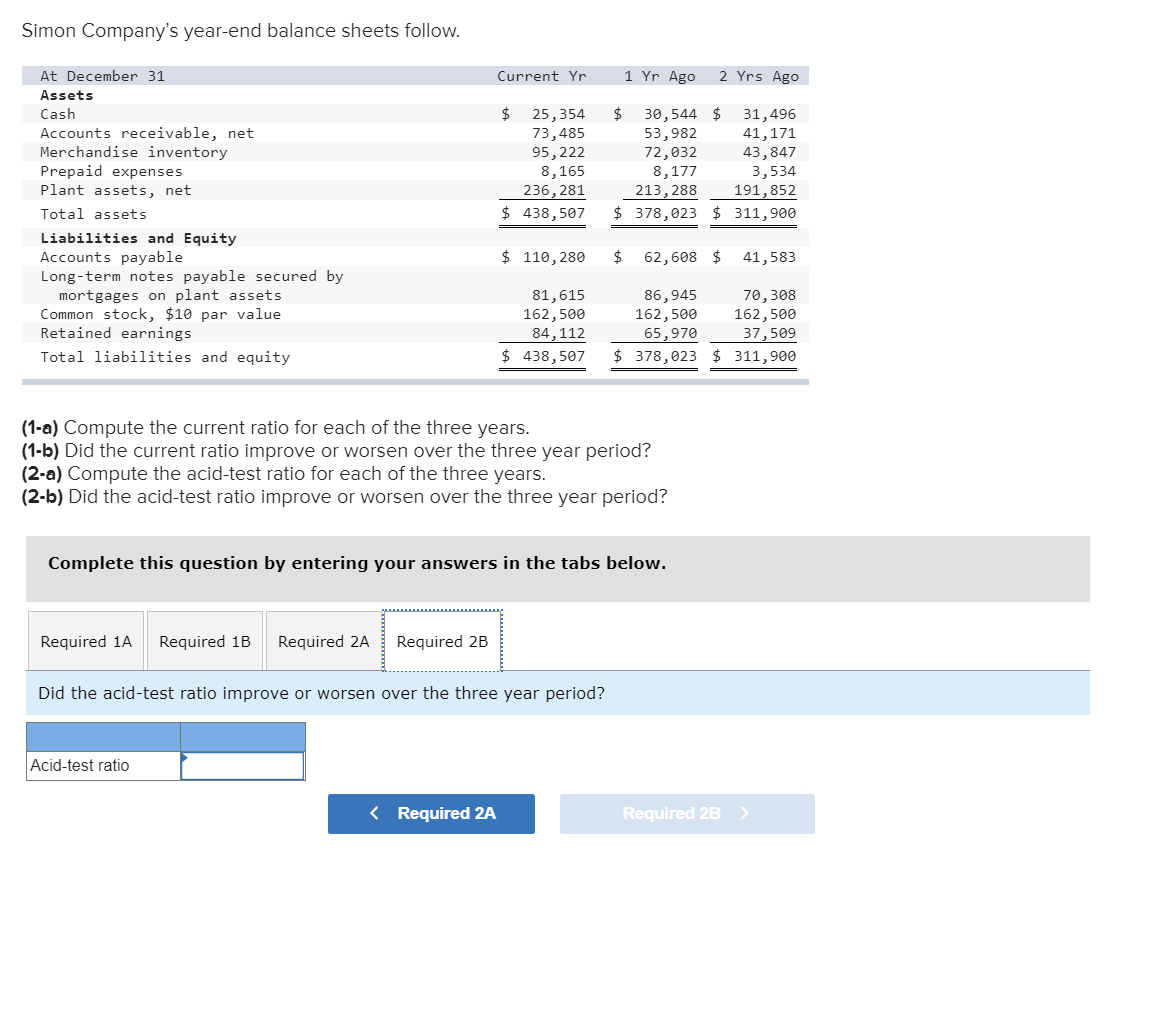

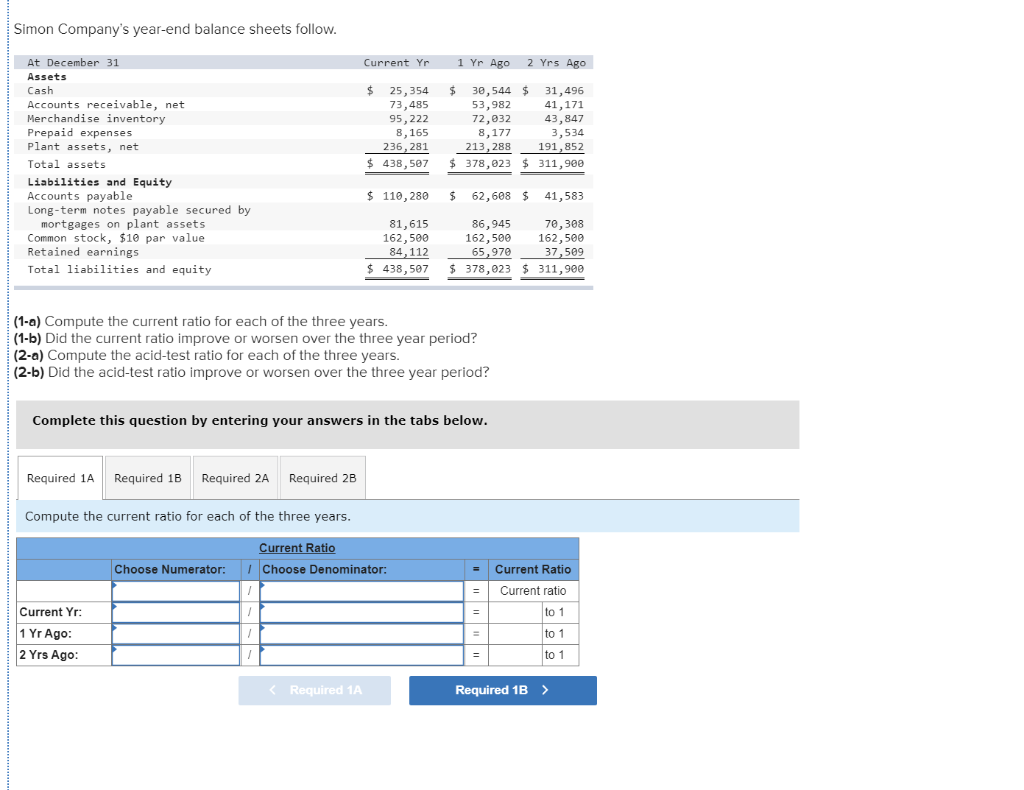

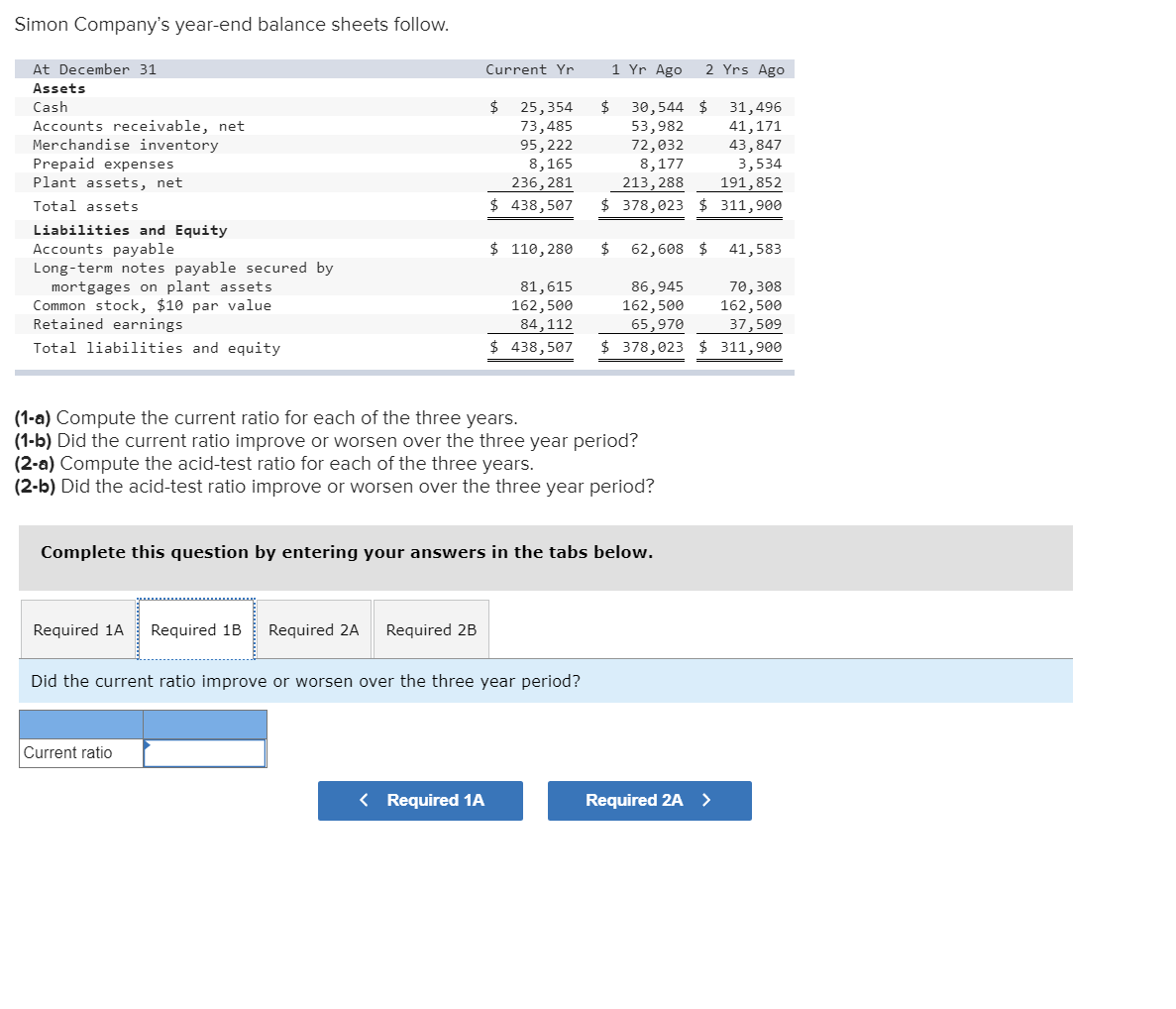

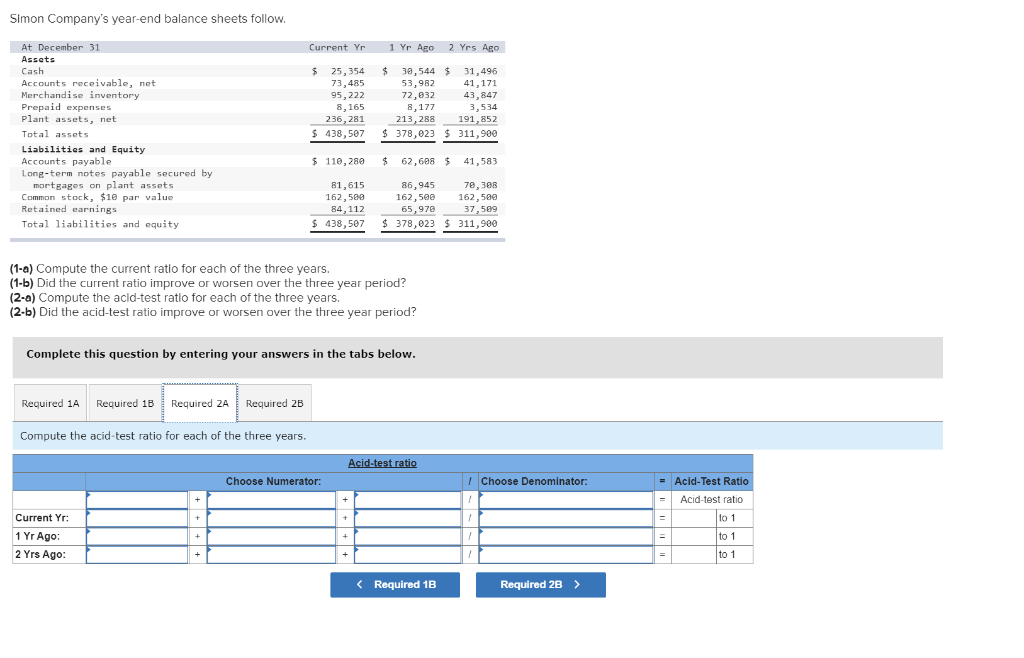

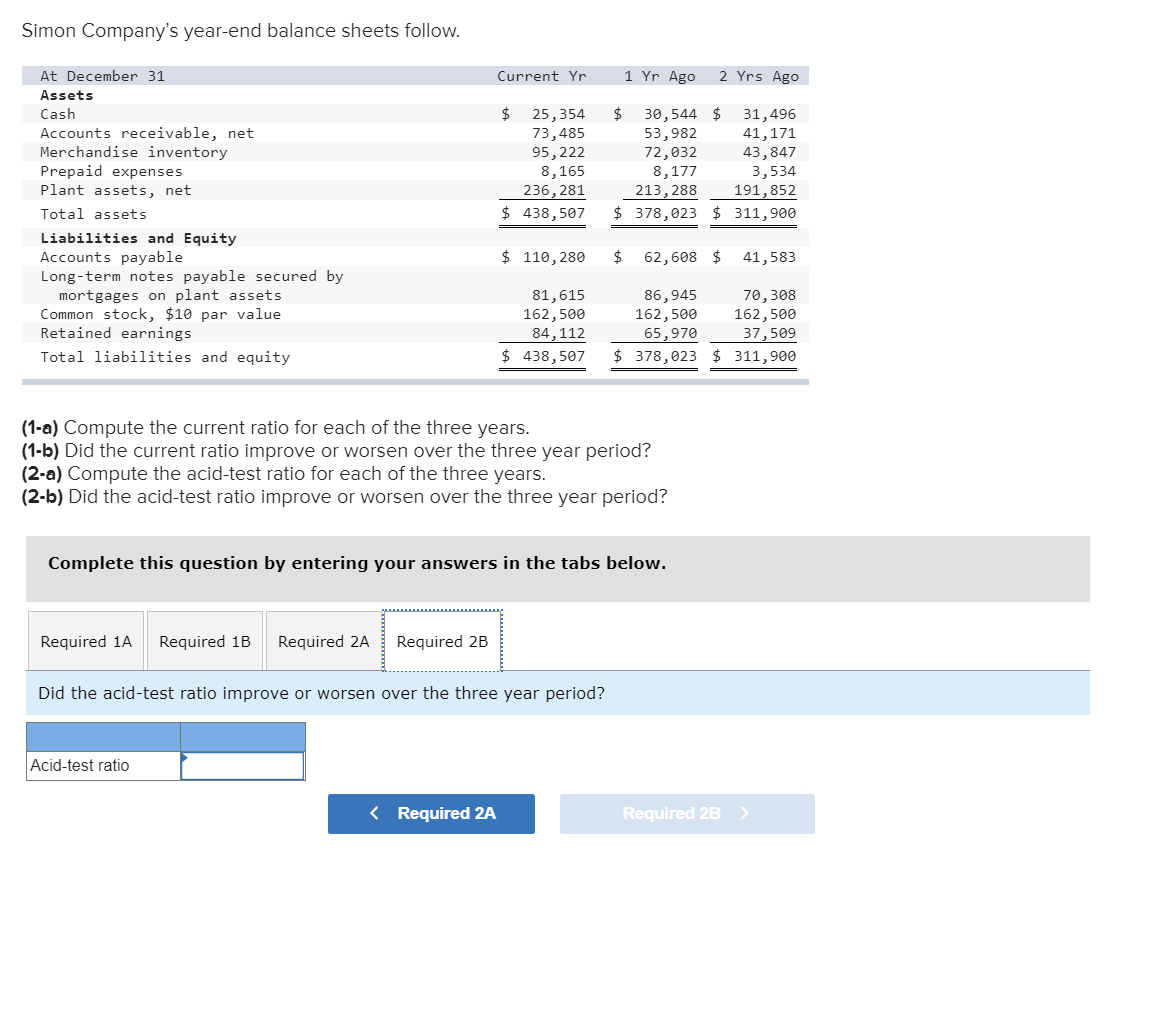

Simon Company's year-end balance sheets follow. Current Yr 1 Yr Ago 2 Yrs Ago At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable secured by mortgages on plant assets Common stock, $10 par value Retained earnings Total liabilities and equity $ 25,354 73,485 95,222 8,165 236, 281 $ 438,507 $ 30,544 $ 31,496 53,982 41,171 72,032 43,847 8,1773 ,534 213,288 191,852 $ 378,023 $ 311,900 $ 110,280 $ 62,608 $ 41,583 162,500 84,112 $ 438,507 86,945 70,308 162,500 162,500 65,970 37,509 $ 378,023 $ 311,900 (1-a) Compute the current ratio for each of the three years. (1-b) Did the current ratio improve or worsen over the three year period? (2-a) Compute the acid-test ratio for each of the three years. (2.b) Did the acid-test ratio improve or worsen over the three year period? Complete this question by entering your answers in the tabs below. Required 1A Required 1B Required 2A Required 2B Compute the current ratio for each of the three years. Current Ratio Choose Denominator: Choose Numerator: = Current Yr: 1 Yr Ago: 2 Yrs Ago: Current Ratio Current ratio to 1 to 1 to 1 Simon Company's year-end balance sheets follow. Current Yr 1 Yr Ago 2 Yrs Ago At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable secured by mortgages on plant assets Common stock, $10 par value Retained earnings Total liabilities and equity $ 25, 354 73,485 95,222 8,165 236, 281 $ 438,507 $ 30,544 $ 31,496 53,982 41,171 72,032 43,847 8,177 3,534 213,288 191,852 $ 378,023 $ 311,900 $ 110,280 $ 62,608 $ 41,583 81,615 162,500 84,112 $ 438,507 86,945 70,308 162,500 162,500 65,970 37,509 $ 378,023 $ 311,900 (1-a) Compute the current ratio for each of the three years. (1-b) Did the current ratio improve or worsen over the three year period? (2-a) Compute the acid-test ratio for each of the three years. (2-b) Did the acid-test ratio improve or worsen over the three year period? Complete this question by entering your answers in the tabs below. Required 1A Required 1B Required 2A Required 2B Did the current ratio improve or worsen over the three year period? Current ratio Required 1A Required 2A > Simon Company's year-end balance sheets follow. Current Yr 1 Yr Ago 2 Yrs Ago At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable secured by mortgages on plant assets Common stock, $10 par value Retained earnings Total liabilities and equity $ 25,354 73,485 95,222 8,165 236, 281 $ 438,507 $ 30,544 $ 31,496 53,98241,171 72,632 43,847 8,177 3,534 213,288 191,852 $ 378,023 $ 311,900 $ 110,280 $ 62,688 $ 41,583 81,615 162,589 84,112 $ 438,507 86,945 70,388 162,50 162,500 65,970 37,589 $ 378,023 $ 311,900 (1-a) Compute the current ratio for each of the three years. (1-b) Did the current ratio improve or worsen over the three year period? (2-a) Compute the acid-test ratio for each of the three years. (2-b) Did the acid-test ratio improve or worsen over the three year period? Complete this question by entering your answers in the tabs below. Required 1A Required 1B Required 2A Required 2B Compute the acid-test ratio for each of the three years. Acid-test ratio Choose Numerator: 1 Choose Denominator: - Acid-Test Ratio Acid-test ratio Current Yr: 1 Yr Ago: 2 Yrs Ago Simon Company's year-end balance sheets follow. Current Yr 1 Yr Ago 2 Yrs Ago At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable secured by mortgages on plant assets Common stock, $10 par value Retained earnings Total liabilities and equity $ 25,354 73,485 95, 222 8,165 236, 281 $ 438,507 $ 30,544 $ 31,496 53,982 41,171 72,032 43,847 8,177 3,534 213,288 191,852 $ 378,023 $ 311,900 $ 110,280 $ 62,608 $ 41,583 81,615 162,500 84,112 $ 438,507 86,945 70,308 162,500 162,500 65,970 37,509 $ 378,023 $ 311,900 (1-a) Compute the current ratio for each of the three years. (1-b) Did the current ratio improve or worsen over the three year period? (2-a) Compute the acid-test ratio for each of the three years. (2-b) Did the acid-test ratio improve or worsen over the three year period? Complete this question by entering your answers in the tabs below. Required 1A Required 1B Required 2A Required 2B Did the acid-test ratio improve or worsen over the three year period? Acid-test ratio