Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Simple RI In 2014, American Faucet Corporation (AFC) had earnings before interest and taxes of $100 million. AFC is subject to a tax rate of

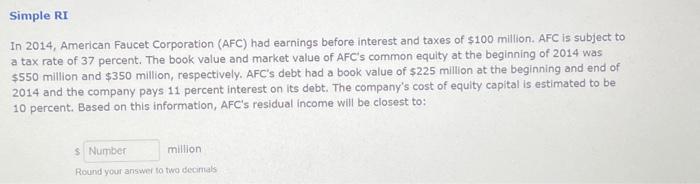

Simple RI In 2014, American Faucet Corporation (AFC) had earnings before interest and taxes of $100 million. AFC is subject to a tax rate of 37 percent. The book value and market value of AFC's common equity at the beginning of 2014 was $550 million and $350 million, respectively. AFC's debt had a book value of $225 million at the beginning and end of 2014 and the company pays 11 percent interest on its debt. The company's cost of equity capital is estimated to be 10 percent. Based on this information, AFC's residual income will be closest to: $ Number million Round your answer to two decimals

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started