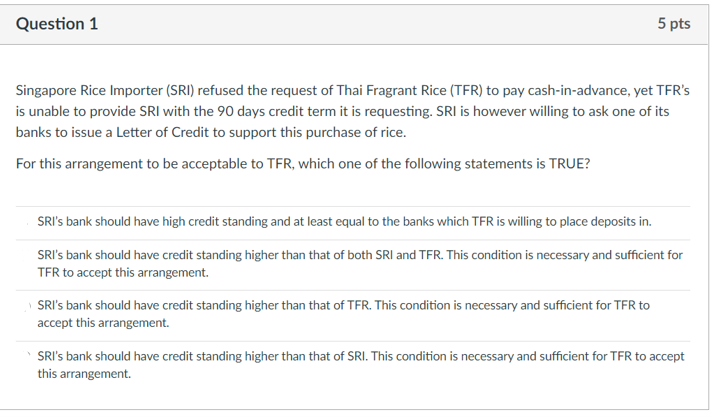

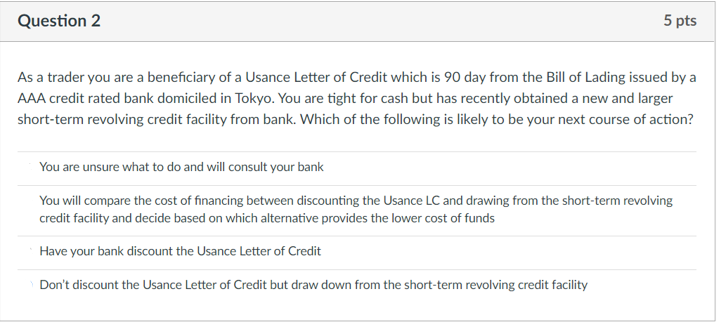

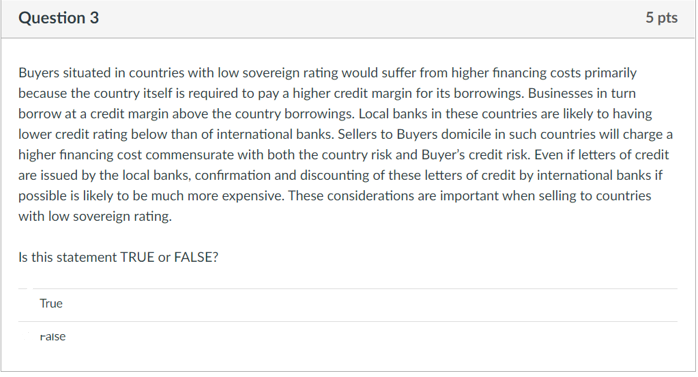

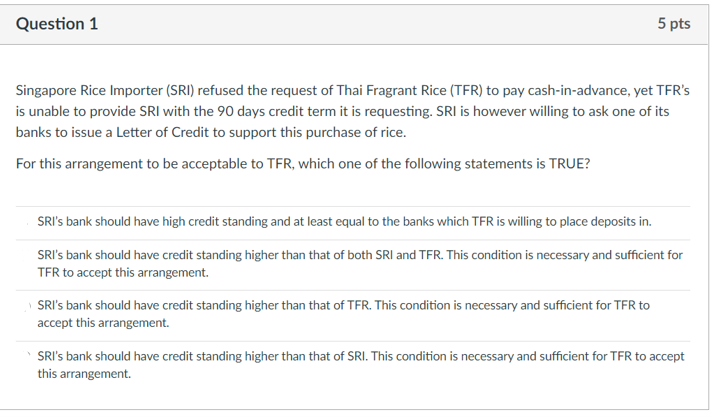

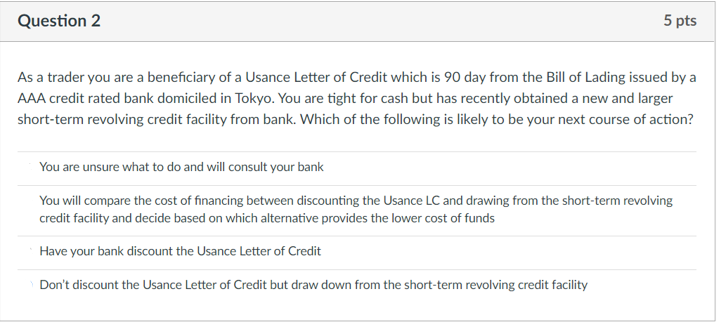

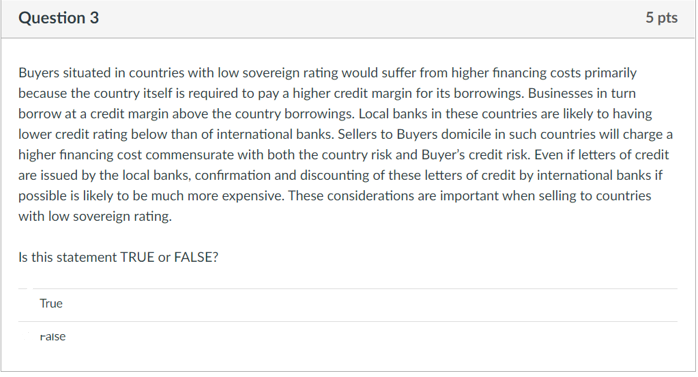

Singapore Rice Importer (SRI) refused the request of Thai Fragrant Rice (TFR) to pay cash-in-advance, yet TFR's is unable to provide SRI with the 90 days credit term it is requesting. SRI is however willing to ask one of its banks to issue a Letter of Credit to support this purchase of rice. For this arrangement to be acceptable to TFR, which one of the following statements is TRUE? SRI's bank should have high credit standing and at least equal to the banks which TFR is willing to place deposits in. SRI's bank should have credit standing higher than that of both SRI and TFR. This condition is necessary and sufficient for TFR to accept this arrangement. SRI's bank should have credit standing higher than that of TFR. This condition is necessary and sufficient for TFR to accept this arrangement. SRI's bank should have credit standing higher than that of SRI. This condition is necessary and sufficient for TFR to accept this arrangement. As a trader you are a beneficiary of a Usance Letter of Credit which is 90 day from the Bill of Lading issued by a AAA credit rated bank domiciled in Tokyo. You are tight for cash but has recently obtained a new and larger short-term revolving credit facility from bank. Which of the following is likely to be your next course of action? You are unsure what to do and will consult your bank You will compare the cost of financing between discounting the Usance LC and drawing from the short-term revolving credit facility and decide based on which alternative provides the lower cost of funds Have your bank discount the Usance Letter of Credit Don't discount the Usance Letter of Credit but draw down from the short-term revolving credit facility Buyers situated in countries with low sovereign rating would suffer from higher financing costs primarily because the country itself is required to pay a higher credit margin for its borrowings. Businesses in turn borrow at a credit margin above the country borrowings. Local banks in these countries are likely to having lower credit rating below than of international banks. Sellers to Buyers domicile in such countries will charge a higher financing cost commensurate with both the country risk and Buyer's credit risk. Even if letters of credit are issued by the local banks, confirmation and discounting of these letters of credit by international banks if possible is likely to be much more expensive. These considerations are important when selling to countries with low sovereign rating. Is this statement TRUE or FALSE? True ralse