Sing, Inc., is a taxable domestic C corporation. On January 1, 2017, of its 2,000 issued and outstanding shares, 1,575 were owned by Snap,

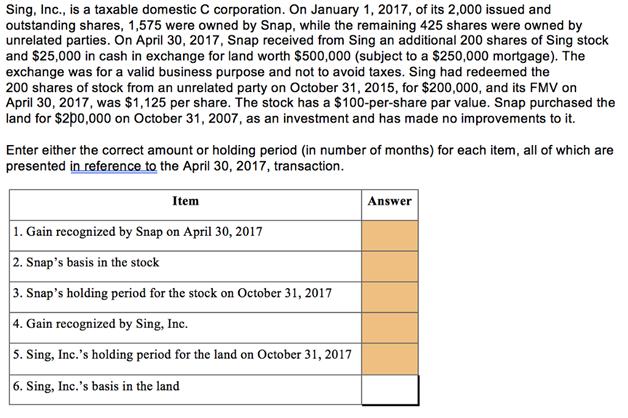

Sing, Inc., is a taxable domestic C corporation. On January 1, 2017, of its 2,000 issued and outstanding shares, 1,575 were owned by Snap, while the remaining 425 shares were owned by unrelated parties. On April 30, 2017, Snap received from Sing an additional 200 shares of Sing stock and $25,000 in cash in exchange for land worth $500,000 (subject to a $250,000 mortgage). The exchange was for a valid business purpose and not to avoid taxes. Sing had redeemed the 200 shares of stock from an unrelated party on October 31, 2015, for $200,000, and its FMV on April 30, 2017, was $1,125 per share. The stock has a $100-per-share par value. Snap purchased the land for $200,000 on October 31, 2007, as an investment and has made no improvements to it. Enter either the correct amount or holding period (in number of months) for each item, all of which are presented in reference to the April 30, 2017, transaction. Item 1. Gain recognized by Snap on April 30, 2017 2. Snap's basis in the stock 3. Snap's holding period for the stock on October 31, 2017 4. Gain recognized by Sing, Inc. 5. Sing, Inc.'s holding period for the land on October 31, 2017 6. Sing, Inc.'s basis in the land Answer

Step by Step Solution

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

1 Gain recognized by Snap on April 30 2017 ANS WER 300 000 D ETA IL ED WORK ING G ain recognized by Snap FM V of land received FM V of 200 shares of S...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started