Answered step by step

Verified Expert Solution

Question

1 Approved Answer

since Chegg decided it would change the numbers last post, please do the updated one. Chinglish Dirk (B).Chinglish Dirk Company (Hong Kong) exports razor blades

since Chegg decided it would change the numbers last post, please do the updated one.

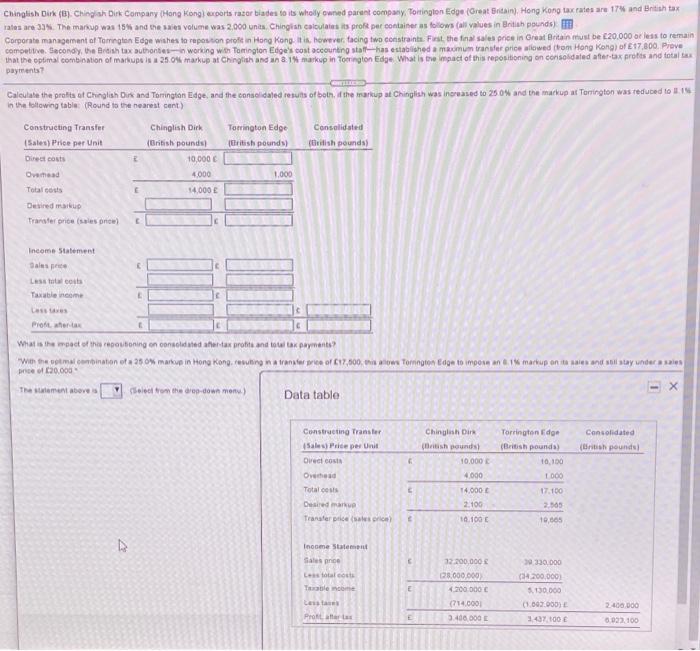

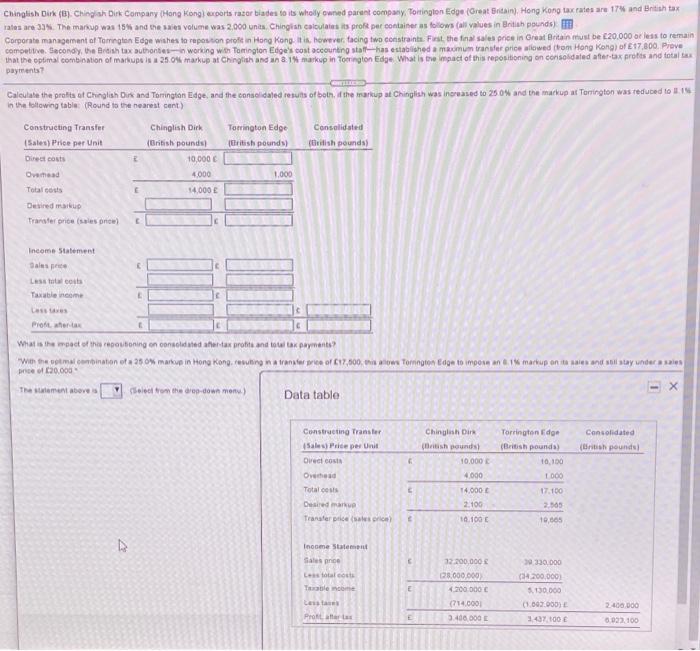

Chinglish Dirk (B).Chinglish Dirk Company (Hong Kong) exports razor blades to its wholly owned parent company, Torrington Edy (Great Britain, Hong Kong tax rates are 17 and British tax rates are 3. The markup was 15 and the volume was 2,000 units Chingish calculates its pro per container as follows (all values in British pounds) Corporate management of Tomington Edge wishes to reposition profit in Hong Kong However, tacing two constraints. First, the final sale price in Great Britain must be C20,000 or less to remain competitive. Secondly, the British tax authenties working with Tomington Edge's cost accounting stalas established a momum transfer price allowed to Hong Kong) of 17,000. Prove that the optimal combination of markupels 25.0markup at Chinglish and an 81% markup in Tomington Edge What is the mpact of this repositioning on consolidated after tax erotts and totalt payments Calculate the protte of Chinglish Dirk and Torrington Edge, and the consolidated results of both, if the markup ut Chinglan was increased to 23 04 and the markup at Torrington was teduted to 1.16 in the following table (Round to the nearest cent) Constructing Transfer Chinglish Dirk Torrington Edge Consolidated (Sales) Proe per Unit (British pounds British pounds) (British pounds Direct costs 10,000 Omad 4.000 1.000 Totalcos 14.000 Desired Transferences once Income Statement Less to Taxable income E Profit when C What is the most of this rouloning en onded after tax profit and to al tax payments w me vetmel commination of a 28 % marum in Hong Kong, resulting in a transfer ca 0617,800, ena alowe Tornington Edge to imponn an markup on to make and und stay under a 1203 of 30.000 holdet trom the doop down menu Data table Thement above Consolidated Torrington Edge (British pound 10.100 (British pounds Constructing Transfer Sale Price per Unit Oct costa Othe Total costs Desired Transfer price (sales) Chinglish Di British pounds 10.000 4.000 000 14.000 2.100 17.100 2.565 16.100 10,805 Income Statement Salence 39 330.000 Lesotalout Telecom E 72.200,000 28.000.000 4.200.000 (714.000 3.400.000 (4.200,000 5.130.000 (1.097.000) 1.437.100 Les Protaras E 2400.000 0022100

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started