Question

Since this is your first day, youre relieved to find that the company has only three employees in the main office that have not yet

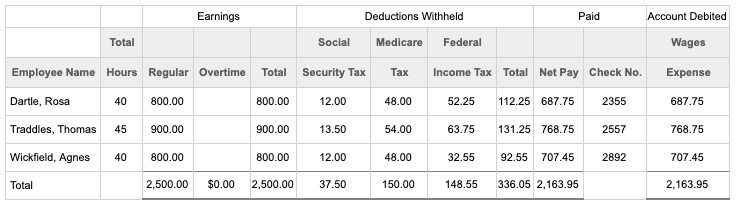

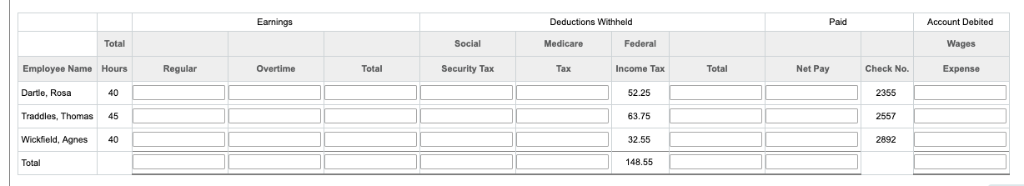

Since this is your first day, youre relieved to find that the company has only three employees in the main office that have not yet been reviewed. The partial payroll register for these employees is below. Some data is missing, and other data may be in error. Each of these employees earns $20.00 per hour, and the company follows the Fair Labor Standards Act in paying overtime to its employees. You have been assured that the Federal Income Tax withholding and check numbers are correct, so you do not need to check those figures.

Note 1: For 2015, the social security tax rate was 6.2% and the medicare tax rate was 1.45%. However, for text examples and problems, including this one, use rates of 6% for social security tax and 1.5% for medicare tax.

Note 2: Earnings subject to the social security tax are limited to an annual threshold amount, but for text examples and problems, including this one, assume all accumulated annual earnings are below this threshold and subject to the tax.

Review the payroll register below, which was prepared by your predecessor, and then scroll down to complete a corrected payroll register. If there is no amount or an amount is zero, enter 0. Round your interim computations to the nearest cent, if required.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started