Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Simone Smith, trading as Scents of Jamaica, is applying for a small-business loan. She provides the bank with the following information: cash in checking account,

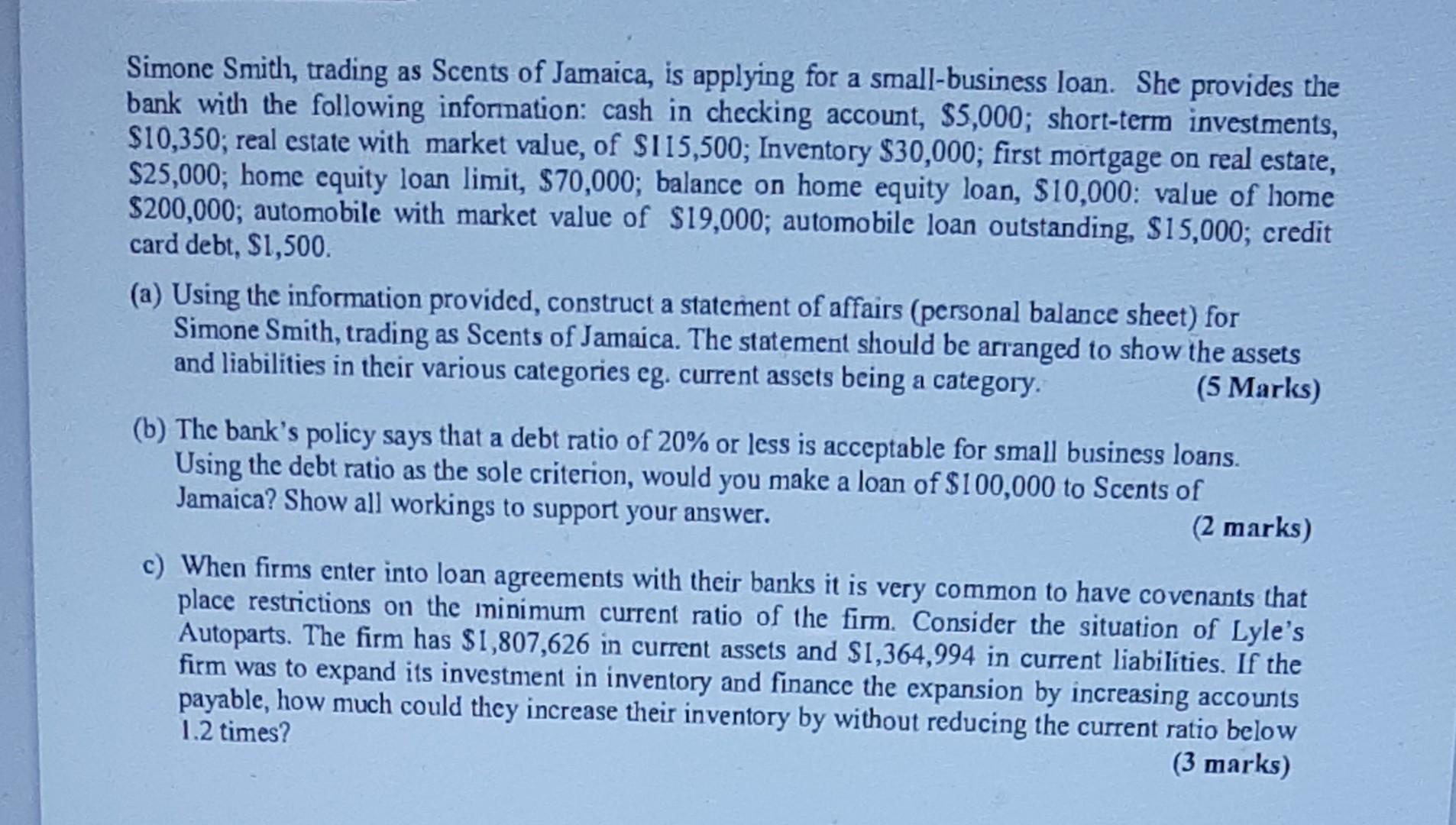

Simone Smith, trading as Scents of Jamaica, is applying for a small-business loan. She provides the bank with the following information: cash in checking account, $5,000; short-term investments, $10,350; real estate with market value, of $115,500; Inventory $30,000; first mortgage on real estate, $25,000; home equity loan limit, $70,000; balance on home equity loan, $10,000 : value of home $200,000; automobile with market value of $19,000; automobile loan outstanding, $15,000; credit card debt, S1,500. (a) Using the information provided, construct a statement of affairs (personal balance sheet) for Simone Smith, trading as Scents of Jamaica. The statement should be arranged to show the assets and liabilities in their various categories eg. current assets being a category. ( 5 Marks) (b) The bank's policy says that a debt ratio of 20% or less is acceptable for small business loans. Using the debt ratio as the sole criterion, would you make a loan of $100,000 to Scents of Jamaica? Show all workings to support your answer. ( 2 marks) c) When firms enter into loan agreements with their banks it is very common to have covenants that place restrictions on the ininimum current ratio of the firm. Consider the situation of Lyle's Autoparts. The firm has $1,807,626 in current assets and $1,364,994 in current liabilities. If the firm was to expand its investment in inventory and finance the expansion by increasing accounts payable, how much could they increase their inventory by without reducing the current ratio below 1.2 times

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started