Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sisters Natalie and Ashley purchased a condo and titled it as joint tenancy with right of survivorship, ten years ago. At the time of

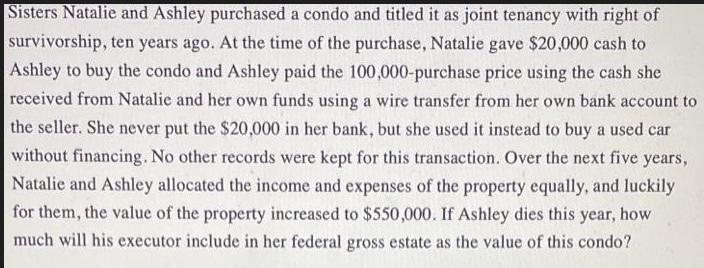

Sisters Natalie and Ashley purchased a condo and titled it as joint tenancy with right of survivorship, ten years ago. At the time of the purchase, Natalie gave $20,000 cash to Ashley to buy the condo and Ashley paid the 100,000-purchase price using the cash she received from Natalie and her own funds using a wire transfer from her own bank account to the seller. She never put the $20,000 in her bank, but she used it instead to buy a used car without financing. No other records were kept for this transaction. Over the next five years, Natalie and Ashley allocated the income and expenses of the property equally, and luckily for them, the value of the property increased to $550,000. If Ashley dies this year, how much will his executor include in her federal gross estate as the value of this condo?

Step by Step Solution

★★★★★

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Ashley contributed 80000 of her own funds and 20000 from Natalie t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started