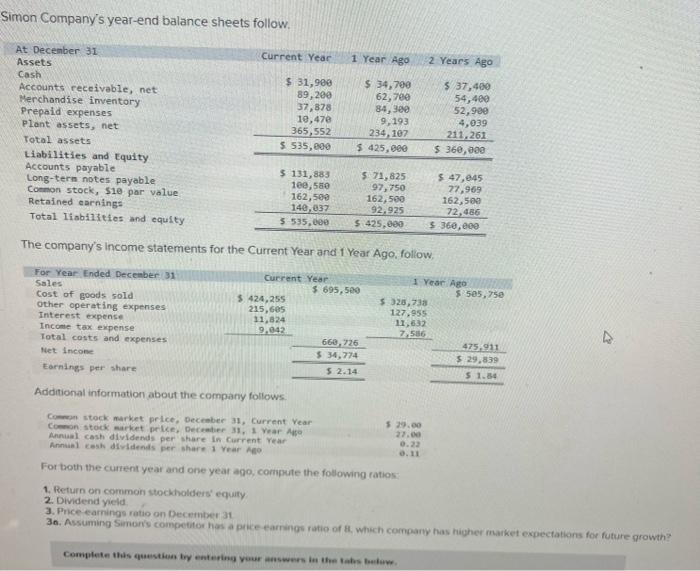

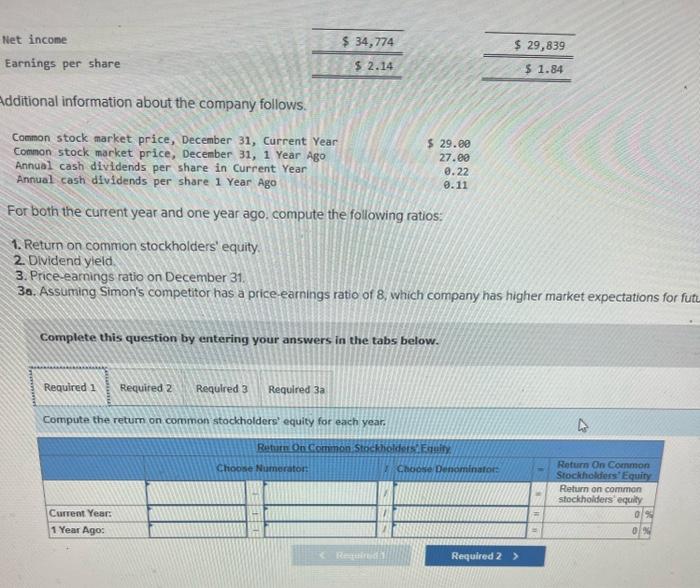

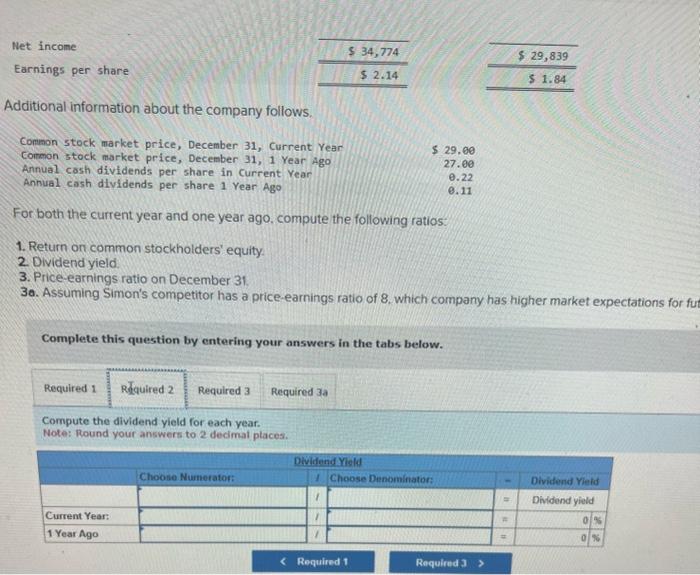

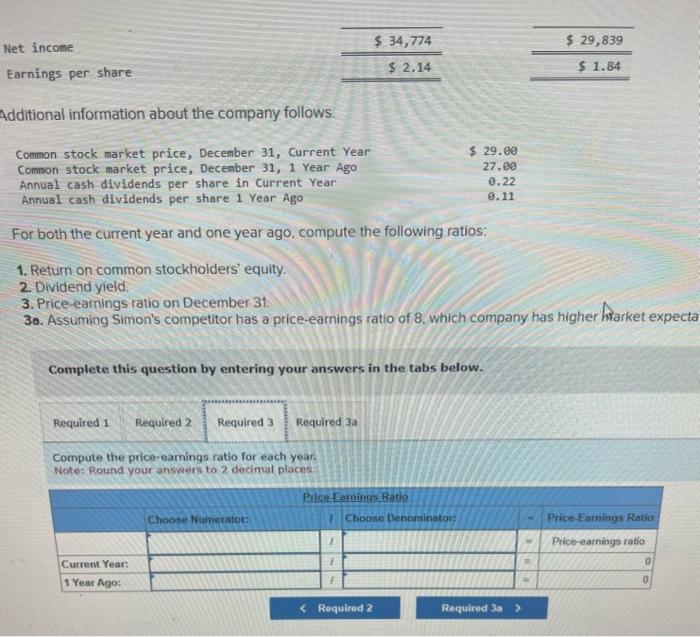

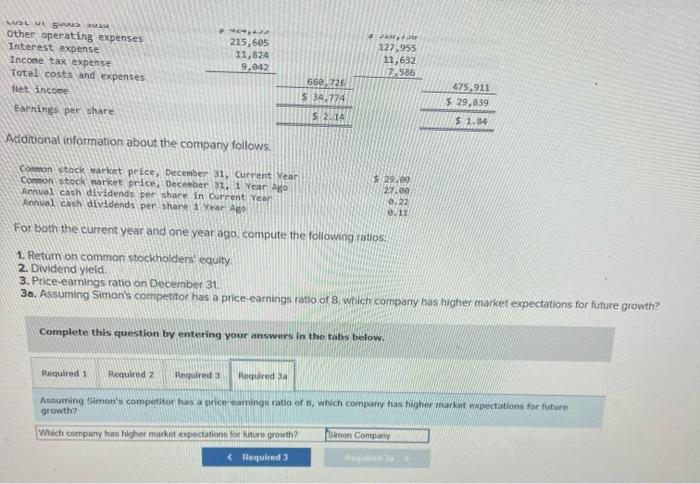

Simon Company's year-end balance sheets follow. The company's income statements for the Current Year and 1 Year Ago, follow Additional information about the company follows For both the current year and one year ago, compute the following ratios: 1. Return on common stockholders' equity 2. Dividend yield 3. Price earnings ratio on December at 30. Assuming Simorrs competitor has a price earnings ratio of a, which compary has higher makket expectations for future growth? Idditional information about the company follows. For both the current year and one year ago, compute the following ratios: 1. Retum on common stockholders' equity. 2. Dividend yleld 3. Price-earnings ratio on December 31. 30. Assuming Simon's competitor has a price-earnings ratio of 8 , which company has higher market expectations for fut Complete this question by entering your answers in the tabs below. Compute the return on common stockholders' equity for each year. Additional information about the company follows. For both the current year and one year ago, compute the following ratios: 1. Return on common stockholders' equity. 2. Dividend yield. 3. Price-earnings ratio on December 31 30. Assuming Simon's competitor has a price-earnings ratio of 8 , which company has higher market expectations for fu Complete this question by entering your answers in the tabs below. Compute the dividend yield for each year. Note: Round your answers to 2 dedmat places. Additional information about the company follows. For both the current year and one year ago, compute the following ratios: 1. Return on common stockholders' equity. 2. Dividend yield. 3. Price-earnings ratio on December 31 . 30. Assuming Simon's competitor has a price-earnings ratio of 8 , which company has higher hiarket expecto Complete this question by entering your answers in the tabs below. Compute the price-earnings ratio for each year. Note: Round your answers to 2 decimal places Axditonal information about the company follows. For both the current year and one year ago, compute the following ratios: 1. Retum on common stockholders' equity 2. Dividend yield 3. Price-earnings ratio on December 31 3a. Assuming Simon's competitor has a price-earnings ratio of 8 , which company has higher market expectations for future growth? Complete this question by entering your answers in the tabs below. Assuming Simon" competitor has a price- eamings ratio of 8, which company has higher market expectations for futurn growth? Which company has higher makket expectations for fulure qrowth