Sir, please solve all parts 1st, 2nd and 3rd. Thanks a lot

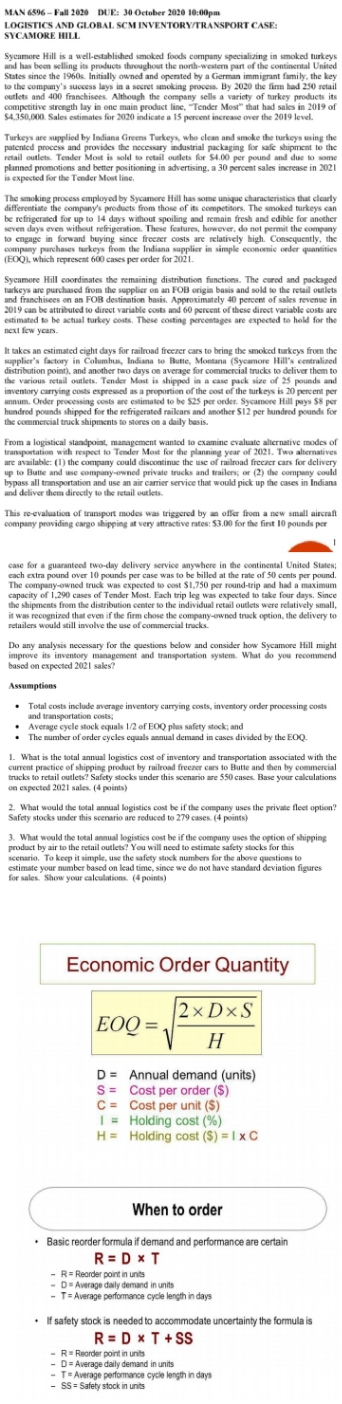

CoursHeroTranscribedText: MAN 6596 - Fall 2020 DUE: 30 October 2020 10:00pm LOGISTICS AND GLOBAL SCM INVENTORY/TRANSPORT CASE: SYCAMORE HILL Sycamore Hill is a well-established smoked foods company specializing in smoked turkeys and has been selling its products throughout the north-western part of the continental United States since the 1960s. Initially owned and operated by a German immigrant family, the key to the com lays in a secret smoking process. By 2020 the firm had 250 retail outlets and 400 franchisees. Although the company sells a variety of turkey products its competitive strength lay in one main product line. "Tender Most" that had sales in 2019 of $4.350,000. Sales estimates for 2020 indicate a 15 percent inc or the 2019 level. Turkeys are supplied by Indiana Greens Turkeys, who clean and smoke the turkeys using the patented process and provides the necessary industrial packaging for safe shipment to the retail outlets. Tender Most is sold to retail outlets for $4.00 per pound and due to some planned promotions and better positioning in advertising, a 30 percent sales increase in 202 1 is expected for the Tender Most line. The smoking process employed by Sycamore Hill has some unique characteristics that clearly differentiate the company's products from those of its competitors. The smoked turkeys can be refrigerated for up to 14 days without spoiling and remain fresh and edible for another seven days even without refrigeration. These features, however, do not permit the company to engage in forward buying since freezer costs are relatively high. Consequently. the company purchases turkeys from the Indiana supplier in simple economic order quantities (EQQ), which represen ases per rder for 2021. Sycamore Hill coordimates the remaining distribution functions. The cured and packaged barkeys are purchased from the supp lier on an FOB origin basis and sold to the retail outlets and franchisees on an FOB destination basis. Approximately 40 percent of sales revenue in 2019 can be attributed to direct variable costs and 60 percent of these direct variable costs are estimated to be actual turkey costs. These costing percentages are expected to hold for the next few years. It takes an estimated eight days for railroad freezer cars to bring the smoked turkeys from the supplier's factory in Columbus, Indiana to Butte, Montana (Sycamore Hill's centralized distribution point). and another two days on average for commercial tracks to deliver them to the various retail outlets. Tender Mast is shipped in a case pack size of 25 pounds and inventory carrying proportion of the cost of the turkeys is 20 percent per undred ated to be $25 per order. Sycamore Hill pays $8 p is shipped for the refrigerated railcars and another $12 per hundred pounds for the commercial truck shipments to stores on a daily basis. From a logistical standpoint, manag alternative modes of transportation with respect to Tender Most for the planning year of 2021. Two alternatives are available: (I) the company could discontinue the use of railroad freezer cars for delivery up to Butte and use company-owned private trucks and trailers; or (2) the company could bypass all transportation and use an air carrier service that wo and deliver the ould pick up the cases in Indiana This re-evaluation of transport modes was triggered by an offer from a new small aircraft company providing cargo shipping at very attractive rates: 53.00 for the first 10 pounds per case for a guaranteed two-day delivery service anywhere in the continental United States; each extra pound over 10 pounds per case was to be billed at the rate of 50 cents per pound. The company-owned truck was expected to cost $1,750 per round-trip and had a maximum capacity of 1,290 cases of Tender Most. Each trip leg was expected to t ake four days. the shipments from the distribution center to the individual retail outlets were relatively small, it was recognized that even if the firm chose the company-owned truck option, the delivery to retailers would still involve the use Do any analysis necessary for the questions below and consider how Sycamore Hill might improve its inventory management and transportation system. What do you recommend based on expected 2021 sales? Assumptions Total costs include average inventory carrying costs, inventory order processing costs and transportation costs; Average cycle stock equals 1/2 of EOQ plus safety stock; and The number of order cycles equals annual demand in cases divided by the EOQ. 1. What is the total annual logistics cost of inventory and transportation associated with the current practice of shipping product by railroad freezer cars to Butte and then by commercia trucks to retail outlets? Safety stocks under this sce are 550 cases. Base your calculations on expected 2021 sales. (4 points) 2. What would the total annual logistics cost be if the company uses the private fleet option? Safety stocks under this scenario are reduced to 279 cases. (4 points) 3. What would the total annual logistics cost be if the company uses the option of shipping product by air to the retail outlets? You will need to estimate safety stocks for this scenario, To keep it simple, use the safety stock numbers for the above questions to estimate your number based on lead time, since we do not have standard deviation figures for sales. Show your calculations. (4 points) Economic Order Quantity EOO = 2 x D XS H D = Annual demand (units) S = Cost per order ($) C = Cost per unit ($) | = Holding cost (%) H = Holding cost ($) = 1 x C When to order . Basic reorder formula if demand and performance are certain R= D X T - R = Rearder point in units - D = Average daily demand in units - T= Average performance cycle length in days . If safety stock is needed to accommodate uncertainty the formula is R = D x T +SS - R = Reorder point in units D = Average daily demand in units T = Average performance cycle length in days SS = Safety stock in units