Answered step by step

Verified Expert Solution

Question

1 Approved Answer

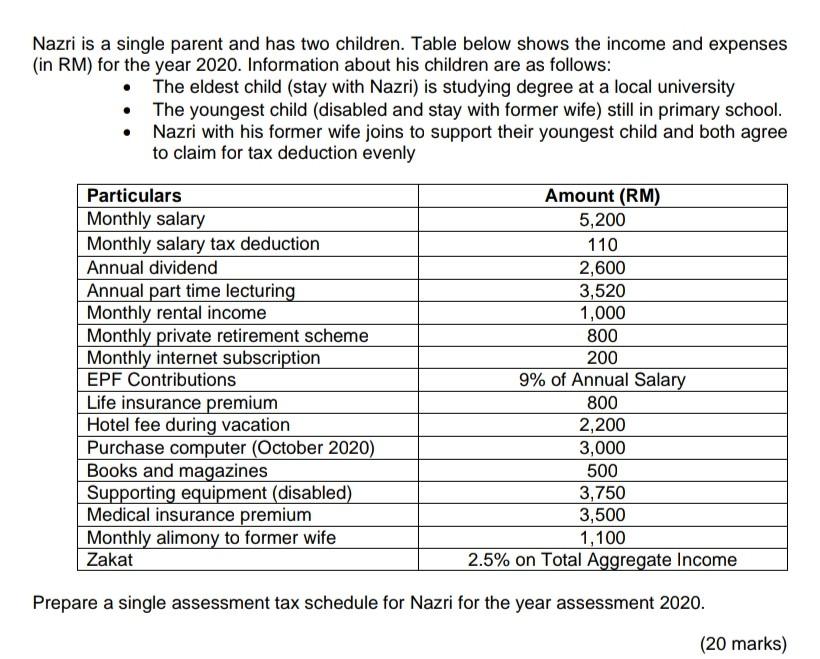

single assesment tax is based on Malaysia's rate and value Nazri is a single parent and has two children. Table below shows the income and

single assesment tax is based on Malaysia's rate and value

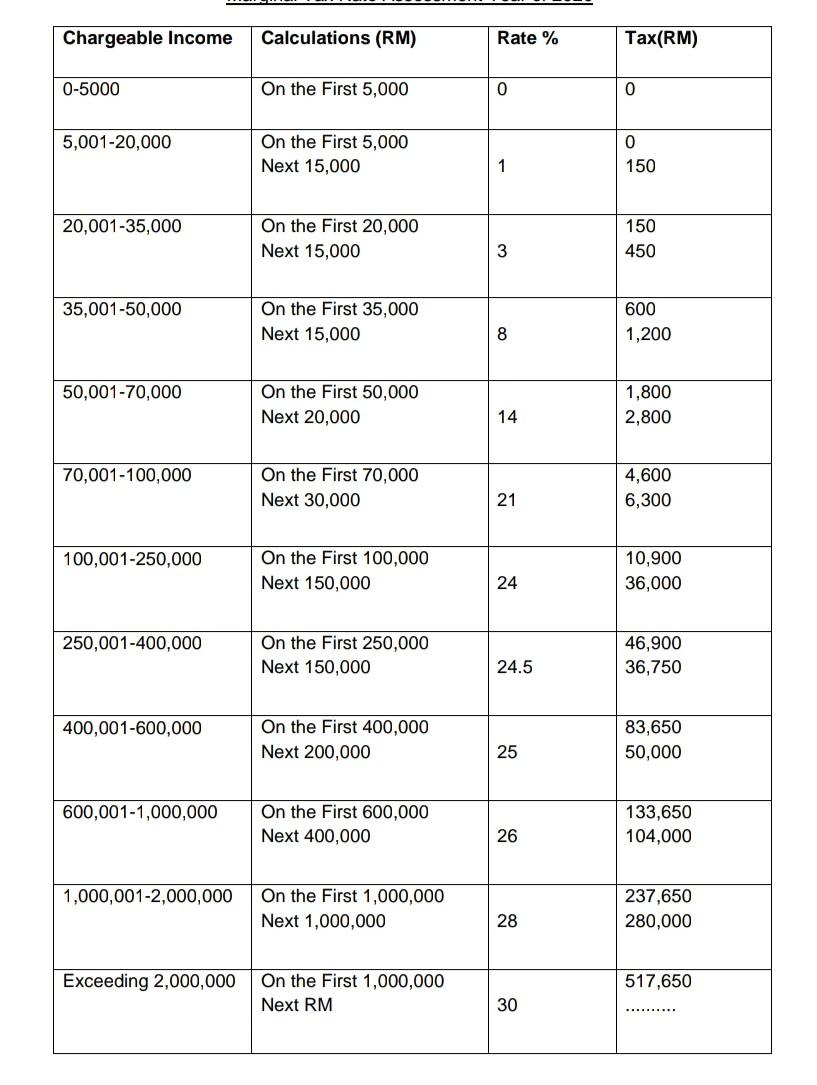

Nazri is a single parent and has two children. Table below shows the income and expenses (in RM) for the year 2020. Information about his children are as follows: The eldest child (stay with Nazri) is studying degree at a local university The youngest child (disabled and stay with former wife) still in primary school. Nazri with his former wife joins to support their youngest child and both agree to claim for tax deduction evenly Particulars Amount (RM) Monthly salary 5,200 Monthly salary tax deduction 110 Annual dividend 2,600 Annual part time lecturing 3,520 Monthly rental income 1,000 Monthly private retirement scheme 800 Monthly internet subscription 200 EPF Contributions 9% of Annual Salary Life insurance premium 800 Hotel fee during vacation 2,200 Purchase computer (October 2020) 3,000 Books and magazines 500 Supporting equipment (disabled) 3,750 Medical insurance premium 3,500 Monthly alimony to former wife 1,100 Zakat 2.5% on Total Aggregate Income Prepare a single assessment tax schedule for Nazri for the year assessment 2020. (20 marks) Chargeable Income Calculations (RM) Rate % Tax(RM) 0-5000 On the First 5,000 0 0 5,001-20,000 On the First 5,000 Next 15,000 0 150 1 20,001-35,000 On the First 20,000 Next 15,000 150 450 3 35,001-50,000 On the First 35,000 Next 15,000 600 1,200 8 50,001-70,000 On the First 50,000 Next 20,000 1,800 2,800 14 70,001-100,000 On the First 70,000 Next 30,000 4,600 6,300 21 100,001-250,000 On the First 100,000 Next 150,000 10,900 36,000 24 250,001-400,000 On the First 250,000 Next 150,000 46,900 36,750 24.5 400,001-600,000 On the First 400,000 Next 200,000 83,650 50,000 25 600,001-1,000,000 On the First 600,000 Next 400,000 133,650 104,000 26 1,000,001-2,000,000 On the First 1,000,000 Next 1,000,000 237,650 280,000 28 Exceeding 2,000,000 517,650 On the First 1,000,000 Next RM 30Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started