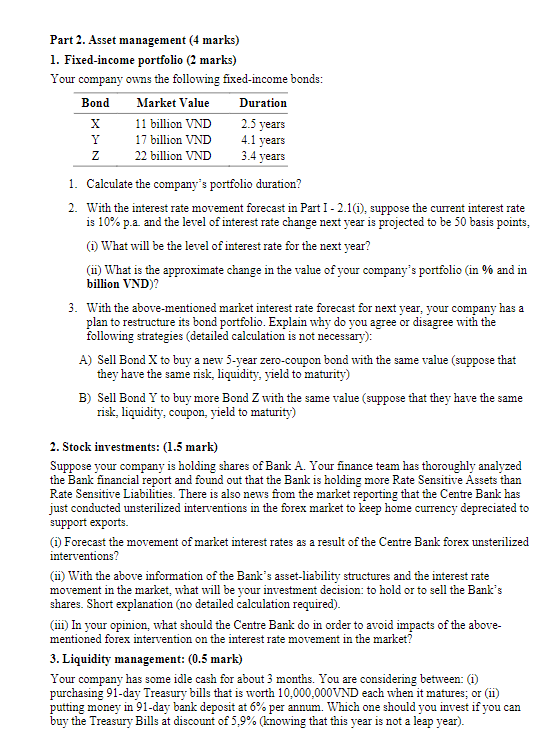

Situation overview: Raising funds and allocations of funds are two important functions of a company's Financial Manager. As a CFO of Company A. you and your team are responsible for taking a comprehensive analysis about financial markets and economy, to forecast the movement of the interest rates and exchange rates, determine the Company's risk exposures in some scenarios and propose strategies to manage the funds raising and allocation to maximize the Company's profit. Write a report on the following issues regarding the two important functions of Financial Management in Company A: Part 1. Fund Raising (6 marks) 1. Proposal (2.5 marks) Your Company is going to have a big real estate project which requires significant source of funds. What should be your arguments to persuade Board of Directors to approve your team's plan in issuing bonds rather than stocks (from the point of view of the Company's benefits). 2. Fixed-income debt instrument issuance strategy (3.5 marks) 2.1. Bond maturity (1) With the fact that the economy is rapidly recovering after the pandemic, it is expected that there will be a lot of great investment opportunities, meanwhile inflation may face rising trend the next year. Forecast and explain the interest rate movement in the market for the year to come, using bond supply and demand curves model and graph with the above-mentioned factors (holding other things being unchanged, including macroeconomic policies such as fiscal policies). (i) With the above-mentioned forecast, propose and explain your decision for the maturity of the bonds (long or short term) issued right now. 2.2. Bond coupon There have currently been tax-free Municipal Bonds with 4% coupon annually in the market with the same liquidity and risk. (1) What is the most important factor that influences the corporate bond purchasing decision of investors? What should be your bond's minimum coupon rate in order to attract investors to buy your bonds, knowing that the marginal tax rate is 28%. (11) Is there any possibility for you to successfully sell the bond with 5% coupon rate? Why? 2.3. Bond prices Suppose you decide to issue 3-year-bonds with 1 million VND face value, 6%p.a. coupon, semi- annual coupon payment. You know that investors will be happy with the yield of 8%p.a. for their investment, what is the bond price you should offer in the market? Show table of calculation. 2.4. Bond currency denomination Beside domestic issuances, your team also proposes a plan to issue bonds abroad. Singapore financial market is one of your preferred market. Market research from your team shows that while Singapore economy is booming with high Balance of Payment surplus, the US economy is just starting recovery so FED still keeps easing monetary policies, leading to the risk of high inflation 1) Forecast (with explanation) movement trends of the value of Singapore Dollar and US Dollar. (i) How will the above movement trends affect your choice of issuing Eurobonds or Foreign Bonds in Singapore market. Y 4.1 years Part 2. Asset management (4 marks) 1. Fixed-income portfolio (2 marks) Your company owns the following fixed-income bonds: Bond Market Value Duration X 11 billion VND 2.5 years 17 billion VND Z 22 billion VND 3.4 years 1. Calculate the company's portfolio duration? 2. With the interest rate movement forecast in Part I -2.11), suppose the current interest rate is 10% p.a. and the level of interest rate change next year is projected to be 50 basis points, 1) What will be the level of interest rate for the next year? (ii) What is the approximate change in the value of your company's portfolio (in % and in billion VND)? 3. With the above-mentioned market interest rate forecast for next year, your company has a plan to restructure its bond portfolio. Explain why do you agree or disagree with the following strategies (detailed calculation is not necessary): A) Sell Bond X to buy a new 5-year zero-coupon bond with the same value (suppose that they have the same risk, liquidity, yield to maturity) B) Sell Bond Y to buy more Bond Z with the same value (suppose that they have the same risk, liquidity, coupon, yield to maturity) 2. Stock investments: (1.5 mark) Suppose your company is holding shares of Bank A. Your finance team has thoroughly analyzed the Bank financial report and found out that the Bank is holding more Rate Sensitive Assets than Rate Sensitive Liabilities. There is also news from the market reporting that the Centre Bank has just conducted unsterilized interventions in the forex market to keep home currency depreciated to support exports. (1) Forecast the movement of market interest rates as a result of the Centre Bank forex unsterilized interventions? (ii) With the above information of the Bank's asset-liability structures and the interest rate movement in the market, what will be your investment decision: to hold or to sell the Bank's shares. Short explanation (no detailed calculation required) (ii) In your opinion, what should the Centre Bank do in order to avoid impacts of the above- mentioned forex intervention on the interest rate movement in the market? 3. Liquidity management: (0.5 mark) Your company has some idle cash for about 3 months. You are considering between: (1) purchasing 91-day Treasury bills that is worth 10,000,000 VND each when it matures; or (i) putting money in 91-day bank deposit at 6% per annum. Which one should you invest if you can buy the Treasury Bills at discount of 5,9% (knowing that this year is not a leap year)