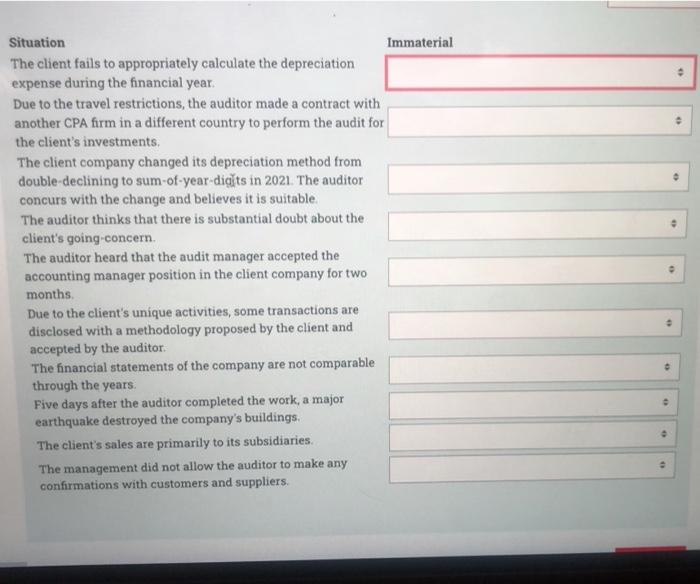

Situation Immaterial The client fails to appropriately calculate the depreciation expense during the financial year. Due to the travel restrictions, the auditor made a contract with another CPA firm in a different country to perform the audit for the client's investments The client company changed its depreciation method from double-declining to sum-of-year-digits in 2021. The auditor concurs with the change and believes it is suitable The auditor thinks that there is substantial doubt about the client's going concern. The auditor heard that the audit manager accepted the accounting manager position in the client company for two months Due to the client's unique activities, some transactions are disclosed with a methodology proposed by the client and accepted by the auditor. The financial statements of the company are not comparable through the years Five days after the auditor completed the work, a major earthquake destroyed the company's buildings. The client's sales are primarily to its subsidiaries. The management did not allow the auditor to make any confirmations with customers and suppliers . . Situation Immaterial The client fails to appropriately calculate the depreciation expense during the financial year. Due to the travel restrictions, the auditor made a contract with another CPA firm in a different country to perform the audit for the client's investments The client company changed its depreciation method from double-declining to sum-of-year-digits in 2021. The auditor concurs with the change and believes it is suitable The auditor thinks that there is substantial doubt about the client's going concern. The auditor heard that the audit manager accepted the accounting manager position in the client company for two months Due to the client's unique activities, some transactions are disclosed with a methodology proposed by the client and accepted by the auditor. The financial statements of the company are not comparable through the years Five days after the auditor completed the work, a major earthquake destroyed the company's buildings. The client's sales are primarily to its subsidiaries. The management did not allow the auditor to make any confirmations with customers and suppliers