Answered step by step

Verified Expert Solution

Question

1 Approved Answer

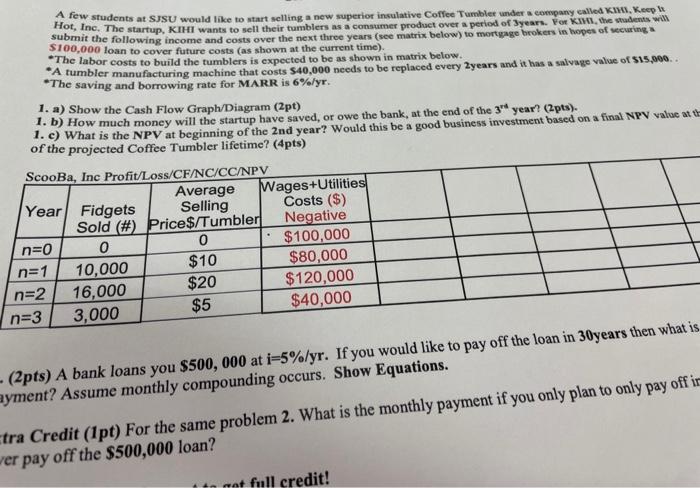

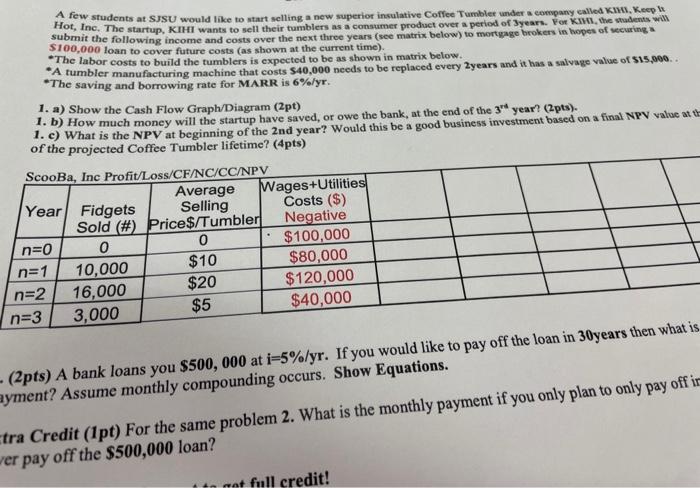

SIO0,000 loan to cover future costs (as shown at the current time). +The labor costs to build the tumblers is expected to be as shown

SIO0,000 loan to cover future costs (as shown at the current time). +The labor costs to build the tumblers is expected to be as shown in matrix below. -The saving and borrowing rate for MARR is 6%/y. 1. a) Show the Cash Flow Graph/Diagram (2pt) 1. b) How much money will the startup have saved, or owe the bank, at the end of the 3ri year? (2pts). 1. c) What is the NPV at beginning of the 2 nd year? Would this be a good business investment based on a final NPV value at t) of the projected Coffee Tumbler lifetime? (4pts) (2pts) A bank loans you $500,000 at i=5%/y. If you would like to pay off the loan in 30 years then wnat v yment? Assume monthly compounding occurs. Show Equations. tra Credit (1pt) For the same problem 2. What is the monthly payment if you only plan to only pay off i er pay off the 500,000 loan? SIO0,000 loan to cover future costs (as shown at the current time). +The labor costs to build the tumblers is expected to be as shown in matrix below. -The saving and borrowing rate for MARR is 6%/y. 1. a) Show the Cash Flow Graph/Diagram (2pt) 1. b) How much money will the startup have saved, or owe the bank, at the end of the 3ri year? (2pts). 1. c) What is the NPV at beginning of the 2 nd year? Would this be a good business investment based on a final NPV value at t) of the projected Coffee Tumbler lifetime? (4pts) (2pts) A bank loans you $500,000 at i=5%/y. If you would like to pay off the loan in 30 years then wnat v yment? Assume monthly compounding occurs. Show Equations. tra Credit (1pt) For the same problem 2. What is the monthly payment if you only plan to only pay off i er pay off the 500,000 loan

SIO0,000 loan to cover future costs (as shown at the current time). +The labor costs to build the tumblers is expected to be as shown in matrix below. -The saving and borrowing rate for MARR is 6%/y. 1. a) Show the Cash Flow Graph/Diagram (2pt) 1. b) How much money will the startup have saved, or owe the bank, at the end of the 3ri year? (2pts). 1. c) What is the NPV at beginning of the 2 nd year? Would this be a good business investment based on a final NPV value at t) of the projected Coffee Tumbler lifetime? (4pts) (2pts) A bank loans you $500,000 at i=5%/y. If you would like to pay off the loan in 30 years then wnat v yment? Assume monthly compounding occurs. Show Equations. tra Credit (1pt) For the same problem 2. What is the monthly payment if you only plan to only pay off i er pay off the 500,000 loan? SIO0,000 loan to cover future costs (as shown at the current time). +The labor costs to build the tumblers is expected to be as shown in matrix below. -The saving and borrowing rate for MARR is 6%/y. 1. a) Show the Cash Flow Graph/Diagram (2pt) 1. b) How much money will the startup have saved, or owe the bank, at the end of the 3ri year? (2pts). 1. c) What is the NPV at beginning of the 2 nd year? Would this be a good business investment based on a final NPV value at t) of the projected Coffee Tumbler lifetime? (4pts) (2pts) A bank loans you $500,000 at i=5%/y. If you would like to pay off the loan in 30 years then wnat v yment? Assume monthly compounding occurs. Show Equations. tra Credit (1pt) For the same problem 2. What is the monthly payment if you only plan to only pay off i er pay off the 500,000 loan

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started