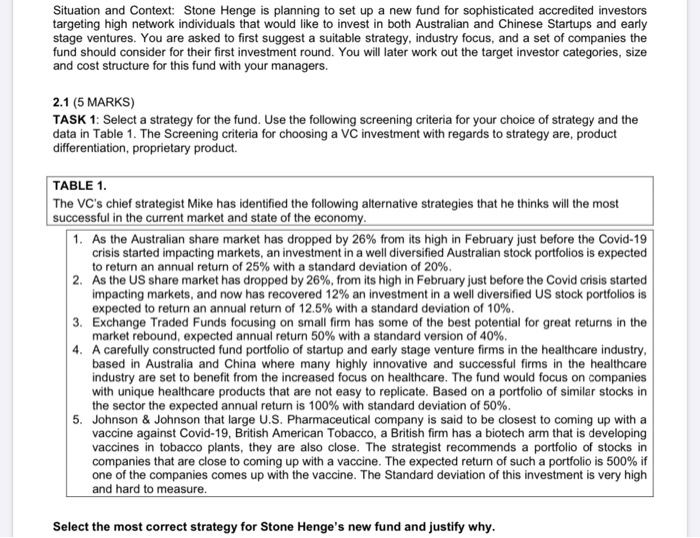

Situation and Context: Stone Henge is planning to set up a new fund for sophisticated accredited investors targeting high network individuals that would like to invest in both Australian and Chinese Startups and early stage ventures. You are asked to first suggest a suitable strategy, industry focus, and a set of companies the fund should consider for their first investment round. You will later work out the target investor categories, size and cost structure for this fund with your managers. 2.1 (5 MARKS) TASK 1: Select a strategy for the fund. Use the following screening criteria for your choice of strategy and the data in Table 1. The Screening criteria for choosing a VC investment with regards to strategy are, product differentiation, proprietary product. TABLE 1. The VC's chief strategist Mike has identified the following alternative strategies that he thinks will the most successful in the current market and state of the economy. 1. As the Australian share market has dropped by 26% from its high in February just before the Covid-19 crisis started impacting markets, an investment in a well diversified Australian stock portfolios is expected to return an annual return of 25% with a standard deviation of 20%. 2. As the US share market has dropped by 26%, from its high in February just before the Covid crisis started impacting markets, and now has recovered 12% an investment in a well diversified US stock portfolios is expected to return an annual return of 12.5% with a standard deviation of 10%. 3. Exchange Traded Funds focusing on small firm has some of the best potential for great returns in the market rebound, expected annual return 50% with a standard version of 40%. 4. A carefully constructed fund portfolio of startup and early stage venture firms in the healthcare industry, based in Australia and China where many highly innovative and successful firms in the healthcare industry are set to benefit from the increased focus on healthcare. The fund would focus on companies with unique healthcare products that are not easy to replicate. Based on a portfolio of similar stocks in the sector the expected annual return is 100% with standard deviation of 50%. 5. Johnson & Johnson that large U.S. Pharmaceutical company is said to be closest to coming up with a vaccine against Covid-19, British American Tobacco, a British firm has a biotech arm that is developing vaccines in tobacco plants, they are also close. The strategist recommends a portfolio of stocks in companies that are close to coming up with a vaccine. The expected return of such a portfolio is 500% if one of the companies comes up with the vaccine. The Standard deviation of this investment is very high and hard to measure. Select the most correct strategy for Stone Henge's new fund and justify why. Situation and Context: Stone Henge is planning to set up a new fund for sophisticated accredited investors targeting high network individuals that would like to invest in both Australian and Chinese Startups and early stage ventures. You are asked to first suggest a suitable strategy, industry focus, and a set of companies the fund should consider for their first investment round. You will later work out the target investor categories, size and cost structure for this fund with your managers. 2.1 (5 MARKS) TASK 1: Select a strategy for the fund. Use the following screening criteria for your choice of strategy and the data in Table 1. The Screening criteria for choosing a VC investment with regards to strategy are, product differentiation, proprietary product. TABLE 1. The VC's chief strategist Mike has identified the following alternative strategies that he thinks will the most successful in the current market and state of the economy. 1. As the Australian share market has dropped by 26% from its high in February just before the Covid-19 crisis started impacting markets, an investment in a well diversified Australian stock portfolios is expected to return an annual return of 25% with a standard deviation of 20%. 2. As the US share market has dropped by 26%, from its high in February just before the Covid crisis started impacting markets, and now has recovered 12% an investment in a well diversified US stock portfolios is expected to return an annual return of 12.5% with a standard deviation of 10%. 3. Exchange Traded Funds focusing on small firm has some of the best potential for great returns in the market rebound, expected annual return 50% with a standard version of 40%. 4. A carefully constructed fund portfolio of startup and early stage venture firms in the healthcare industry, based in Australia and China where many highly innovative and successful firms in the healthcare industry are set to benefit from the increased focus on healthcare. The fund would focus on companies with unique healthcare products that are not easy to replicate. Based on a portfolio of similar stocks in the sector the expected annual return is 100% with standard deviation of 50%. 5. Johnson & Johnson that large U.S. Pharmaceutical company is said to be closest to coming up with a vaccine against Covid-19, British American Tobacco, a British firm has a biotech arm that is developing vaccines in tobacco plants, they are also close. The strategist recommends a portfolio of stocks in companies that are close to coming up with a vaccine. The expected return of such a portfolio is 500% if one of the companies comes up with the vaccine. The Standard deviation of this investment is very high and hard to measure. Select the most correct strategy for Stone Henge's new fund and justify why