Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Singapore Taxation Question 1 10 pts QUESTION ONE You are assisting the finance editor of the Straits Times. The newspaper has received the following two

Singapore Taxation

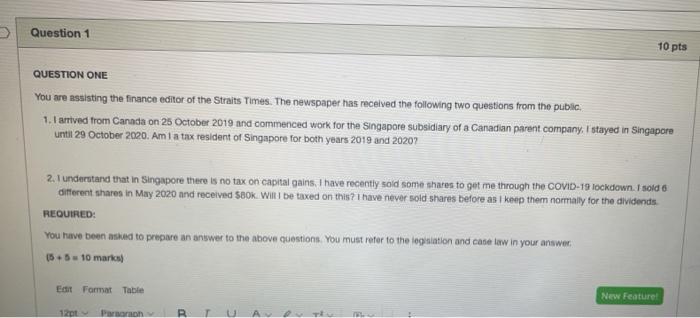

Question 1 10 pts QUESTION ONE You are assisting the finance editor of the Straits Times. The newspaper has received the following two questions from the public 1. I arrived from Canada on 25 October 2019 and commenced work for the Singapore subsidiary of a Canadian parent company, I stayed in Singapore until 29 October 2020. Am 1 a tax resident of Singapore for both years 2019 and 2020 2. I understand that in Singapore there is no tax on capital gains. I have recently sold some shares to get me through the COVID-19 lockdown. I sold 6 different shares in May 2020 and received Seok. Will be taxed on this? I have never sold shares before as I knep them normally for the dividends REQUIRED: You have been asked to prepare an answer to the above questions. You must refer to the legislation and case law in your answer 15.5-10 marks Et Format Table New Feature 120 Paran R Question 1 10 pts QUESTION ONE You are assisting the finance editor of the Straits Times. The newspaper has received the following two questions from the public 1. I arrived from Canada on 25 October 2019 and commenced work for the Singapore subsidiary of a Canadian parent company, I stayed in Singapore until 29 October 2020. Am 1 a tax resident of Singapore for both years 2019 and 2020 2. I understand that in Singapore there is no tax on capital gains. I have recently sold some shares to get me through the COVID-19 lockdown. I sold 6 different shares in May 2020 and received Seok. Will be taxed on this? I have never sold shares before as I knep them normally for the dividends REQUIRED: You have been asked to prepare an answer to the above questions. You must refer to the legislation and case law in your answer 15.5-10 marks Et Format Table New Feature 120 Paran R Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started