Answered step by step

Verified Expert Solution

Question

1 Approved Answer

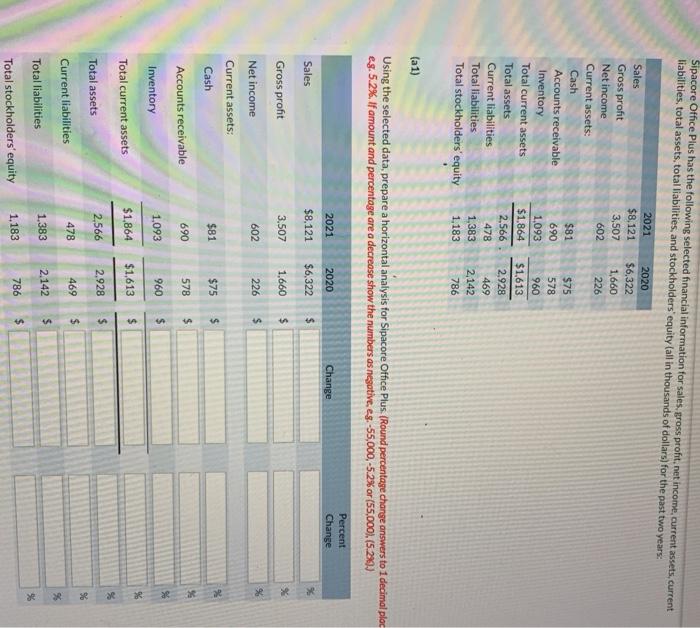

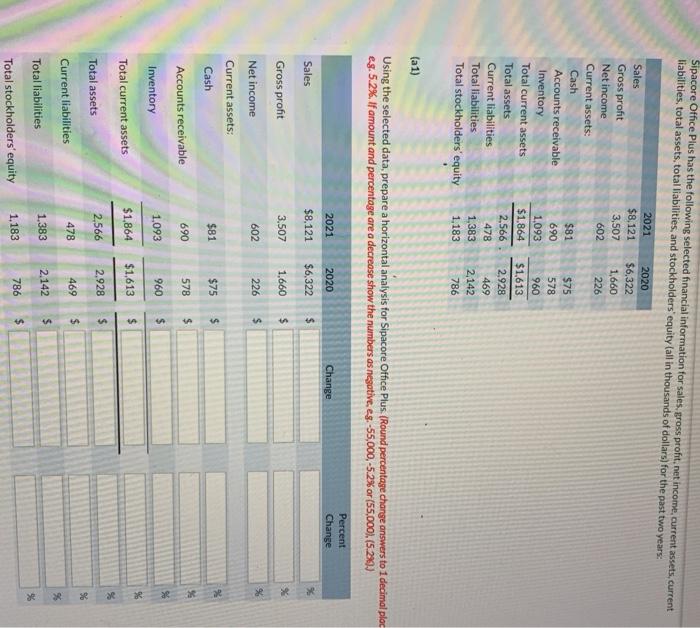

Sipacore Office Plus has the following selected financial information for sales, gross profit, net income, current assets, current liabilities, total assets, total liabilities, and stockholders'

Sipacore Office Plus has the following selected financial information for sales, gross profit, net income, current assets, current liabilities, total assets, total liabilities, and stockholders' equity (all in thousands of dollars) for the past two years: 2020 2021 $8,121 3,507 $6,322 1,660 226 602 $75 Sales Gross profit Net income Current assets Cash Accounts receivable Inventory Total current assets Total assets Current liabilities Total liabilities Total stockholders' equity $81 690 1,093 $1.864 2.566 478 1,383 1,183 578 960 $1,613 2,928 469 2,142 786 (a1) Using the selected data, prepare a horizontal analysis for Sipacore Office Plus. (Round percentage change answers to 1 decimal pla eg. 5.2%. If amount and percentage are a decrease show the numbers as negative, eg.-55,000,-5.2% or (55,000), (5.2%)) 2021 2020 Change Percent Change Sales $8.121 $6,322 $ Gross profit 3.507 1,660 $ Net income 602 226 $ Current assets: $81 Cash $ $75 578 690 $ Accounts receivable 1,093 960 $ Inventory Total current assets % $1,864 $1,613 $ % $ Total assets 2.928 2,566 56 478 469 $ Current liabilities % $ 2.142 1.383 56 Total liabilities Total stockholders' equity 786 $ 1,183

Sipacore Office Plus has the following selected financial information for sales, gross profit, net income, current assets, current liabilities, total assets, total liabilities, and stockholders' equity (all in thousands of dollars) for the past two years: 2020 2021 $8,121 3,507 $6,322 1,660 226 602 $75 Sales Gross profit Net income Current assets Cash Accounts receivable Inventory Total current assets Total assets Current liabilities Total liabilities Total stockholders' equity $81 690 1,093 $1.864 2.566 478 1,383 1,183 578 960 $1,613 2,928 469 2,142 786 (a1) Using the selected data, prepare a horizontal analysis for Sipacore Office Plus. (Round percentage change answers to 1 decimal pla eg. 5.2%. If amount and percentage are a decrease show the numbers as negative, eg.-55,000,-5.2% or (55,000), (5.2%)) 2021 2020 Change Percent Change Sales $8.121 $6,322 $ Gross profit 3.507 1,660 $ Net income 602 226 $ Current assets: $81 Cash $ $75 578 690 $ Accounts receivable 1,093 960 $ Inventory Total current assets % $1,864 $1,613 $ % $ Total assets 2.928 2,566 56 478 469 $ Current liabilities % $ 2.142 1.383 56 Total liabilities Total stockholders' equity 786 $ 1,183

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started