Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Single ,Married status tax program c++ 3. Implement the solution. Students must be able to write program with at least FIVE (5) functions inclusive of

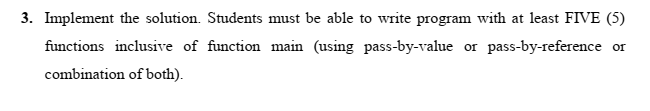

Single ,Married status tax program c++

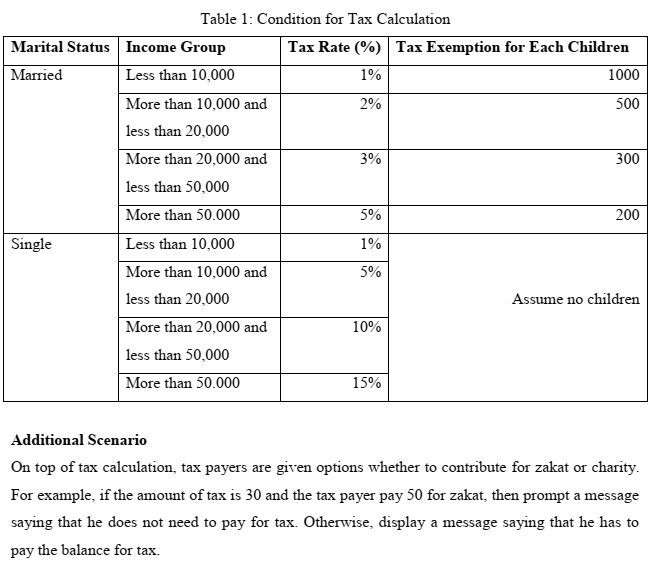

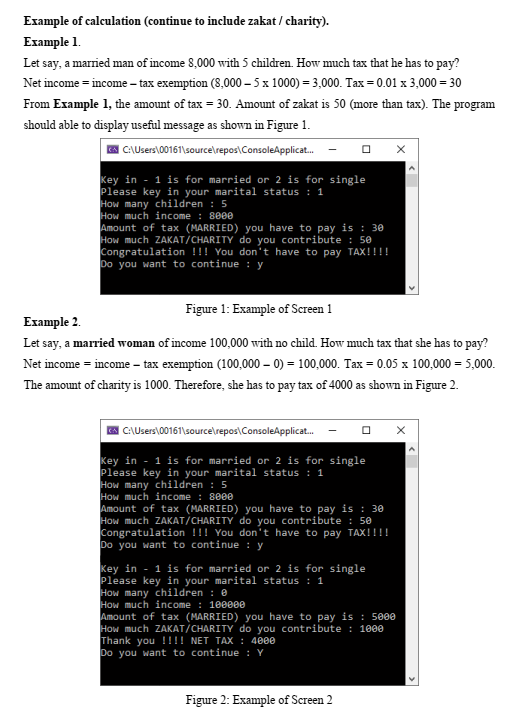

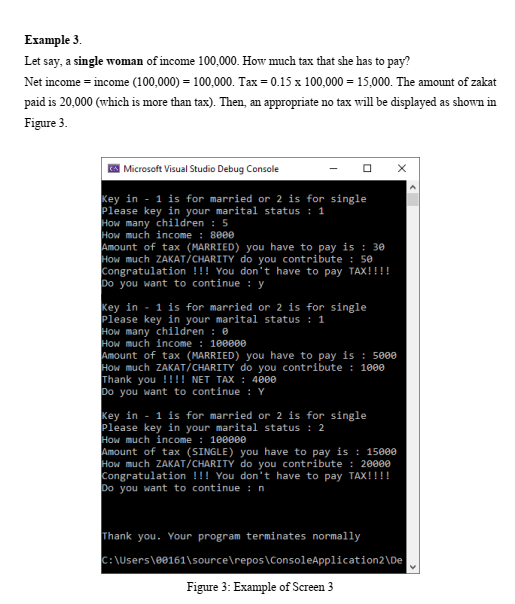

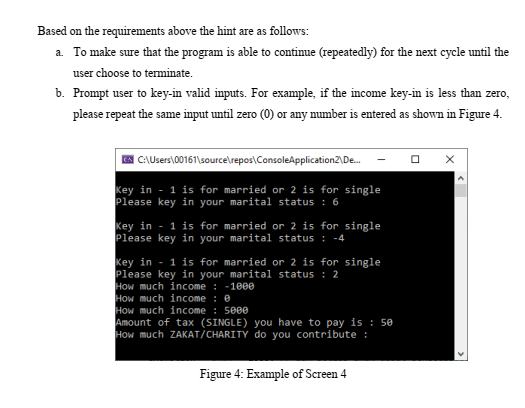

3. Implement the solution. Students must be able to write program with at least FIVE (5) functions inclusive of function main (using pass-by-value or pass-by-reference or combination of both). Table 1: Condition for Tax Calculation Marital Status Income Group Tax Rate (%) Tax Exemption for Each Children Married Less than 10,000 1% 1000 More than 10,000 and 2% 500 less than 20,000 More than 20,000 and 3% 300 less than 50,000 More than 50.000 5% 200 Single Less than 10,000 1% More than 10,000 and 5% less than 20,000 Assume no children More than 20,000 and 10% less than 50,000 More than 50.000 15% Additional Scenario On top of tax calculation, tax payers are given options whether to contribute for zakat or charity. For example, if the amount of tax is 30 and the tax payer pay 50 for zakat, then prompt a message saying that he does not need to pay for tax. Otherwise, display a message saying that he has to pay the balance for tax. Example of calculation (continue to include zakat / charity). Example 1. Let say, a married man of income 8,000 with 5 children. How much tax that he has to pay? Net income = income tax exemption (8,000 5 x 1000) = 3,000. Tax=0.01 x 3,000 = 30 From Example 1, the amount of tax = 30. Amount of zakat is 50 (more than tax). The program should able to display useful message as shown in Figwe 1. C:\Users\00161\source repos ConsoleApplicat... Key in - 1 is for married or 2 is for single Please key in your marital status : 1 How many children : 5 How much income : 8eee Amount of tax (MARRIED) you have to pay is : 30 How much ZAKAT/CHARITY do you contribute : 50 Congratulation !!! You don't have to pay TAX!!!! Do you want to continue : y Figure 1: Example of Screen 1 Example 2. Let say, a married woman of income 100,000 with no child. How much tax that she has to pay? Net income = income - tax exemption (100,000 - 0) = 100,000. Tax = 0.05 x 100,000 = 5,000. The amount of charity is 1000. Therefore, she has to pay tax of 4000 as shown in Figure 2. C:\Users\00161\source repos ConsoleApplicat... Key in - 1 is for married or 2 is for single Please key in your marital status : 1 How many children : 5 How much income : 8000 Amount of tax (MARRIED) you have to pay is : 30 How much ZAKAT/CHARITY do you contribute : 50 Congratulation !!! You don't have to pay TAX!!!! Do you want to continue : y Key in - 1 is for married or 2 is for single Please key in your marital status : 1 How many children : How much income : 1eeeee Amount of tax (MARRIED) you have to pay is : 5000 How much ZAKAT/CHARITY do you contribute : 1000 Thank you ITT NET TAX : 4000 Do you want to continue : Y Figure 2: Example of Screen 2 Example 3. Let say, a single woman of income 100,000. How much tax that she has to pay? Net income = income (100,000) = 100,000. Tax = 0.15 x 100,000 = 15,000. The amount of zakat paid is 20,000 (which is more than tax). Then, an appropriate no tax will be displayed as shown in Figure 3. | Microsoft Visual Studio Debug Console Key in - 1 is for married or 2 is for single please key in your marital status : 1 How many children : 5 How much income : 8eee Amount of tax (MARRIED) you have to pay is : 30 How much ZAKAT/CHARITY do you contribute : 50 Congratulation !!! You don't have to pay TAX!!!! Do you want to continue : y key in - 1 is for married or 2 is for single Please key in your marital status : 1 How many children : How much income : 100000 Amount of tax (MARRIED) you have to pay is : 5000 How much ZAKAT/CHARITY do you contribute : 1000 Thank you !!!! NET TAX : 4000 Do you want to continue : Y key in - 1 is for married or 2 is for single Please key in your marital status : 2 How much income : 1eeeee Amount of tax (SINGLE) you have to pay is : 15000 How much ZAKAT/CHARITY do you contribute : 20000 Congratulation !!! You don't have to pay TAX!!!! Do you want to continue : n Thank you. Your program terminates normally C:\Users\00161\source epos\ConsoleApplication2\De Figure 3: Example of Screen 3 Based on the requirements above the hint are as follows: a. To make sure that the program is able to continue (repeatedly) for the next cycle until the user choose to terminate. b. Prompt user to key-in valid inputs. For example, if the income key-in is less than zero, please repeat the same input until zero () or any number is entered as shown in Figure 4. C:\Users\00161\source epos ConsoleApplication De... key in - 1 is for married or 2 is for single Please key in your marital status : 6 key in - 1 is for married or 2 is for single Please key in your marital status : -4 Key in - 1 is for married or 2 is for single Please key in your marital status : 2 How much income : -1000 How much income : B How much income : Seee Amount of tax (SINGLE) you have to pay is : 50 How much ZAKAT/CHARITY do you contribute : Figure 4: Example of Screen 4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started