Answered step by step

Verified Expert Solution

Question

1 Approved Answer

sir please Help me with this please expert need asap 7(b). AT 1:01 pm today NMEX reported the price of the nearest (take it as

sir please Help me with this please expert need asap

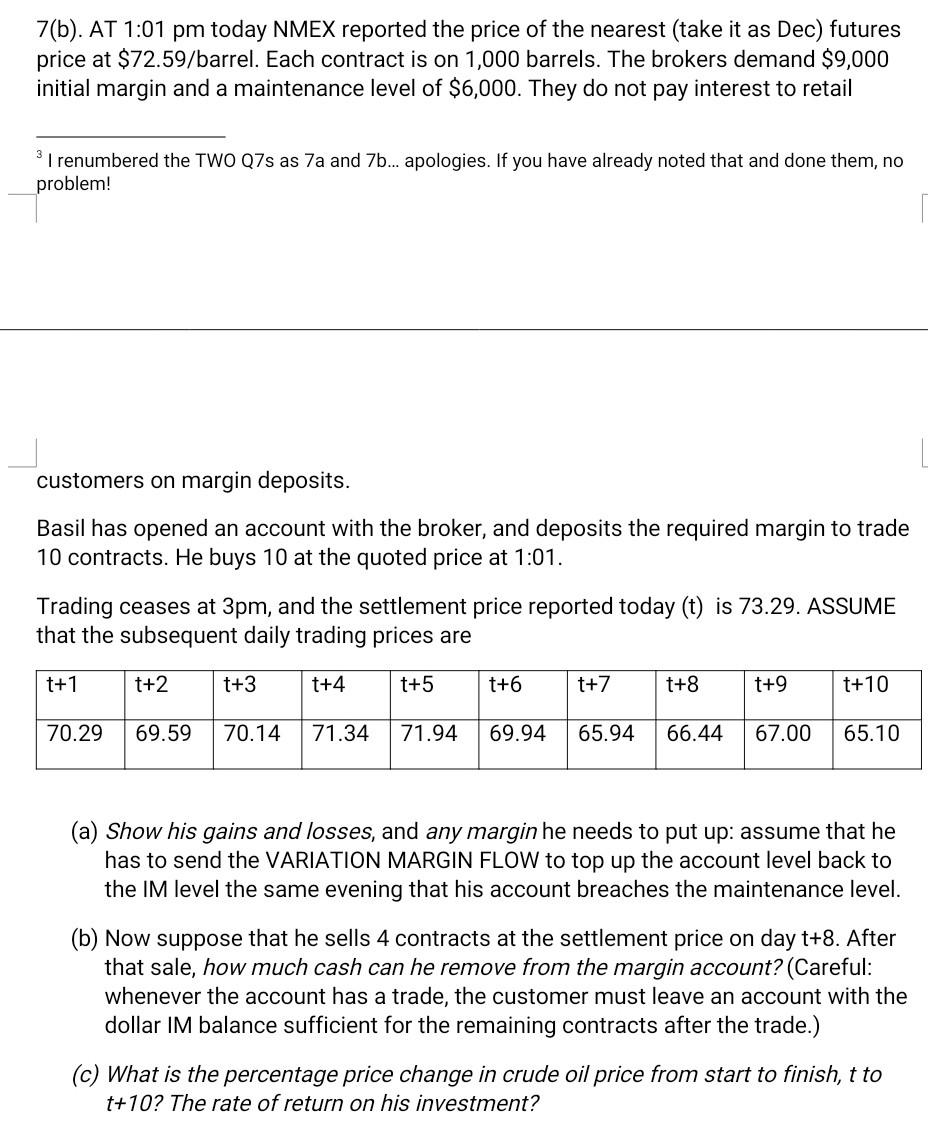

7(b). AT 1:01 pm today NMEX reported the price of the nearest (take it as Dec) futures price at $72.59/barrel. Each contract is on 1,000 barrels. The brokers demand $9,000 initial margin and a maintenance level of $6,000. They do not pay interest to retail 31 renumbered the TWO Q7s as 7a and 7b... apologies. If you have already noted that and done them, no problem! customers on margin deposits. Basil has opened an account with the broker, and deposits the required margin to trade 10 contracts. He buys 10 at the quoted price at 1:01. Trading ceases at 3pm, and the settlement price reported today (t) is 73.29. ASSUME that the subsequent daily trading prices are t+1 t+2 t+3 t+4 t+5 t+6 t+7 t+8 t+9 t+10 70.29 69.59 70.14 71.34 71.94 69.94 65.94 66.44 67.00 65.10 (a) Show his gains and losses, and any margin he needs to put up: assume that he has to send the VARIATION MARGIN FLOW to top up the account level back to the IM level the same evening that his account breaches the maintenance level. (b) Now suppose that he sells 4 contracts at the settlement price on day t+8. After that sale, how much cash can he remove from the margin account? (Careful: whenever the account has a trade, the customer must leave an account with the dollar IM balance sufficient for the remaining contracts after the trade.) (c) What is the percentage price change in crude oil price from start to finish, t to t+10? The rate of return on his investmentStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started