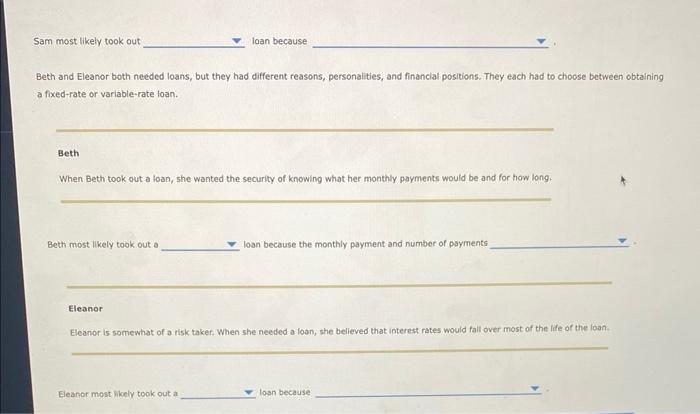

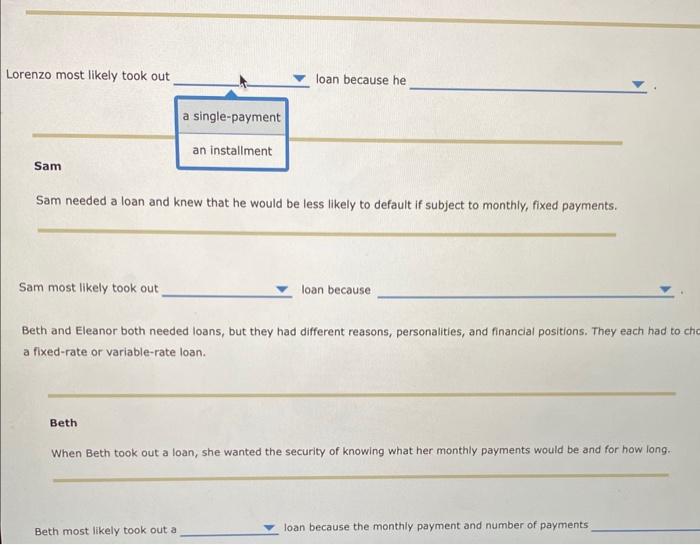

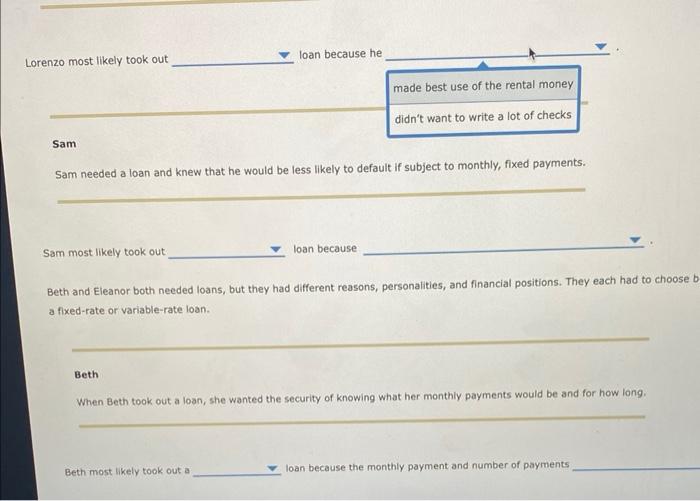

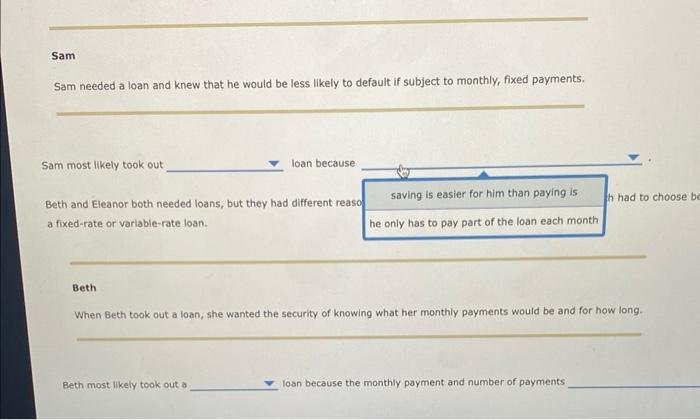

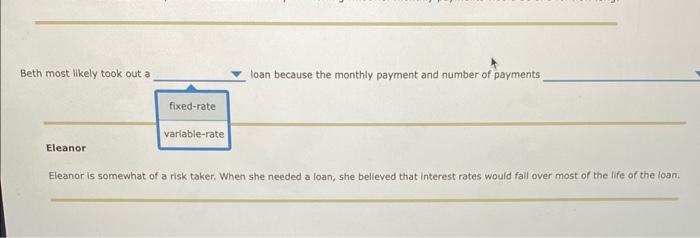

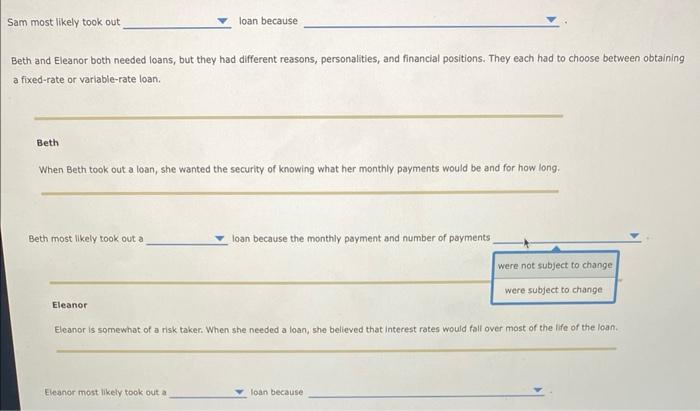

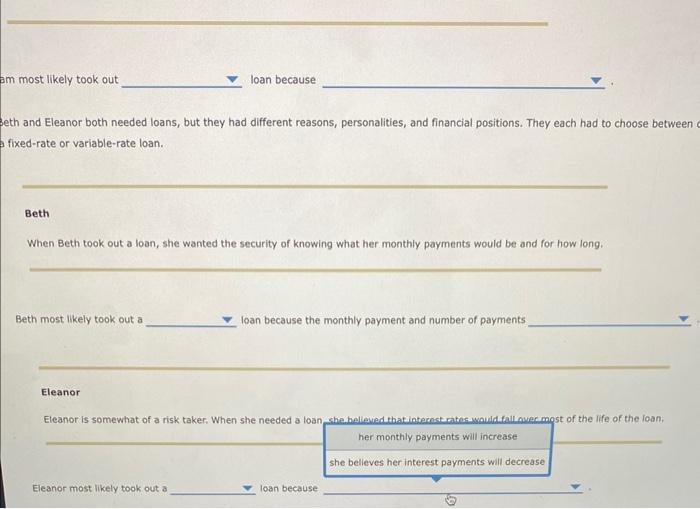

Single-Payment versus Installment Loans, and Fixed-Rate versus Variable-Rate Loans Payments on consumer loans are described by the terms of the loan. When the loan is paid is one factor. An instaliment loan is paid either periodically over the life of the loan, usually monthly, and a single-payment loan is what the name implies: a loan whose entire balance is paid at once, usually ranging from a month to a year after the loan is made. Interest charged on the loan is another factor. Rates are either fixed of variable. A fixed rate is the same throughout the life of the loan. A variable rate may change over the life of the loan and is usually tied to current market conditions. Lorenzo and Sam both needed loans, but they had different reasons, personalitfes, and financial positions, They cach had to choose between obtaining a single-payment or an installment loan. Lorenzo Lorenzo wanted to rent a share in a ski house for the upcoming winter, a six-month season. The house owner would not allow Lorenzo to pay the rent in six equal payments over the course of the ski season and, instead, required full payment up front. Lorenzo found an investment opportunity promising a 7% annual return. He also found a loan with a 4% annual interest rate. He decided to take out the losn to poy the landlord the full amount of the rental. Every month, torenzo planned to deposited one sixth of the loan amount (or what. would have been the monthly rental payment) into the investment and take the chance that the itvestment would return what it promised. Sam most likely took out loan because Beth and Eleanor both needed loans, but they had different reasons, personalities, and financial positions. They each had to choose between obtaining a fixed-rate or varlable-rate loan. Beth When Beth took out a loan, she wanted the security of knowing what her monthly payments would be and for how long. Beth most likely took out a loan because the monthly payment and number of payments Eleanor Eleanor is somewhat of a risk taker, When she needed a loan, she believed that interest rates would fall over most of the life of the loan. Eleanor most hikely took out at loan because loan because he Sam Sam needed a loan and knew that he would be less likely to default if subject to monthly, fixed payments. Sam most likely took out loan because Beth and Eleanor both needed loans, but they had different reasons, personalities, and financial positions. They each had to ch a fixed-rate or variable-rate loan. Beth When Beth took out a loan, she wanted the security of knowing what her monthly payments would be and for how long. Beth most likely took out a loan because the monthly payment and number of payments loan because he Sam Sam needed a loan and knew that he would be less likely to default if subject to monthly, fixed payments. Sam most likely took out loan because Beth and Eleanor both needed loans, but they had different reasons, personalities, and financial positions. They each had to choose a fixed-rate or variable-rate loan. Beth When Beth took out a loan, she wanted the security of knowing what her monthly payments would be and for how long. Beth most likely took out a Ioan because the monthly payment and number of payments Sam needed a loan and knew that he would be less likely to default if subject to monthly, fixed payments. Sam most likely took out loan because Beth and Eleanor both needed loans, but they had different reast h had to choose a fixed-rate or variable-rate loan. Beth When Beth took out a loan, she wanted the security of knowing what her monthly payments would be and for how long. Beth most likely took out a loan because the monthly payment and number of payments Beth most likely took out a loan because the monthly payment and number of payments Eleanor Eleanor is somewhat of a risk taker. When she needed a loan, she believed that interest rates would fall over most of the life of the loan. loan because Beth and Eleanor both needed loans, but they had different reasons, personalities, and financial positions. They each had to choose between obtaining a fixed-rate or variable-rate loan. Beth When Beth took out a loan, she wanted the securlty of knowing what her monthly payments would be and for how long. Beth most likely took out a loan because the monthly payment and number of payments Eleanor Eleanor is somewhat of a risk taker. When she needed a loan, she believed that interest rates would fall over most of the life of the loan. Eleanor most likely took out a loan because loan because eth and Eleanor both needed loans, but they had different reasons, personalities, and financial positions. They each had to choose between fixed-rate or variable-rate loan. Beth When Beth took out a loan, she wanted the security of knowing what her monthly payments would be and for how long. Beth most likely took out a loan because the monthly payment and number of payments Eleanor Eleanor most likely took out a loan because