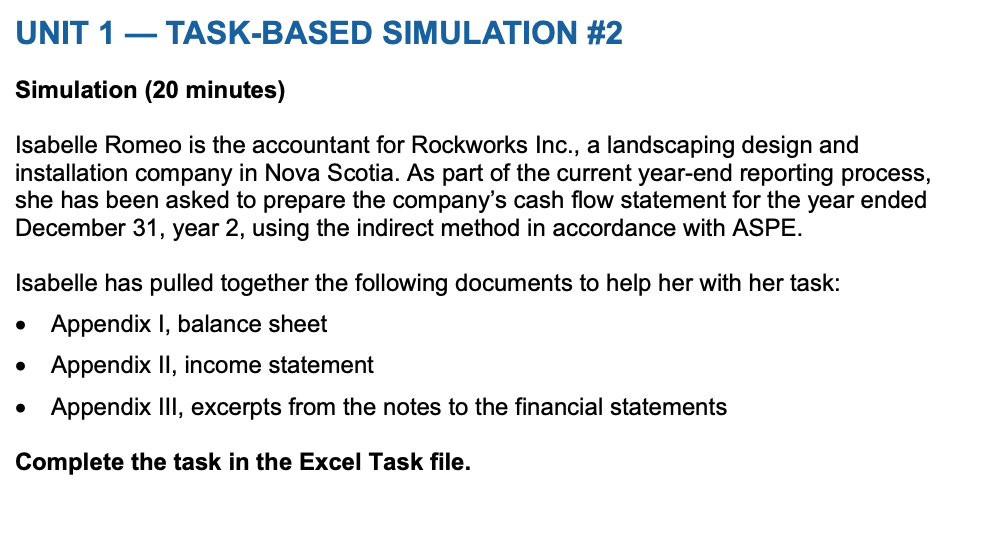

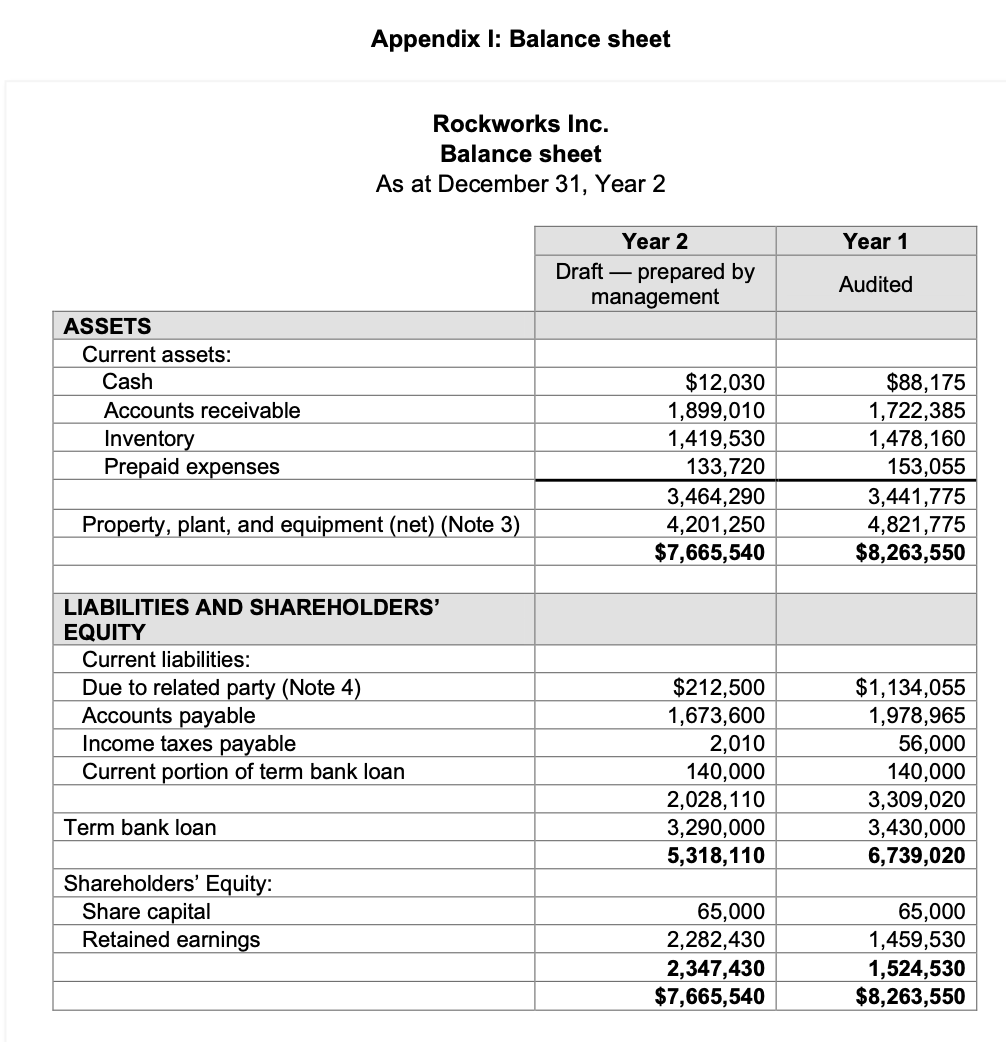

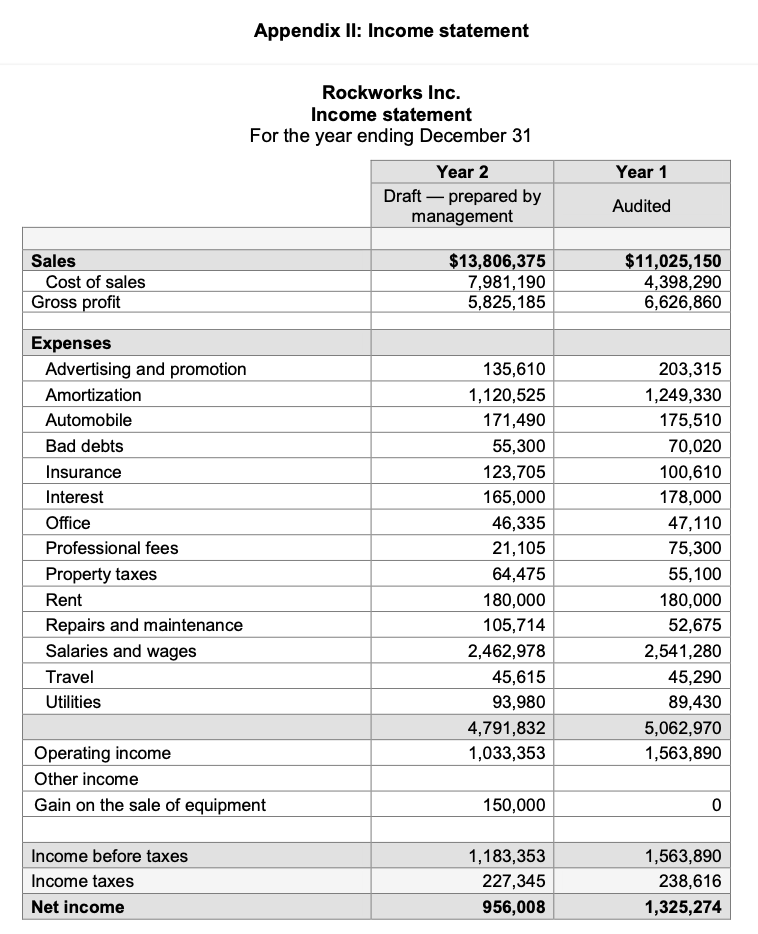

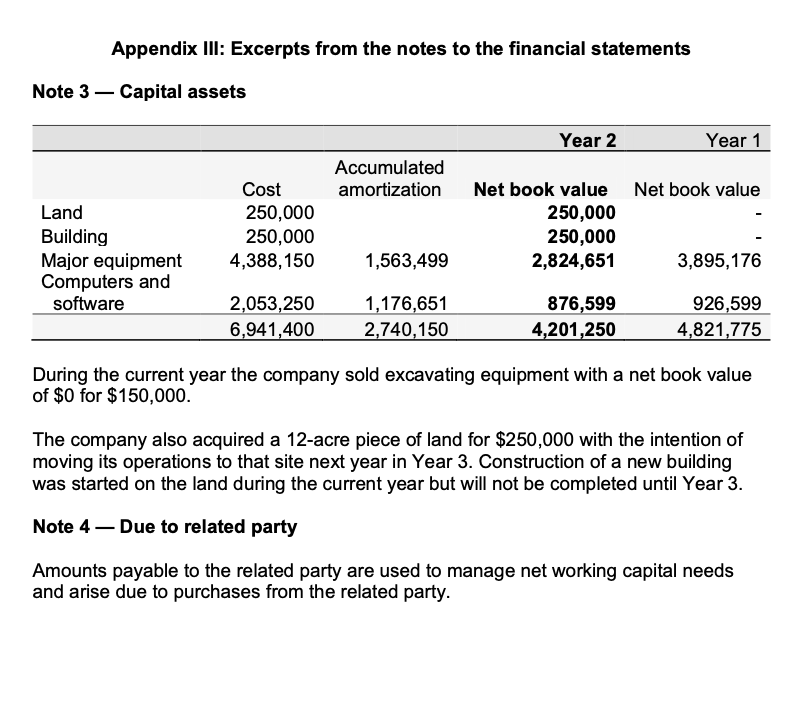

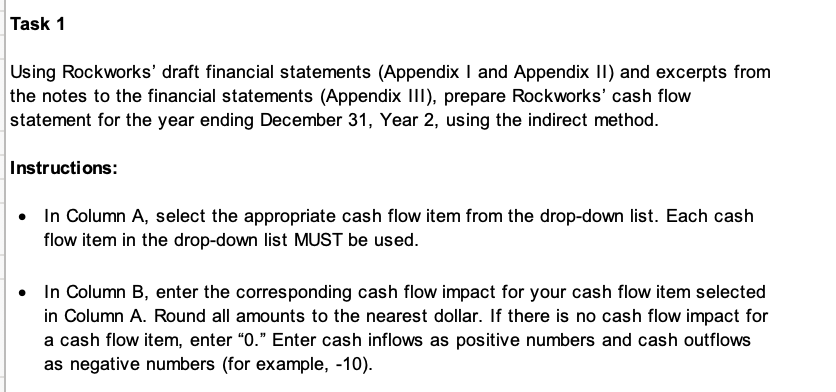

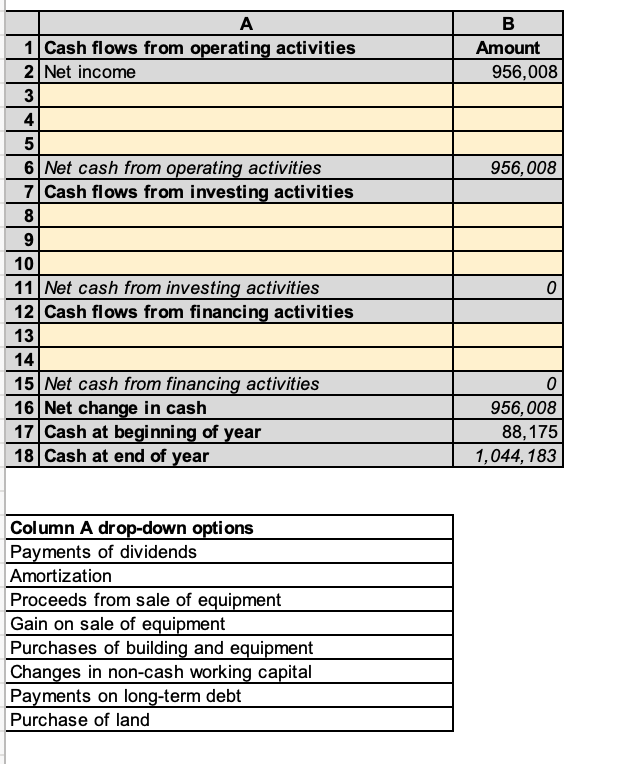

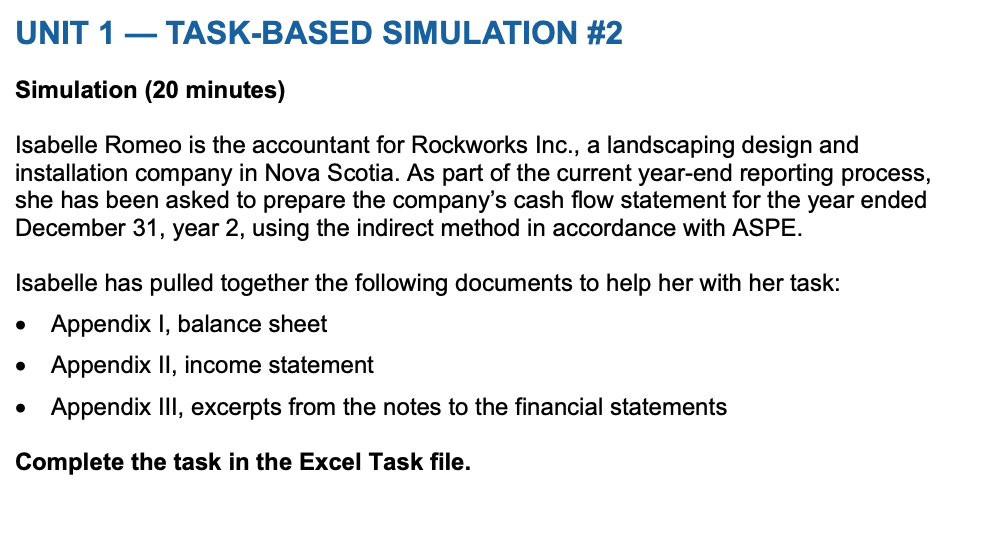

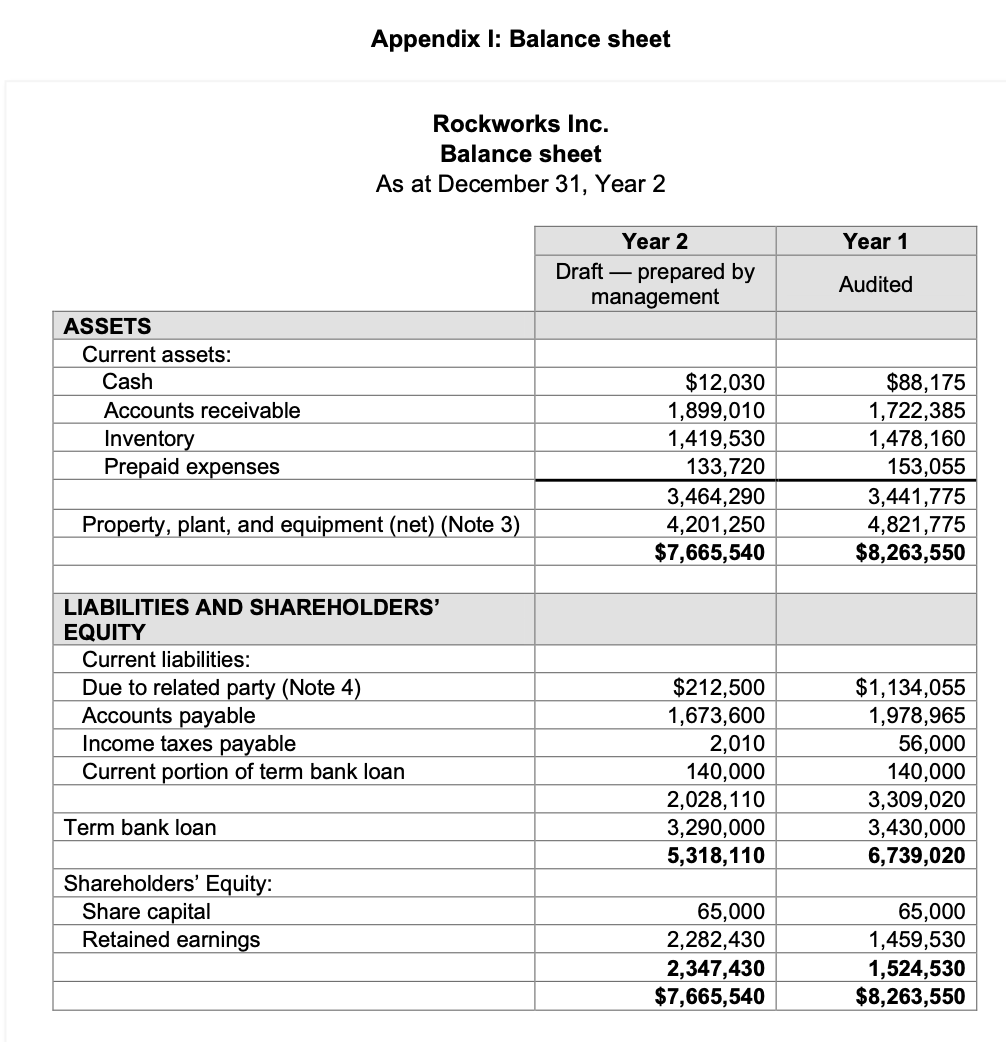

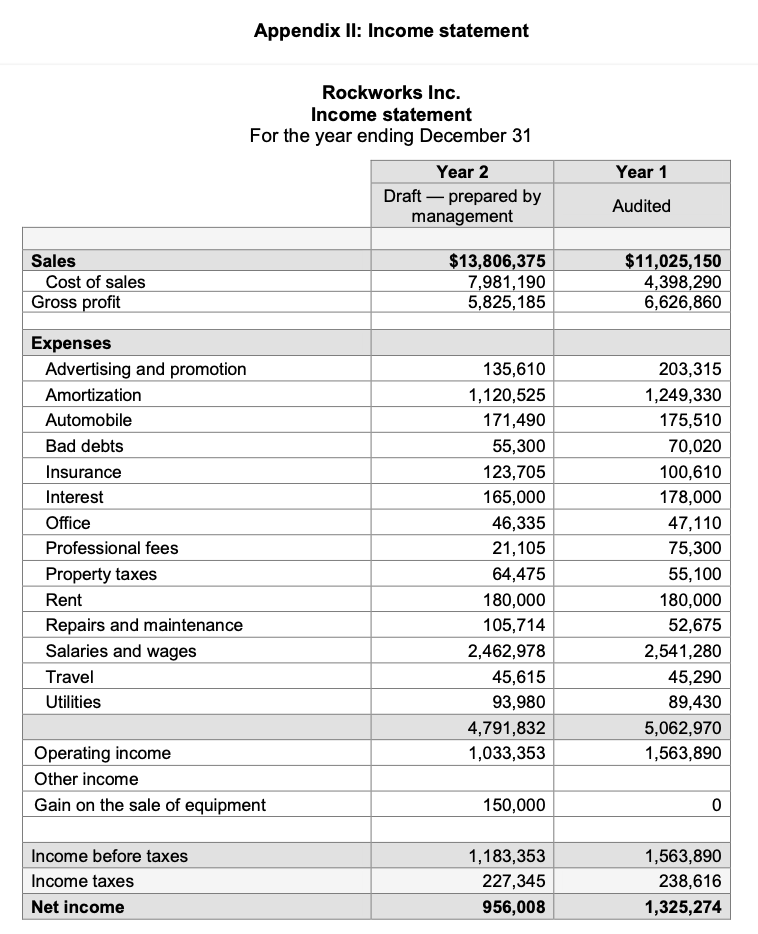

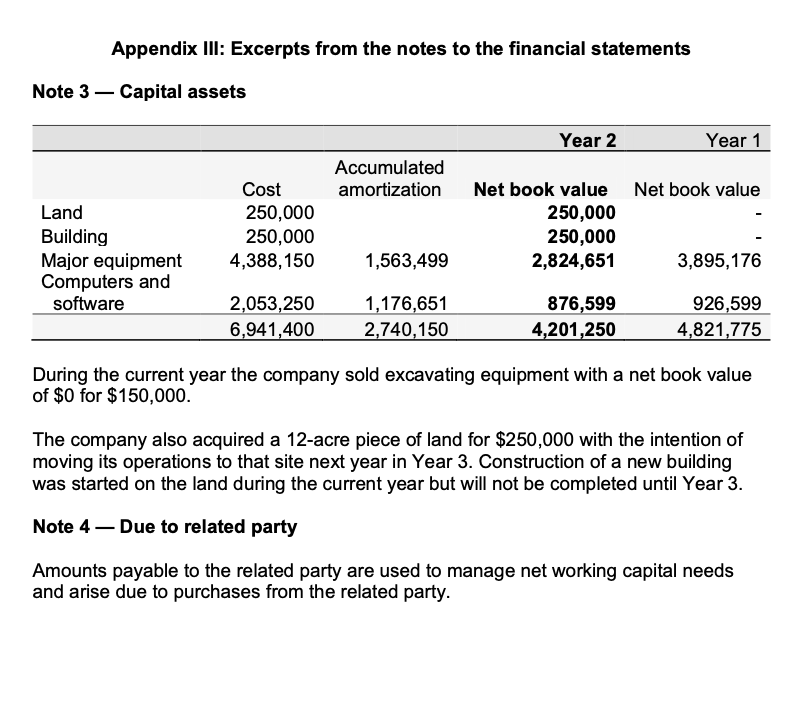

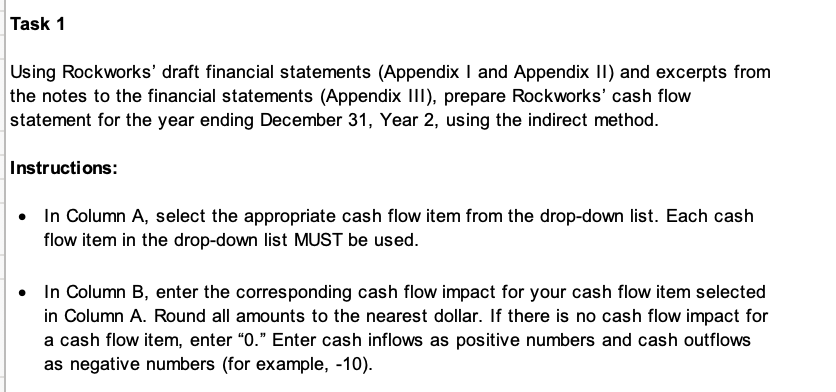

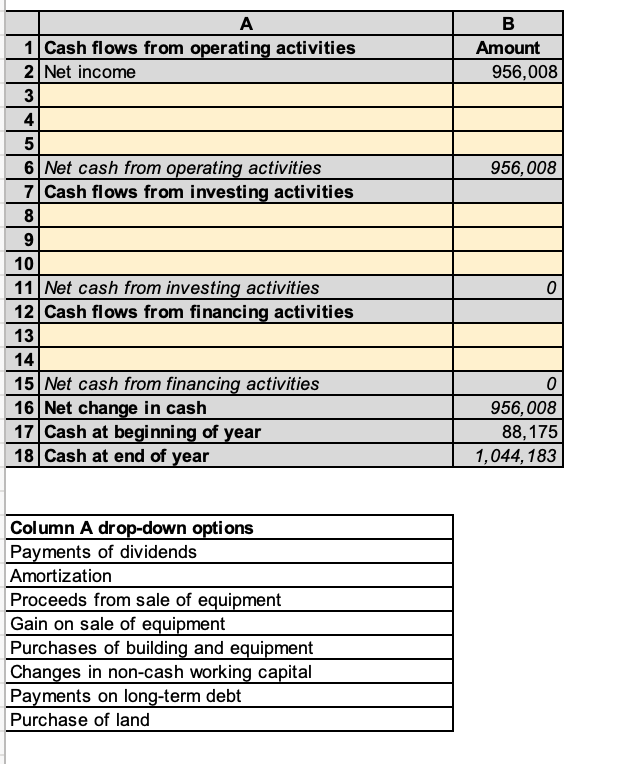

Simulation (20 minutes) Isabelle Romeo is the accountant for Rockworks Inc., a landscaping design and installation company in Nova Scotia. As part of the current year-end reporting process, she has been asked to prepare the company's cash flow statement for the year ended December 31, year 2, using the indirect method in accordance with ASPE. Isabelle has pulled together the following documents to help her with her task: - Appendix I, balance sheet - Appendix II, income statement - Appendix III, excerpts from the notes to the financial statements Complete the task in the Excel Task file. Appendix I: Balance sheet Rockworks Inc. Balance sheet As at December 31, Year 2 Appendix II: Income statement Rockworks Inc. Income statement For the vear endinn Deremher 31 Appendix III: Excerpts from the notes to the financial statements Note 3 - Capital assets During the current year the company sold excavating equipment with a net book value of $0 for $150,000. The company also acquired a 12-acre piece of land for $250,000 with the intention of moving its operations to that site next year in Year 3. Construction of a new building was started on the land during the current year but will not be completed until Year 3. Note 4 - Due to related party Amounts payable to the related party are used to manage net working capital needs and arise due to purchases from the related party. Using Rockworks' draft financial statements (Appendix I and Appendix II) and excerpts from the notes to the financial statements (Appendix III), prepare Rockworks' cash flow statement for the year ending December 31, Year 2, using the indirect method. Instructions: - In Column A, select the appropriate cash flow item from the drop-down list. Each cash flow item in the drop-down list MUST be used. - In Column B, enter the corresponding cash flow impact for your cash flow item selected in Column A. Round all amounts to the nearest dollar. If there is no cash flow impact for a cash flow item, enter "0." Enter cash inflows as positive numbers and cash outflows as negative numbers (for example, -10). \begin{tabular}{r|l|r|} \hline & \multicolumn{1}{|c|}{ A } & \multicolumn{1}{c|}{ B } \\ \hline 1 & Cash flows from operating activities & Amount \\ \hline 2 & Net income & 956,008 \\ \hline 3 & & \\ \hline 4 & & \\ \hline 5 & & \\ \hline 6 & Net cash from operating activities & 956,008 \\ \hline 7 & Cash flows from investing activities & \\ \hline 8 & & \\ \hline 9 & & \\ \hline 10 & & \\ \hline 11 & Net cash from investing activities & \\ \hline 12 & Cash flows from financing activities & \\ \hline 13 & & 0 \\ \hline 14 & & 86,008 \\ \hline 15 & Net cash from financing activities & \\ \hline 16 & Net change in cash & 1,044,183 \\ \hline 17 & Cash at beginning of year & \\ \hline 18 & Cash at end of year & \\ \hline \end{tabular} \begin{tabular}{|l|} \hline Column A drop-down options \\ \hline Payments of dividends \\ \hline Amortization \\ \hline Proceeds from sale of equipment \\ \hline Gain on sale of equipment \\ \hline Purchases of building and equipment \\ \hline Changes in non-cash working capital \\ \hline Payments on long-term debt \\ \hline Purchase of land \\ \hline \end{tabular}