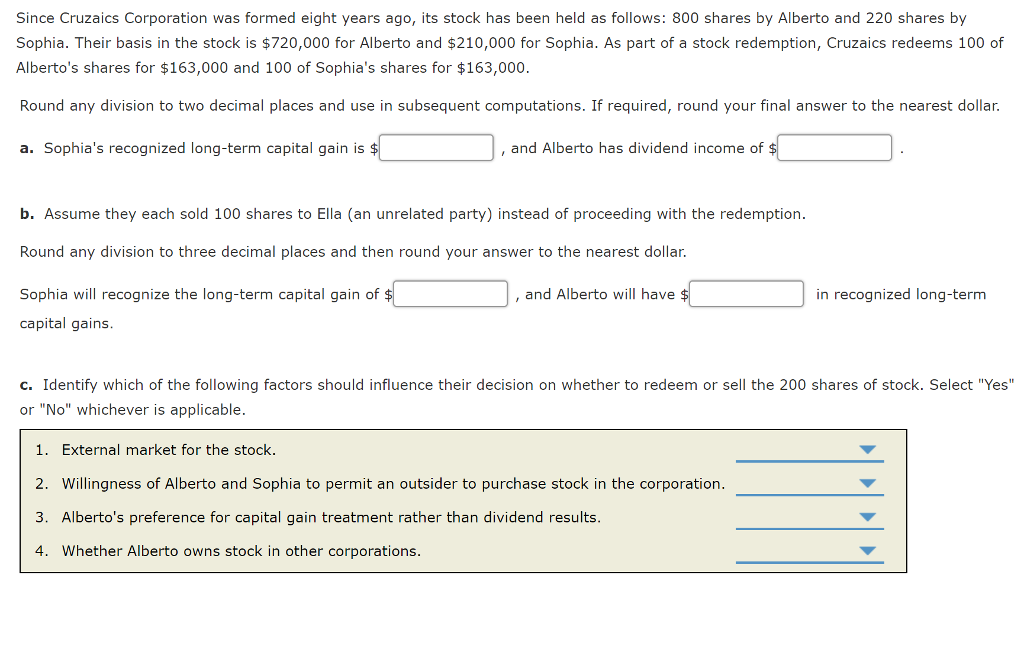

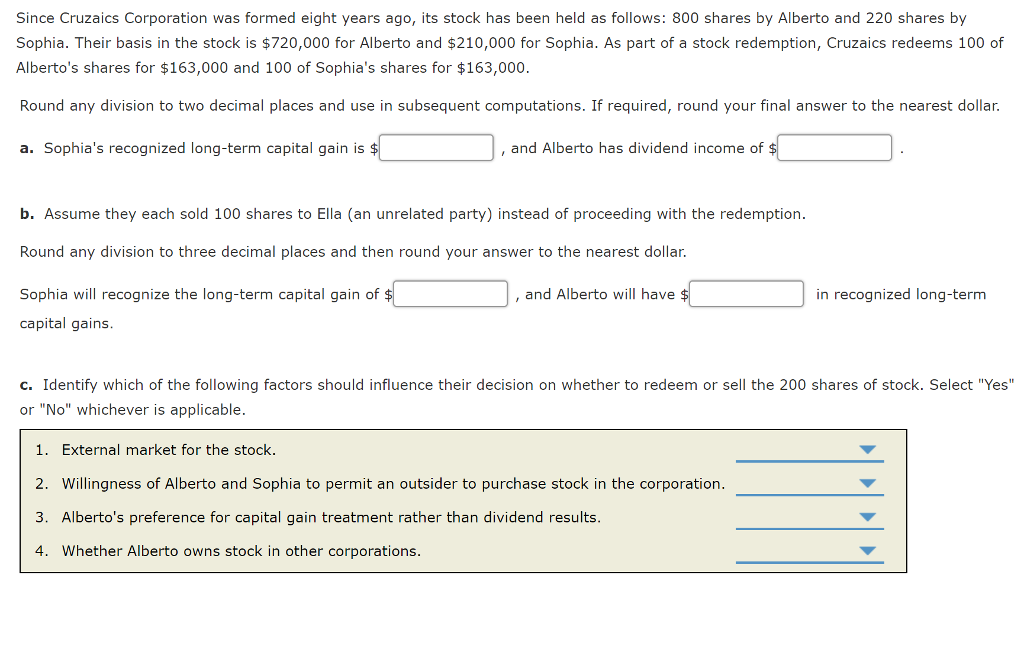

Since Cruzaics Corporation was formed eight years ago, its stock has been held as follows: 800 shares by Alberto and 220 shares by Sophia. Their basis in the stock is $720,000 for Alberto and $210,000 for Sophia. As part of a stock redemption, Cruzaics redeems 100 of Alberto's shares for $163,000 and 100 of Sophia's shares for $163,000. Round any division to two decimal places and use in subsequent computations. If required, round your final answer to the nearest dollar. a. Sophia's recognized long-term capital gain is , and Alberto has dividend income of $ b. Assume they each sold 100 shares to Ella (an unrelated party) instead of proceeding with the redemption Round any division to three decimal places and then round your answer to the nearest dollar. Sophia will recognize the long-term capital gain of capital gains. and Alberto will have in recognized long-term , c. Identify which of the following factors should influence their decision on whether to redeem or sell the 200 shares of stock. Select "Yes" or "No" whichever is applicable 1. External market for the stock. 2. Willingness of Alberto and Sophia to permit an outsider to purchase stock in the corporation. 3. Alberto's preference for capital gain treatment rather than dividend results. 4. Whether Alberto owns stock in other corporations Since Cruzaics Corporation was formed eight years ago, its stock has been held as follows: 800 shares by Alberto and 220 shares by Sophia. Their basis in the stock is $720,000 for Alberto and $210,000 for Sophia. As part of a stock redemption, Cruzaics redeems 100 of Alberto's shares for $163,000 and 100 of Sophia's shares for $163,000. Round any division to two decimal places and use in subsequent computations. If required, round your final answer to the nearest dollar. a. Sophia's recognized long-term capital gain is , and Alberto has dividend income of $ b. Assume they each sold 100 shares to Ella (an unrelated party) instead of proceeding with the redemption Round any division to three decimal places and then round your answer to the nearest dollar. Sophia will recognize the long-term capital gain of capital gains. and Alberto will have in recognized long-term , c. Identify which of the following factors should influence their decision on whether to redeem or sell the 200 shares of stock. Select "Yes" or "No" whichever is applicable 1. External market for the stock. 2. Willingness of Alberto and Sophia to permit an outsider to purchase stock in the corporation. 3. Alberto's preference for capital gain treatment rather than dividend results. 4. Whether Alberto owns stock in other corporations