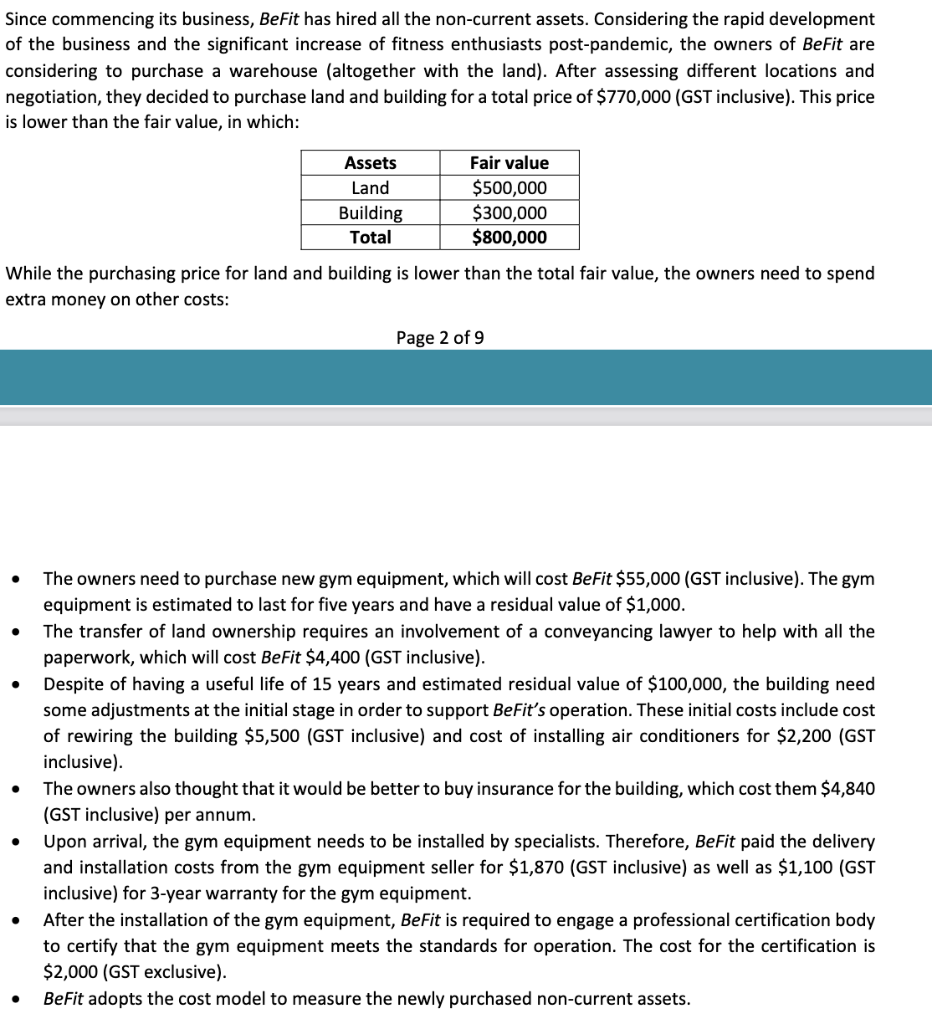

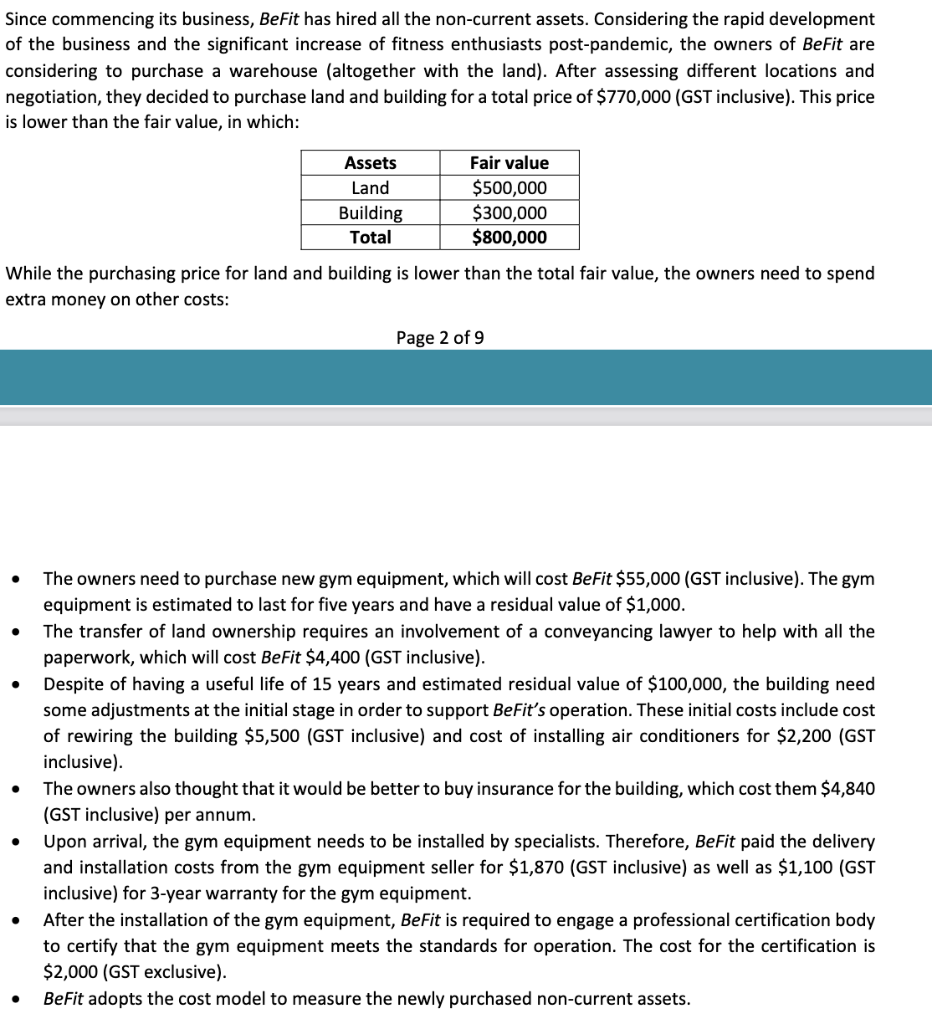

Since commencing its business, BeFit has hired all the non-current assets. Considering the rapid development of the business and the significant increase of fitness enthusiasts post-pandemic, the owners of BeFit are considering to purchase a warehouse (altogether with the land). After assessing different locations and negotiation, they decided to purchase land and building for a total price of $770,000 (GST inclusive). This price is lower than the fair value, in which: While the purchasing price for land and building is lower than the total fair value, the owners need to spend extra money on other costs: Page 2 of 9 - The owners need to purchase new gym equipment, which will cost BeFit $55,000 (GST inclusive). The gym equipment is estimated to last for five years and have a residual value of $1,000. - The transfer of land ownership requires an involvement of a conveyancing lawyer to help with all the paperwork, which will cost BeFit $4,400 (GST inclusive). - Despite of having a useful life of 15 years and estimated residual value of $100,000, the building need some adjustments at the initial stage in order to support BeFit's operation. These initial costs include cost of rewiring the building $5,500 (GST inclusive) and cost of installing air conditioners for $2,200 (GST inclusive). - The owners also thought that it would be better to buy insurance for the building, which cost them $4,840 (GST inclusive) per annum. - Upon arrival, the gym equipment needs to be installed by specialists. Therefore, BeFit paid the delivery and installation costs from the gym equipment seller for $1,870 (GST inclusive) as well as $1,100 (GST inclusive) for 3-year warranty for the gym equipment. - After the installation of the gym equipment, BeFit is required to engage a professional certification body to certify that the gym equipment meets the standards for operation. The cost for the certification is $2,000 (GST exclusive). - BeFit adopts the cost model to measure the newly purchased non-current assets. Propose and justify whether BeFit should apply the percentage of net credit sales method or the ageing method in accounting for doubtful debts. Warranties While BeFit have engaged high-quality local producers of fitness clothing as collaborators for their products, some manufacturing defects are unavoidable. For the year ended 30 June 2022, BeFit recorded net sales of $84,700 (GST inclusive) and sales returns of $1,100 (GST inclusive). Based on prior period, around 1% of net sales are claimed as warranties. The owners believe the warranty amount should be expensed in the period when the claims take places, which is normally in the period following the sale