Question

Singapore is a major global hub for Real Estate Investment Trusts (REITs). REITs attract interest from both local and global investors with their tax-friendly structures

Singapore is a major global hub for Real Estate Investment Trusts (REITs). REITs attract interest from both local and global investors with their tax-friendly structures and stable yields. A property owner, known as the “sponsor”, typically sets up a REIT by transferring an income-generating property or properties to the REIT. In doing so, the sponsor receives cash for the asset transferred. In most arrangements, the sponsor also receives units issued by the REIT.

The remaining units in the REIT are typically sold to unrelated parties. As the REIT has no management team or employees, the sponsor will also normally enter into a management contract to manage the assets and properties on behalf of the REIT. Normally, a company controlled by the sponsor (referred to as “the manager”) will provide asset and property management services. In most structures, there may be two management entities – an Asset Manager and a Property Manager. However, for simplification, we consider them as one entity, “the manager”. A trustee is appointed to safeguard the interests of the unitholders in the REIT. The trustee is normally an unrelated party to the sponsor. The fees earned by the manager are normally pegged to the performance of the REIT to align their interests with the unitholders.

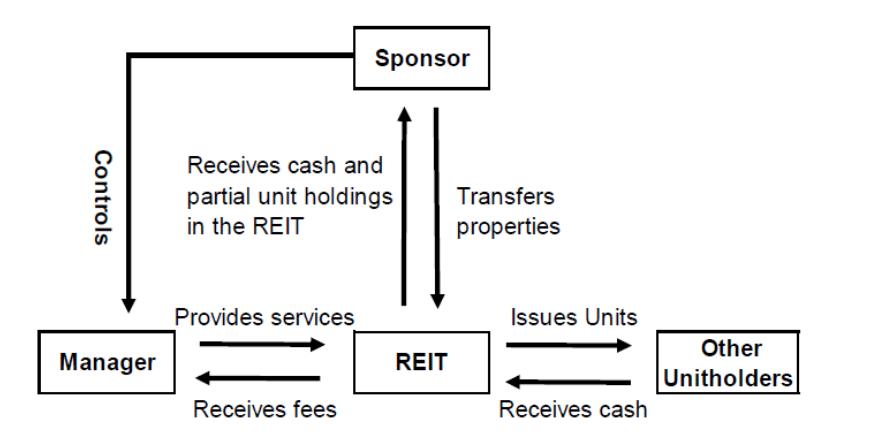

The diagram on the following page shows the typical relationships and transactions between the sponsor, the manager, the other unitholders, and the REIT.

Let us consider a hypothetical case.

Sponsor X sets up a publicly listed REIT, Y-REIT. Sponsor X holds 30% of Y-REIT’s total issued units with the remaining 70% held by 800 unrelated investors, none of whom holds more than 0.1% of Y-REIT’s total issued units. Sponsor X has a controlling interest of 100% ownership in Manager Z who provides asset and property management services to Y-REIT. In exchange for services rendered to Y-REIT,

Manager Z receives a performance fee of 5% per annum of the annual net income of Y-REIT in addition to a base fee of 0.125% of the value of the properties deposited in Y-REIT.

In addition, Manager Z receives an acquisition fee of 1% of the value of properties acquired by Y-REIT during the year and a divestment fee of 0.5% of the value of properties divested by Y-REIT during the year. The remuneration terms of Manager Z are in accordance with market practices for asset and property management services. Manager Z can be removed only if more than 50% of the unitholders of YREIT agree to terminate the management contract with Manager Z at a general meeting.

International Financial Reporting Standard (IFRS) 10 Consolidated Financial

Statements provide principles to assess if the sponsor has control of the REIT.

Apply the principles of IFRS 10 to evaluate if Sponsor X has control of Y-REIT.

[Hint: Do NOT merely regurgitate SFRS10 without applying the principles of SFRS 10 to the case facts.]

Sponsor Receives cash and partial unit holdings in the REIT Transfers properties Provides services Issues Units Other Manager REIT Unitholders Receives fees Receives cash Controls

Step by Step Solution

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

IFRS 10 consolidated financial statements outline the requirements for the preparations and presenta...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started