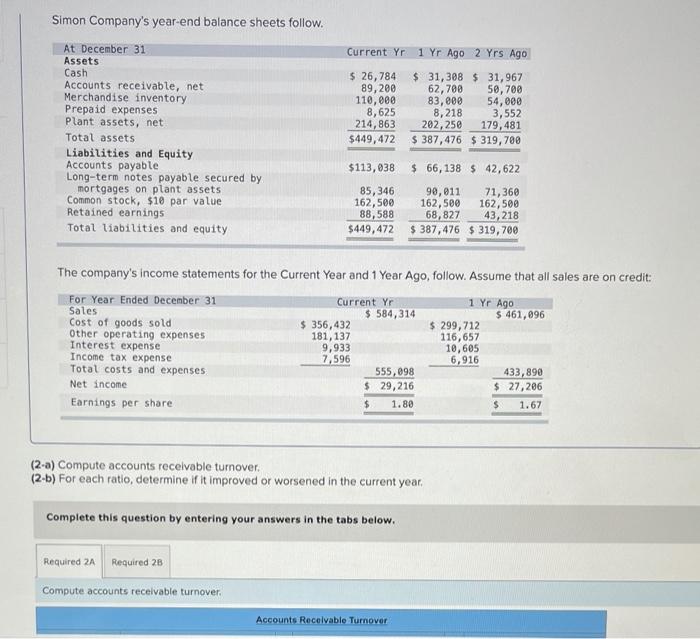

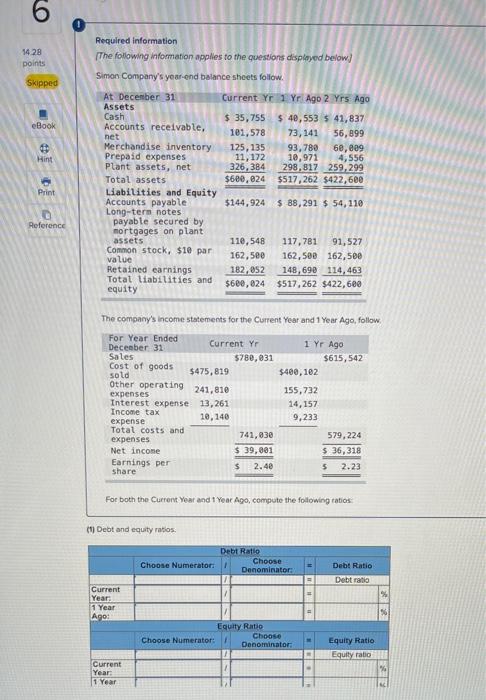

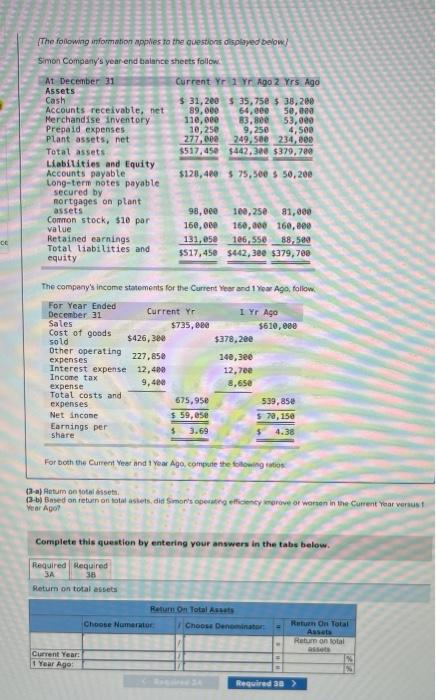

Simon Company's year-end balance sheets follow. Current Yr At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable secured by mortgages on plant assets Common stock, $10 par value Retained earnings Total liabilities and equity $ 26,784 89,200 110,000 8,625 214,863 $449, 472 1 Yr Ago 2 Yrs Ago $ 31,398 $ 31,967 62,700 50,700 83,000 54,000 8,218 3,552 202,250 179,481 $ 387,476 $ 319,700 $113,038 $ 66,138 $ 42,622 85,346 162,500 88,588 $449,472 90,011 71,360 162,500 162,500 68,827 43,218 $ 387,476 $ 319,700 The company's income statements for the Current Year and 1 Year Ago, follow. Assume that all sales are on credit: For Year Ended December 31 Current Yr 1 Yr Ago Sales $ 584,314 $ 461,096 Cost of goods sold $ 356, 432 $ 299,712 Other operating expenses 181,137 116,657 Interest expense 9,933 10,605 Income tax expense 7,596 6,916 Total costs and expenses 555,098 433,890 Net income $ 29,216 $ 27,206 Earnings per share $ 1.80 $ 1.67 (2-a) Compute accounts receivable turnover. (2-6) For each ratio, determine if it improved or worsened in the current year, Complete this question by entering your answers in the tabs below. Required 2A Required 26 Compute accounts receivable turnover. Accounts Receivable Turnover 6 14.28 points Skipped eBook Hint Required information [The following information apples to the questions displayed below) Simon Company's year-end balance sheets follow At December 31 Current Y 1 Yr Ago 2 Yrs Ago Assets Cash $ 35,755 $ 40,553 $ 41,837 Accounts receivable, 101,578 net 73,141 56,899 Merchandise inventory 125, 135 93, 780 60,009 Prepaid expenses 11, 172 10,971 4,556 Plant assets, net 326,384 298,817 259,299 Total assets $600,024 $517,262 $422,600 Liabilities and Equity Accounts payable $144,924 $ 88,291 $ 54,110 Long-term notes payable secured by mortgages on pl assets 110,548 117,781 91,527 Common stock, $10 par value 162,500 162,500 162,500 Retained earnings 182,052 148, 690 114,463 Total liabilities and $600, 824 $517,262 $422, 680 equity Print Reference The company's income statements for the Current Year and 1 Year Ago, follow For Year Ended December 31 Sales Cost of goods sold Current Yr $780,031 $475,819 1 Yr Ago $615,542 $400, 102 Other operating 241,810 155,732 14,157 9,233 expenses Interest expense 13,261 Income tax 10,140 expense Total costs and 741,830 expenses Net income $ 39,001 Earnings per $ 2.40 share 579,224 $ 36,318 $ 2.23 For both the Current Year and 1 Year Ago, compute the following ratios (1) Debt and equity ratios Debt Ratio Choose Denominator: Choose Numerator: Debt Ratio Debt ratio ### 11 Current Year 11 Year Ago: % Equity Ratio Choose Choose Numerator: Denominator Equity Ratio Equity ratio Current Year 1 Year The following information applies to the questions displayed below) Simon Company's year end balance sheets follow Current Y 1 Yr Ago 2 Yrs Ago $ 31,200 $ 35,750 $ 38,200 89,000 64.000 5e, cea 110,000 83.800 53,000 10,250 9,250 4,500 277,200 249.580 234,600 $517,450 $442,300 $379,700 At December 31 Assets Cash Accounts receivable, het Merchandise Inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable secured by mortgages on plant assets Comon stock, $10 par value Retained earnings Total liabilities and equity $120,400 $ 75,500 $ 50,200 98,000 100,250 81,000 160,000 160,000 160,000 131,050 106.550 88,589 5517,450 $442,380 $379,700 ce The company income statements for the Current Year and 1 Yew Age, follow For Year Ended December 31 Current Yr 1 yr ago Sales $735,880 $610,000 Cost of goods sold $426,380 $378,200 Other operating 227,850 142,3ee expenses Interest expense 12,400 12,7ee Income tax 9,400 8.650 expense Total costs and 675,950 539,85e expenses Net Income $ 59, ese $ 70,150 Earnings per 3.69 4.38 share For both the Current Year and Yar Ago compute the following is (2-a) Return on total asset bi med on return on totul asets, die Simon's operating oy rowear wonen in the current Year vernost Wrar Agol Complete this question by entering your answers in the tabs below. Required Required SA 38 Return on total assets Relum On Total Assets Choose Numerator Choose Denominator Run On Total Assets Return on total Current Year: 1 Year Ago Required 30 >