Answered step by step

Verified Expert Solution

Question

1 Approved Answer

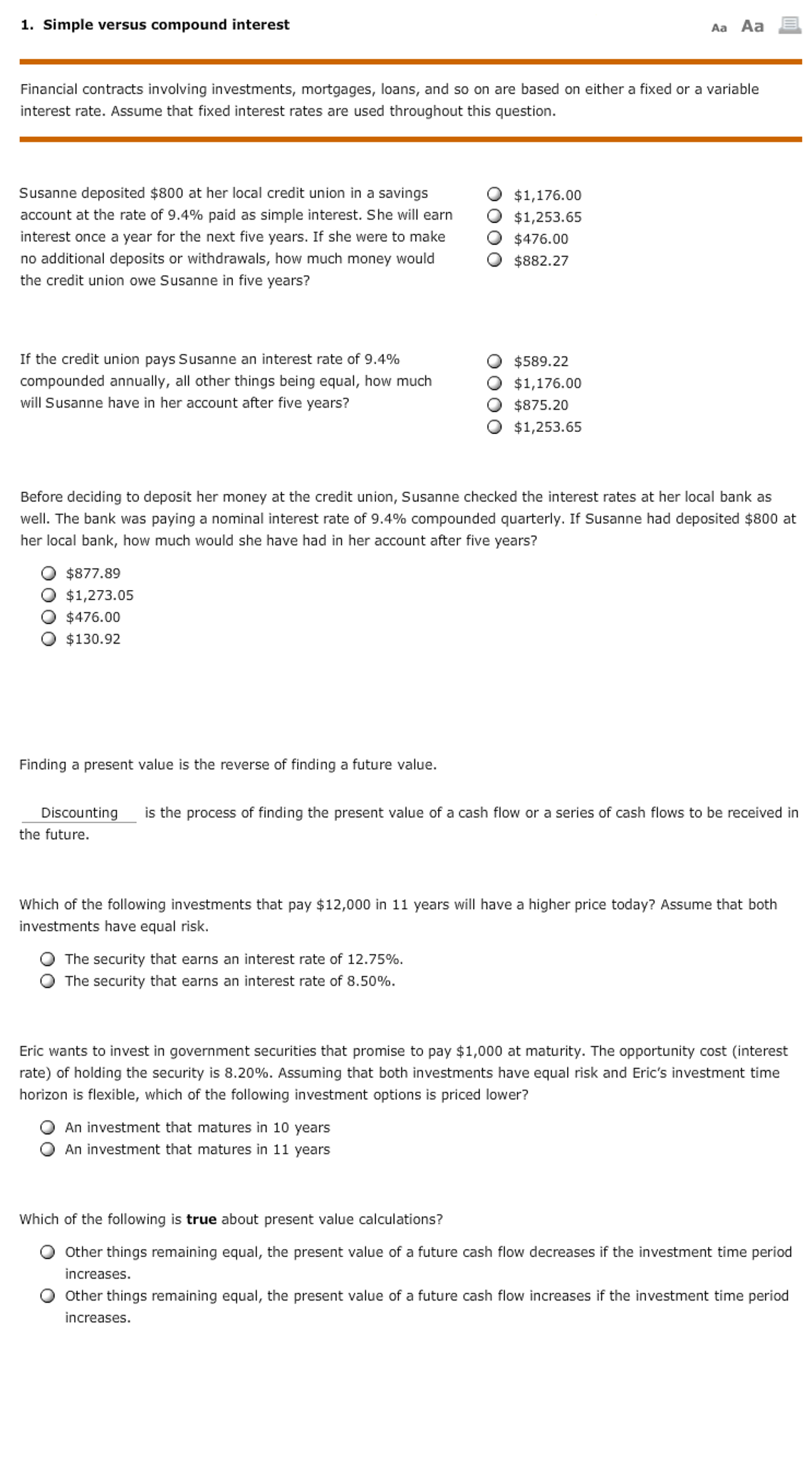

Simple versus Compound (Answer All ) Financial contracts involving investments, mortgages, loans, and so on are based on either a fixed or a variable interest

Simple versus Compound (Answer All )

Financial contracts involving investments, mortgages, loans, and so on are based on either a fixed or a variable interest rate. Assume that fixed interest rates are used throughout this question. Susanne deposited $800 at her local credit union in a savings account at the rate of 9.4% paid as simple interest. She will earn interest once a year for the next five years. If she were to make no additional deposits or withdrawals, how much money would the credit union owe Susanne in five years? $1, 176.00 $1, 253.65 $476.00 $882.27 If the credit union pays Susanne an interest rate of 9.4% compounded annually, all other things being equal, how much will Susanne have in her account after five years? $589.22 $1, 176.00 $875.20 $1, 253.65 Before deciding to deposit her money at the credit union, Susanne checked the interest rates at her local bank as well. The bank was paying a nominal interest rate of 9.4% compounded quarterly. If Susanne had deposited $800 at her local bank, how much would she have had in her account after five years? $877.89 $1, 273.05 $476.00 $130.92 Finding a present value is the reverse of finding a future value. Discounting is the process of finding the present value of a cash flow or a series of cash flows to be received in the future. Which of the following investments that pay $12,000 in 11 years will have a higher price today? Assume that both investments have equal risk. The security that earns an interest rate of 12.75%. The security that earns an interest rate of 8.50%. Eric wants to invest in government securities that promise to pay $1,000 at maturity. The opportunity cost (interest rate) of holding the security is 8.20%. Assuming that both investments have equal risk and Eric's investment time horizon is flexible, which of the following investment options is priced lower? An investment that matures in 10 years An investment that matures in 11 years Which of the following is true about present value calculations? Other things remaining equal, the present value of a future cash flow decreases if the investment time period increases. Other things remaining equal, the present value of a future cash flow increases if the investment time period increasesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started