since no one wanted to answer this posting again and now im out of questions so pls be right

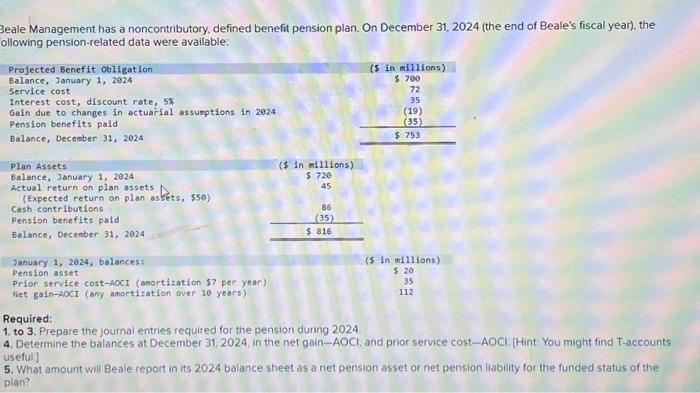

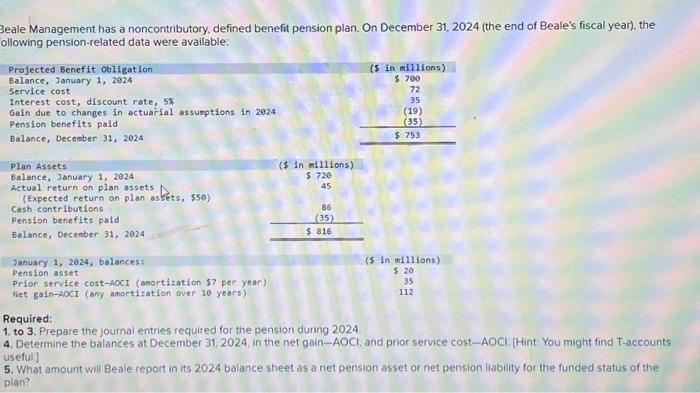

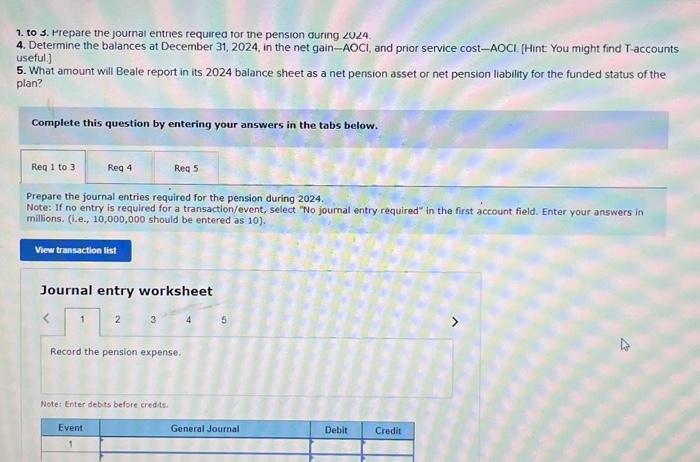

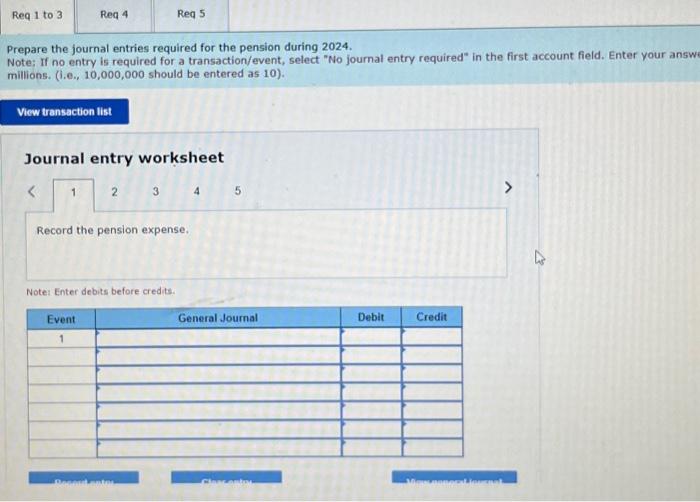

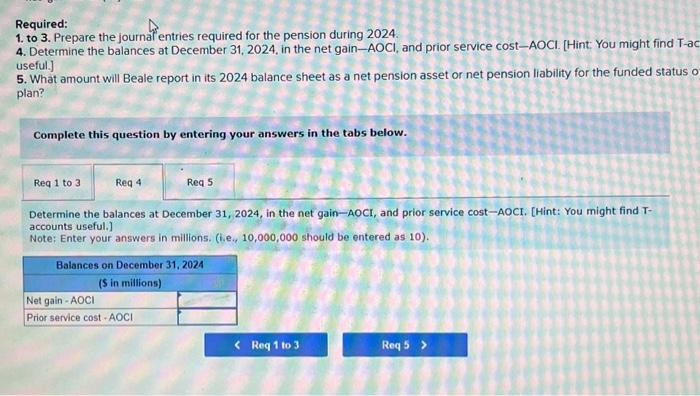

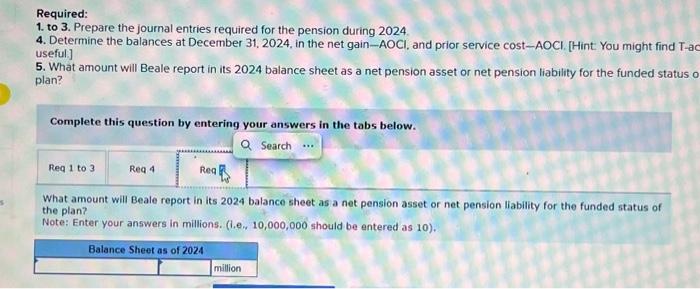

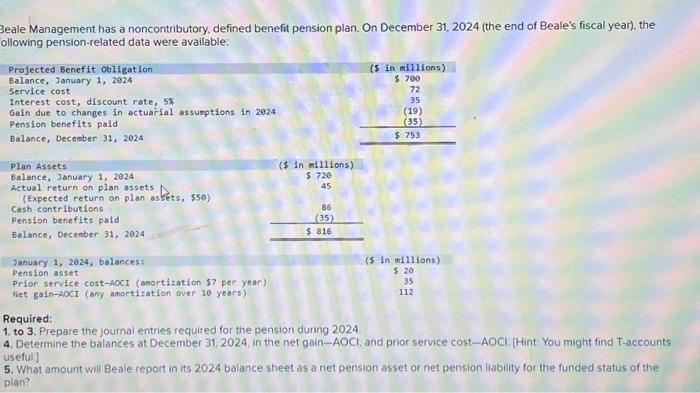

eale Management has a noncontributory, defined benefit pension plan. On December 31, 2024 (the end of Beale's fiscal year), the llowing pension-related data were available: Required: 1. to 3. Prepare the journal entries required for the pension during 2024 4. Determine the balances at December 31, 2024, in the net gain-AOCl, and prior service cost-AOCl. [Hint: You might find T-accounts useful.] 5. What amount will Beale report in its 2024 balance sheet as a net pension asset or net pension liability for the funded status of the plan? 1. to s. Hrepare the journal entnes required tor the pension during U4. 4. Determine the balances at December 31, 2024, in the net gain-AOCI, and prior service cost-AOCI. [Hint: You might find T-accounts useful.] 5. What amount will Beale report in its 2024 balance sheet as a net pension asset or net pension liability for the funded status of the plan? Complete this question by entering your answers in the tabs below. Prepare the journal entries required for the pension during 2024. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in milions. (i.e., 10,000,000 should be entered as 10). Prepare the journal entries required for the pension during 2024. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answ millions. (i.e., 10,000,000 should be entered as 10). Journal entry worksheet Notei Enter debits before credits. Required: 1. to 3. Prepare the journalentries required for the pension during 2024. 4. Determine the balances at December 31, 2024, in the net gain-AOCl, and prior service cost- AOCl. [Hint: You might find T-a useful.] 5. What amount will Beale report in its 2024 balance sheet as a net pension asset or net pension liability for the funded status plan? Complete this question by entering your answers in the tabs below. Determine the balances at December 31, 2024, in the net gain-AOCI, and prior service cost-AOCI. [Hint: You might find Taccounts useful.] Note: Enter your answers in millions. (i.e., 10,000,000 should be entered as 10). Required: 1. to 3. Prepare the journal entries required for the pension during 2024 4. Determine the balances at December 31,2024 , in the net gain-AOCl, and prior service cost-AOCI. [Hint You might find Tuseful ] 5. What amount will Beale report in its 2024 balance sheet as a net pension asset or net pension liability for the funded status plan? Complete this question by entering your answers in the tabs below. What amount will Beale report in its 2024 balance sheet as a net pension asset or net pension liability for the funded status of the plan? Note: Enter your answers in millions. (1.e, 10,000,000 should be entered as 10)