Answered step by step

Verified Expert Solution

Question

1 Approved Answer

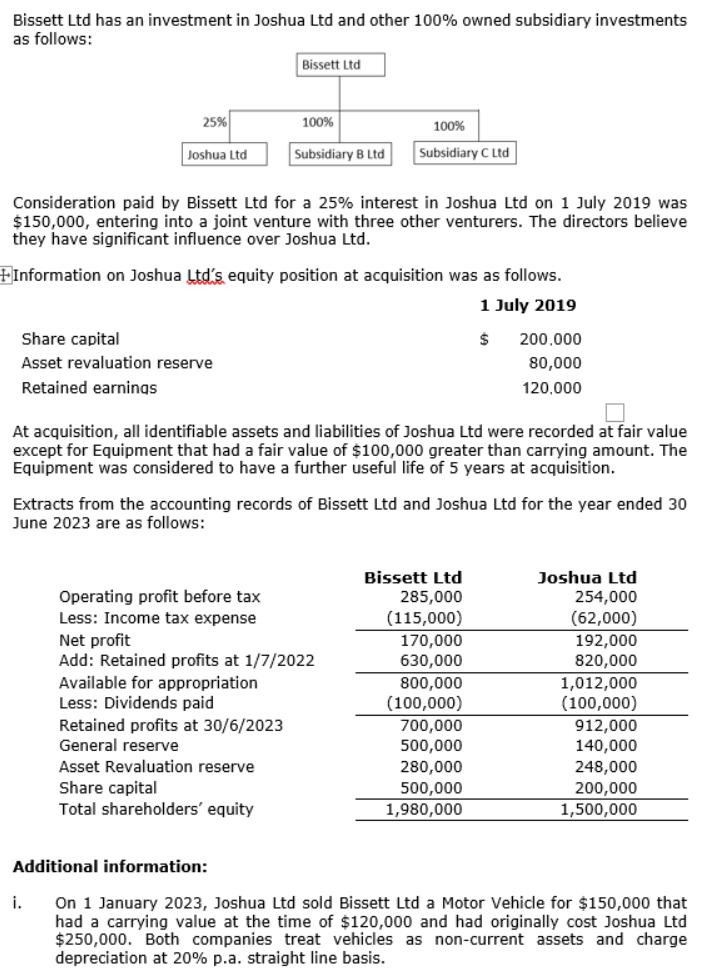

Bissett Ltd has an investment in Joshua Ltd and other 100% owned subsidiary investments as follows: Bissett Ltd 25% 100% 100% Joshua Ltd Subsidiary

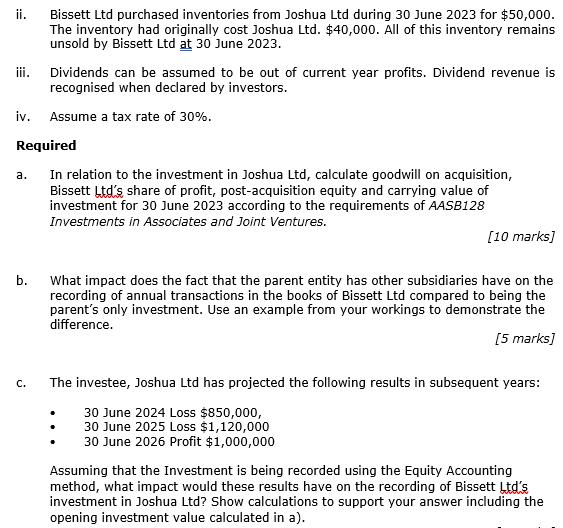

Bissett Ltd has an investment in Joshua Ltd and other 100% owned subsidiary investments as follows: Bissett Ltd 25% 100% 100% Joshua Ltd Subsidiary B Ltd Subsidiary C Ltd Consideration paid by Bissett Ltd for a 25% interest in Joshua Ltd on 1 July 2019 was $150,000, entering into a joint venture with three other venturers. The directors believe they have significant influence over Joshua Ltd. Information on Joshua Ltd's equity position at acquisition was as follows. 1 July 2019 Share capital $ Asset revaluation reserve 200,000 80,000 120,000 Retained earnings At acquisition, all identifiable assets and liabilities of Joshua Ltd were recorded at fair value except for Equipment that had a fair value of $100,000 greater than carrying amount. The Equipment was considered to have a further useful life of 5 years at acquisition. Extracts from the accounting records of Bissett Ltd and Joshua Ltd for the year ended 30 June 2023 are as follows: Bissett Ltd Joshua Ltd Operating profit before tax 285,000 254,000 Less: Income tax expense (115,000) (62,000) Net profit 170,000 192,000 Add: Retained profits at 1/7/2022 630,000 820,000 Available for appropriation 800,000 1,012,000 Less: Dividends paid (100,000) (100,000) Retained profits at 30/6/2023 700,000 912,000 General reserve 500,000 140,000 Asset Revaluation reserve 280,000 248,000 Share capital 500,000 200,000 Total shareholders' equity 1,980,000 1,500,000 Additional information: i. On 1 January 2023, Joshua Ltd sold Bissett Ltd a Motor Vehicle for $150,000 that had a carrying value at the time of $120,000 and had originally cost Joshua Ltd $250,000. Both companies treat vehicles as non-current assets and charge depreciation at 20% p.a. straight line basis. ii. Bissett Ltd purchased inventories from Joshua Ltd during 30 June 2023 for $50,000. The inventory had originally cost Joshua Ltd. $40,000. All of this inventory remains unsold by Bissett Ltd at 30 June 2023. iii. Dividends can be assumed to be out of current year profits. Dividend revenue is recognised when declared by investors. iv. Assume a tax rate of 30%. Required a. In relation to the investment in Joshua Ltd, calculate goodwill on acquisition, Bissett Ltd's share of profit, post-acquisition equity and carrying value of investment for 30 June 2023 according to the requirements of AASB128 Investments in Associates and Joint Ventures. [10 marks] b. What impact does the fact that the parent entity has other subsidiaries have on the recording of annual transactions in the books of Bissett Ltd compared to being the parent's only investment. Use an example from your workings to demonstrate the difference. [5 marks] C. The investee, Joshua Ltd has projected the following results in subsequent years: 30 June 2024 Loss $850,000, 30 June 2025 Loss $1,120,000 30 June 2026 Profit $1,000,000 Assuming that the Investment is being recorded using the Equity Accounting method, what impact would these results have on the recording of Bissett Ltd's investment in Joshua Ltd? Show calculations to support your answer including the opening investment value calculated in a).

Step by Step Solution

★★★★★

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

a Goodwill on acquisition 150000 x 254 37500 Bissett Ltds share of profit 48000 x 254 12000 Postacqu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started