Answered step by step

Verified Expert Solution

Question

1 Approved Answer

sirrrr can h make it quick plzzzz The payroll records of Russon Company's district office provided the following information for the weekly pay period ended

sirrrr can h make it quick plzzzz

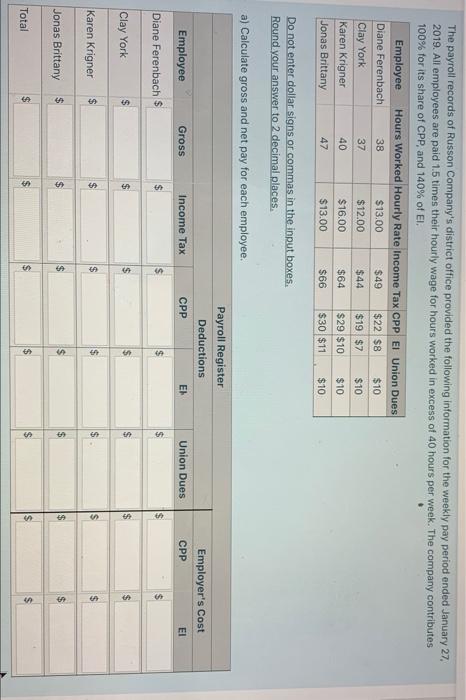

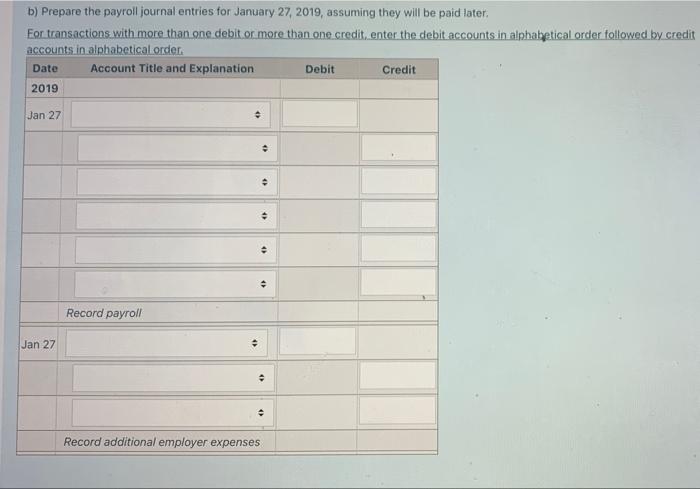

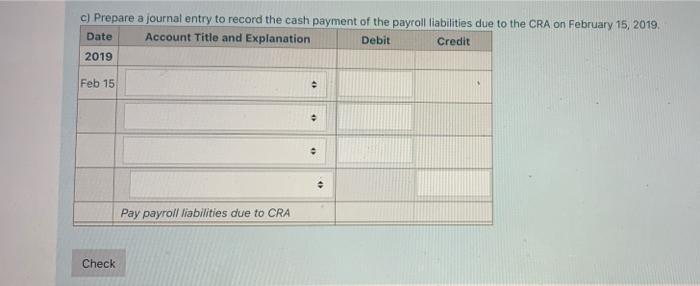

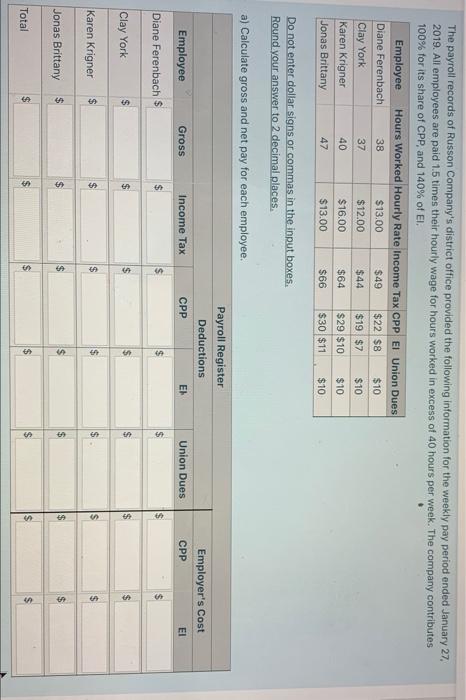

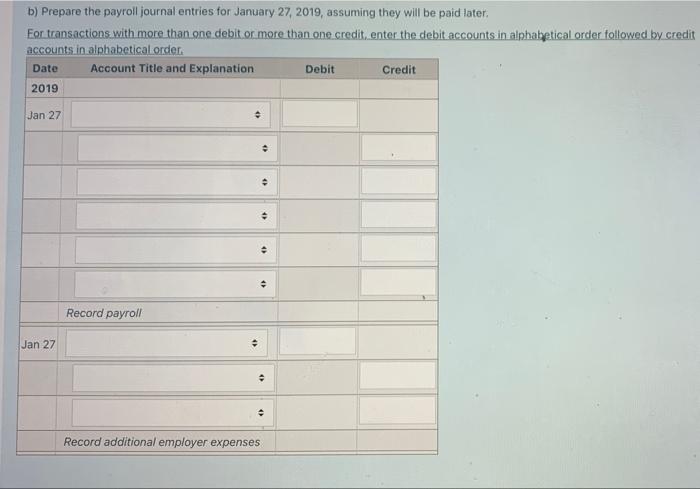

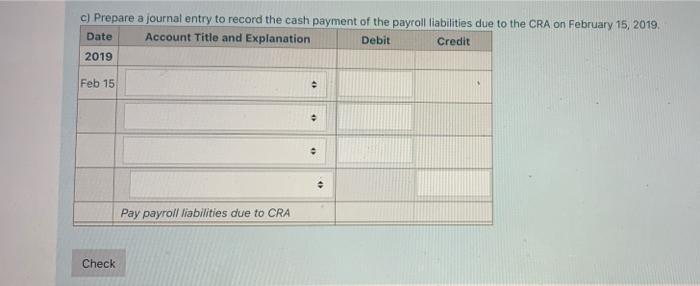

The payroll records of Russon Company's district office provided the following information for the weekly pay period ended January 27, 2019. All employees are paid 1.5 times their hourly wage for hours worked in excess of 40 hours per week. The company contributes 100% for its share of CPP, and 140% of El. Employee Hours Worked Hourly Rate Income Tax CPP El Union Dues Diane Ferenbach 38 $13.00 $49 $22 $8 $10 Clay York 37 $12.00 $44 $19 $7 $10 Karen Krigner 40 $16.00 $64 $29 $10 $10 Jonas Brittany 47 $13.00 $66 $30 $11 $10 Do not enter dollar signs or commas in the input boxes. Round your answer to 2 decimal places a) Calculate gross and net pay for each employee. Payroll Register Deductions Employer's Cost CPP Employee Gross Income Tax CPP Union Dues Diane Ferenbach $ $ $ $ $ $ $ $ $ $ $ Clay York Karen Krigner $ $ $ $ $ $ $ $ $ S Jonas Brittany s $ $ $ $ $ Total $ $ $ b) Prepare the payroll journal entries for January 27, 2019, assuming they will be paid later. For transactions with more than one debitor more than one credit, enter the debit accounts in alphabetical order followed by credit accounts in alphabetical order Date Account Title and Explanation Debit Credit 2019 Jan 27 . . . Record payroll Jan 27 . . . Record additional employer expenses c) Prepare a journal entry to record the cash payment of the payroll liabilities due to the CRA on February 15, 2019 Date Account Title and Explanation Debit Credit 2019 Feb 15 0 : Pay payroll liabilities due to CRA Check

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started