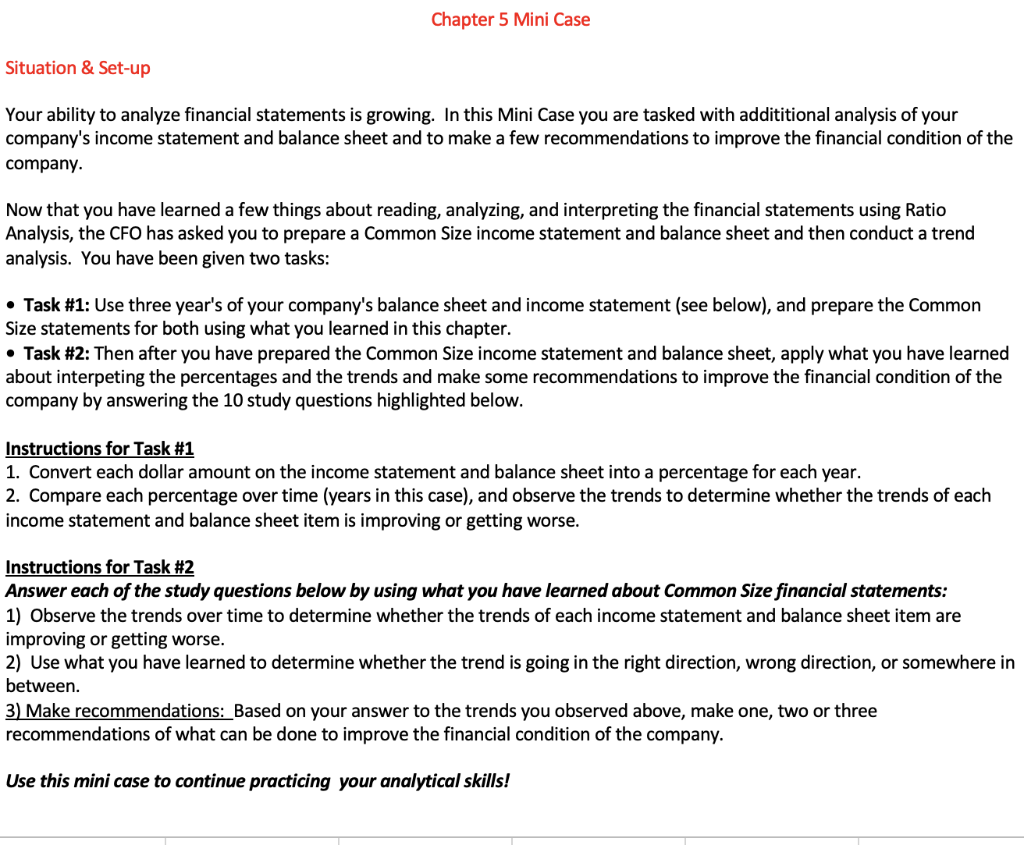

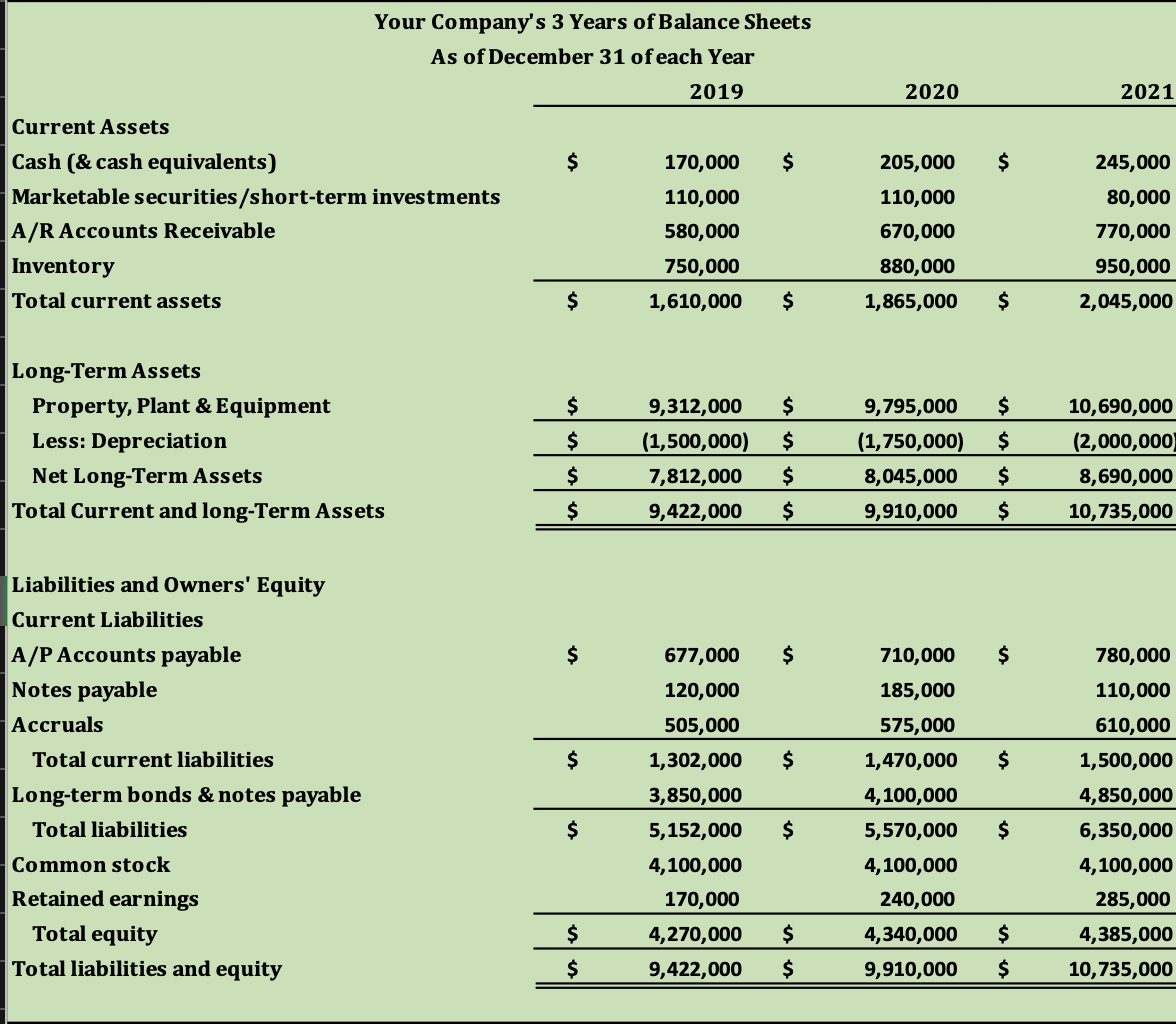

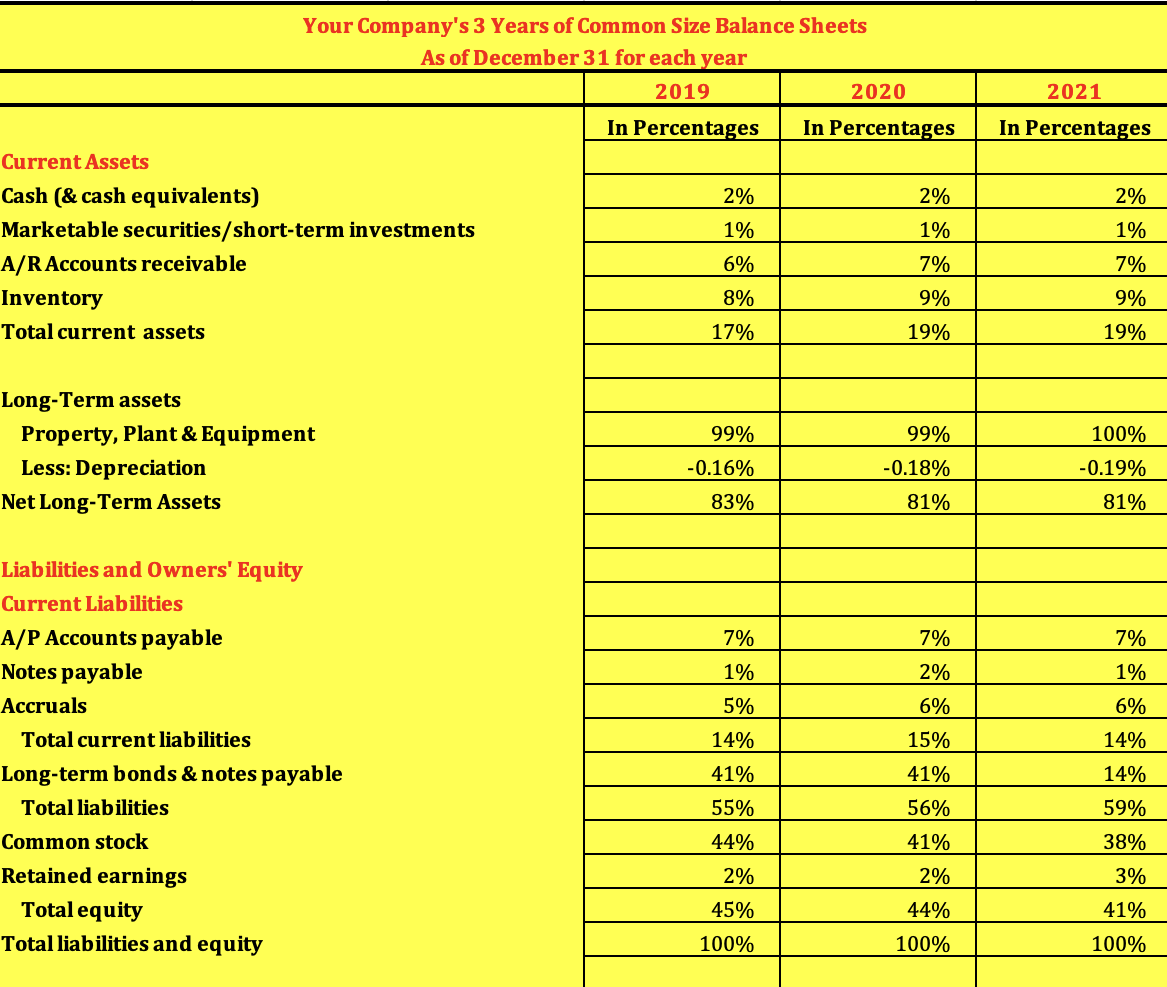

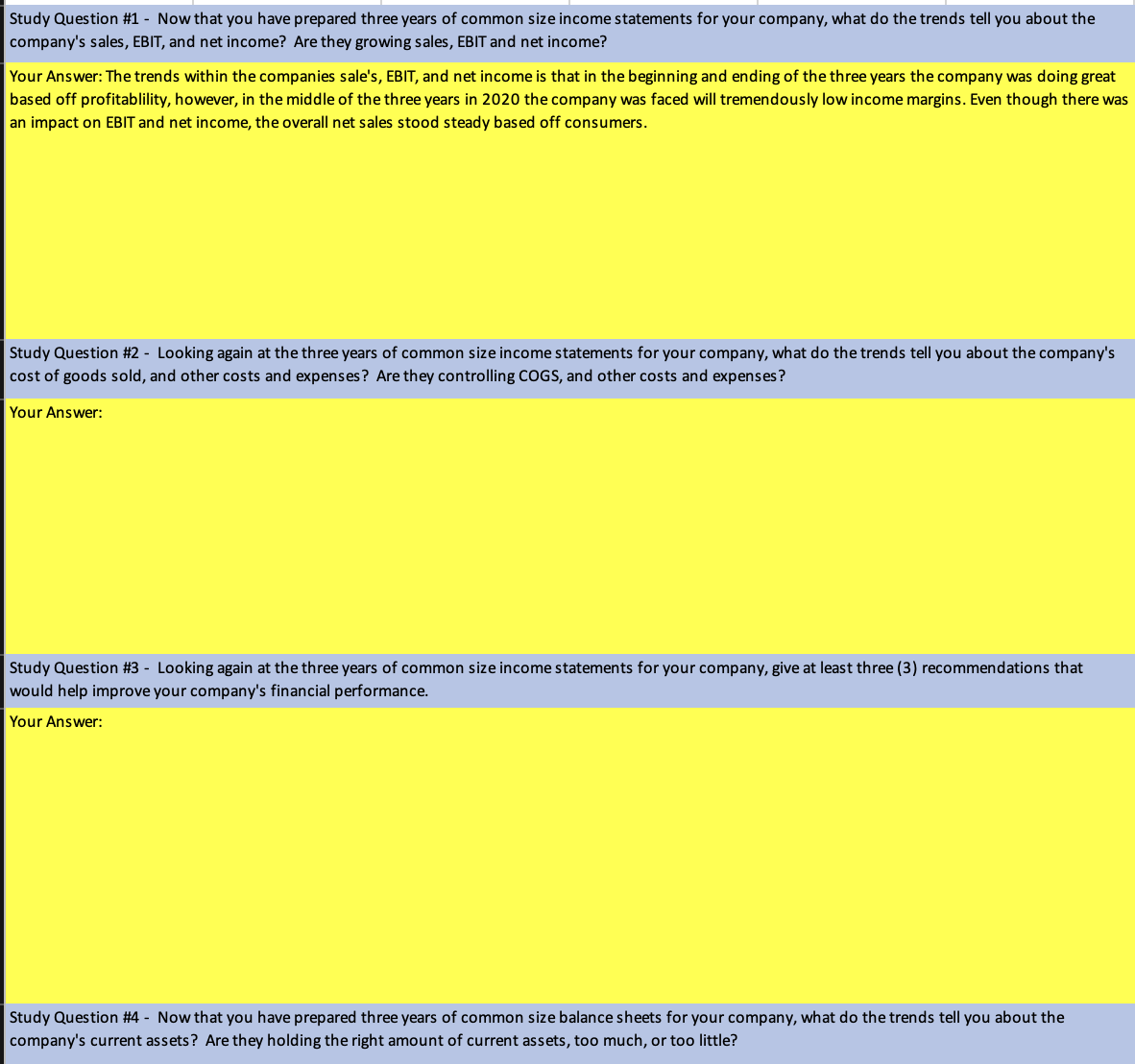

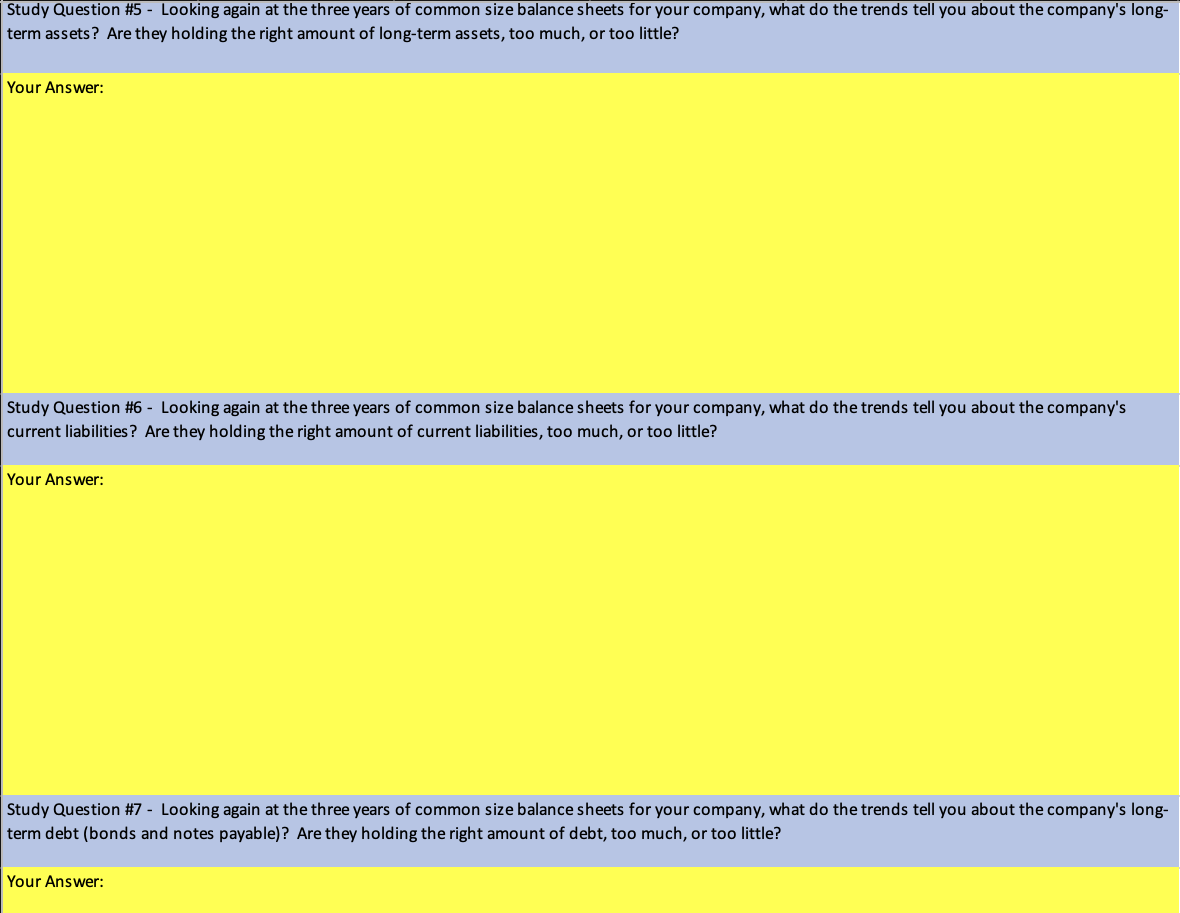

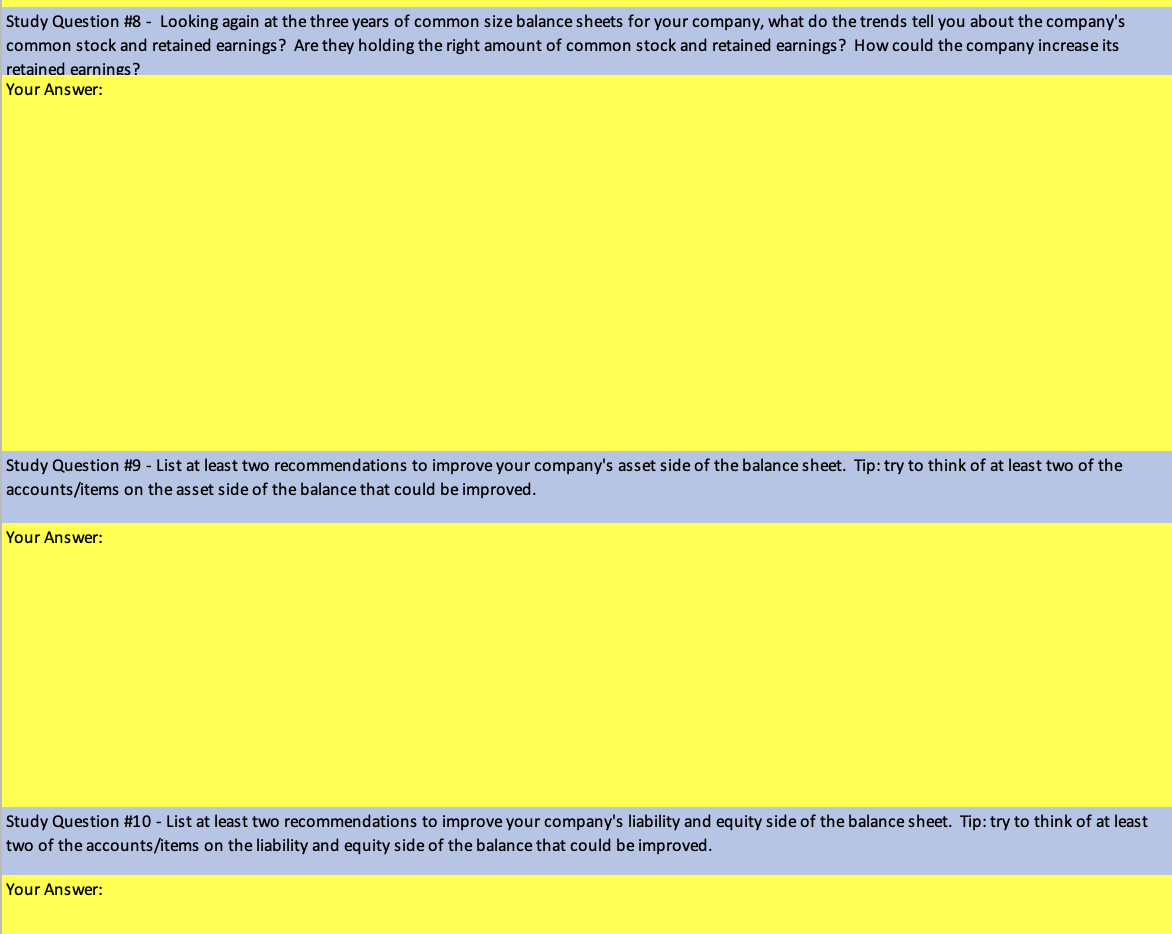

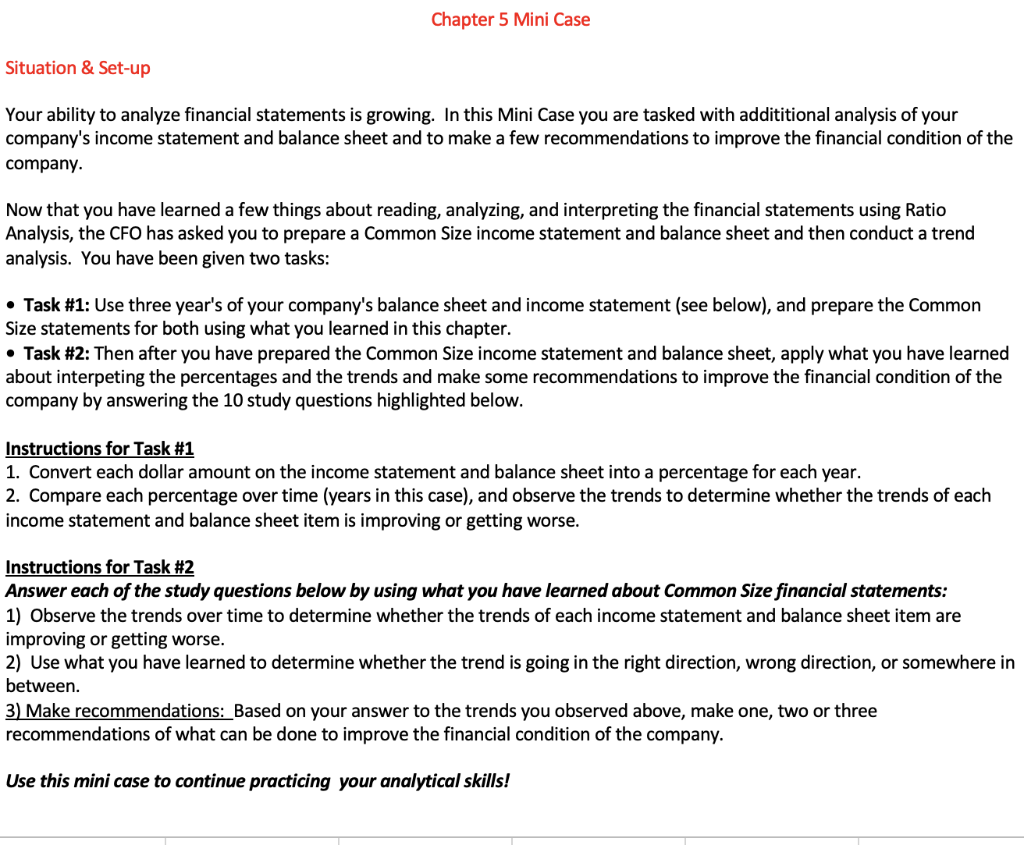

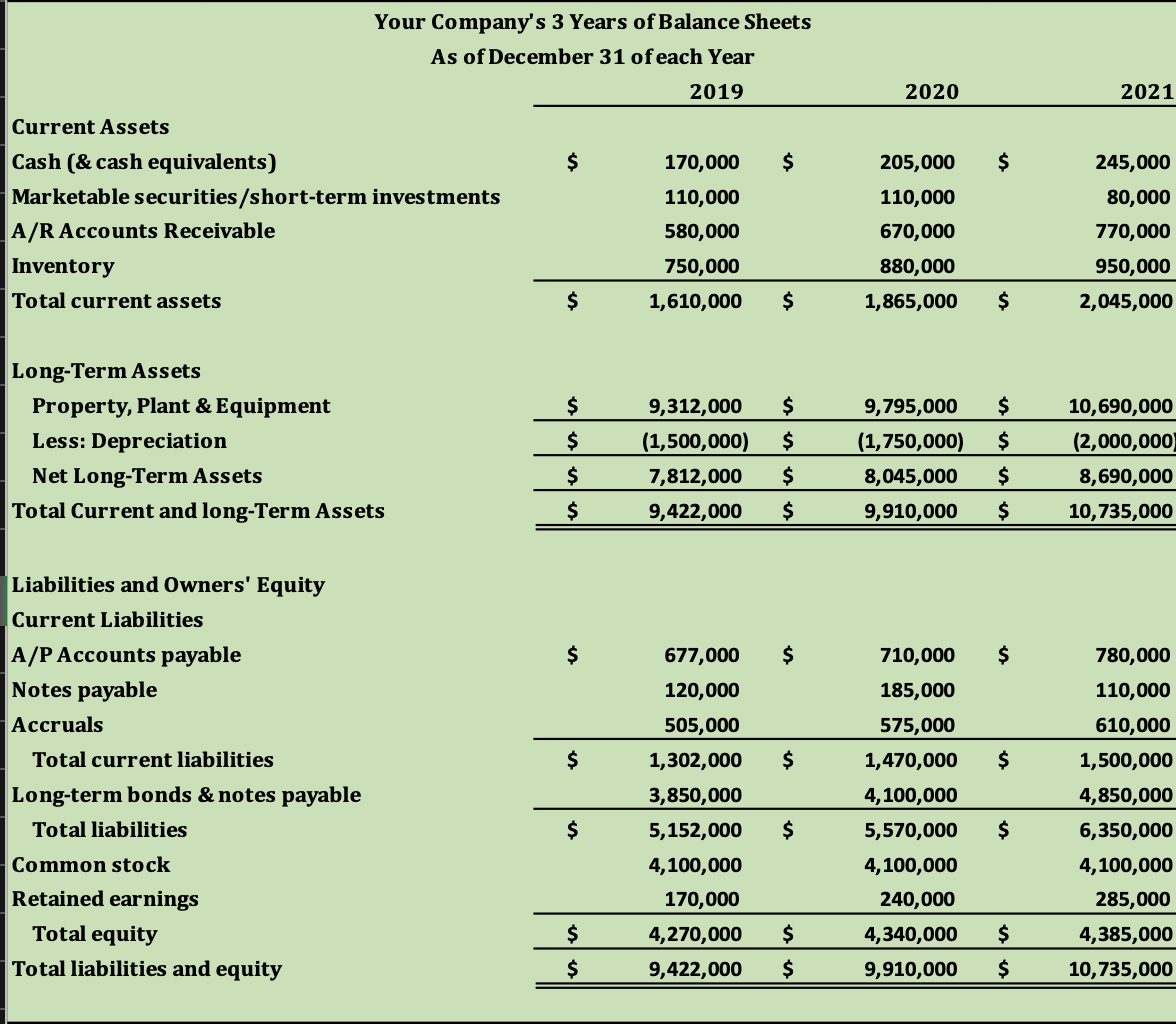

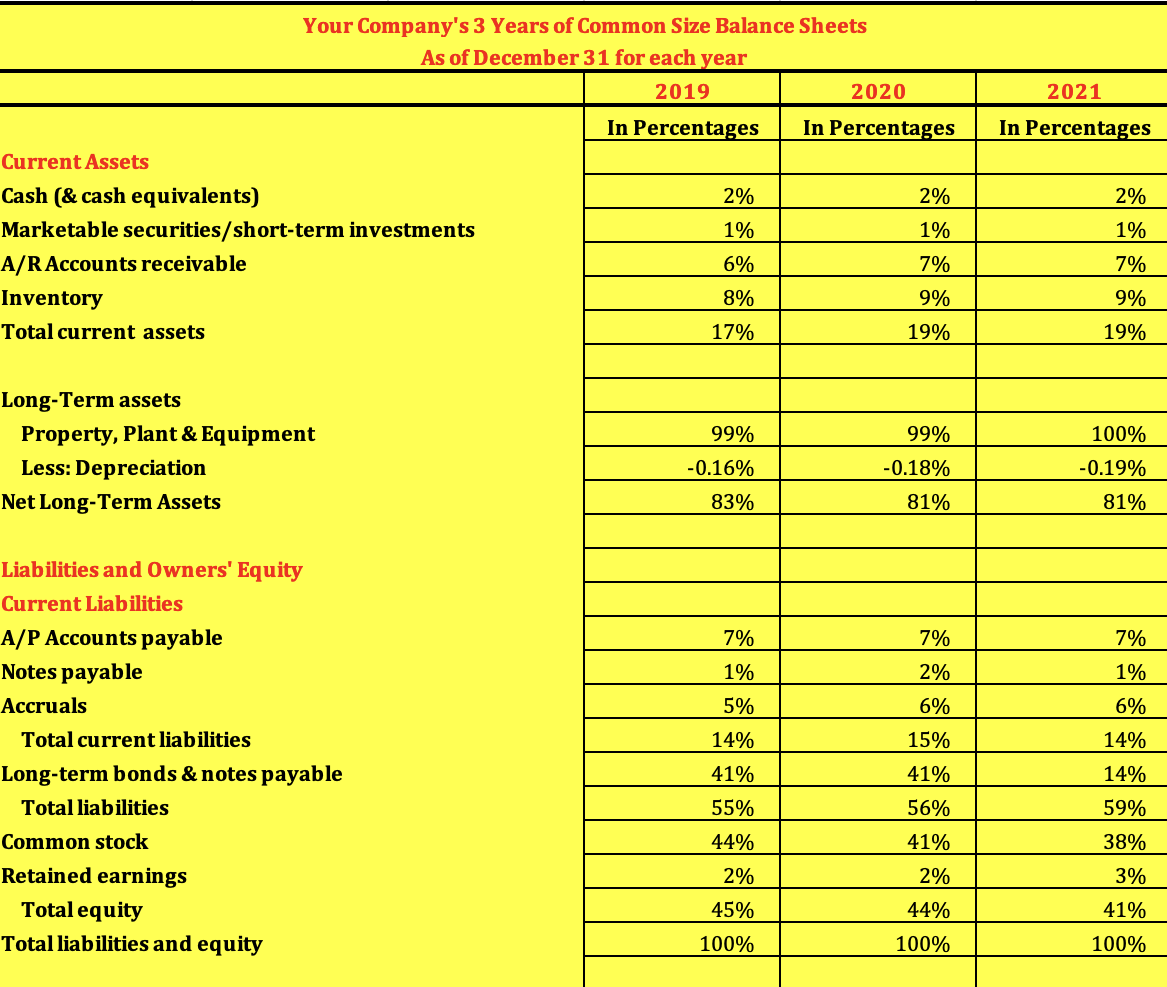

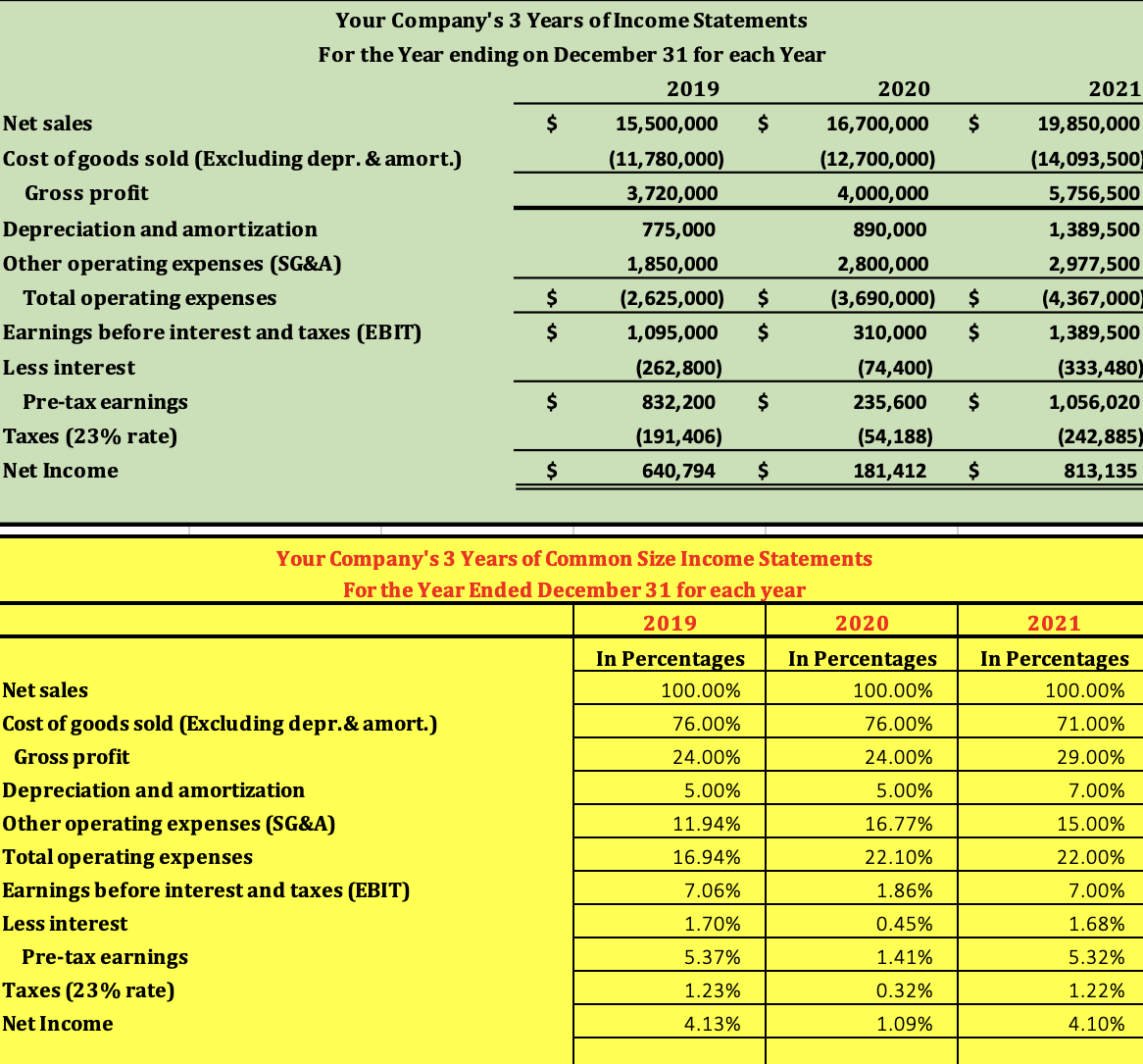

Situation \& Set-up Your ability to analyze financial statements is growing. In this Mini Case you are tasked with addititional analysis of your company's income statement and balance sheet and to make a few recommendations to improve the financial condition of the company. Now that you have learned a few things about reading, analyzing, and interpreting the financial statements using Ratio Analysis, the CFO has asked you to prepare a Common Size income statement and balance sheet and then conduct a trend analysis. You have been given two tasks: - Task \#1: Use three year's of your company's balance sheet and income statement (see below), and prepare the Common Size statements for both using what you learned in this chapter. - Task \#2: Then after you have prepared the Common Size income statement and balance sheet, apply what you have learned about interpeting the percentages and the trends and make some recommendations to improve the financial condition of the company by answering the 10 study questions highlighted below. Instructions for Task \#1 1. Convert each dollar amount on the income statement and balance sheet into a percentage for each year. 2. Compare each percentage over time (years in this case), and observe the trends to determine whether the trends of each income statement and balance sheet item is improving or getting worse. Instructions for Task \#2 Answer each of the study questions below by using what you have learned about Common Size financial statements: 1) Observe the trends over time to determine whether the trends of each income statement and balance sheet item are improving or getting worse. 2) Use what you have learned to determine whether the trend is going in the right direction, wrong direction, or somewhere in between. 3) Make recommendations: Based on your answer to the trends you observed above, make one, two or three recommendations of what can be done to improve the financial condition of the company. Use this mini case to continue practicing your analytical skills! Your Company's 3 Years of Balance Sheets As of December 31 of each Year Current Assets \begin{tabular}{lll} 2019 & 2020 & 2021 \\ \hline \end{tabular} Cash ( & cash equivalents) Marketable securities/short-term investments A/R Accounts Receivable Inventory Total current assets \begin{tabular}{rrrrrr} & 750,000 & 880,000 & 950,000 \\ \hline$ & 1,610,000 & $ & 1,865,000 & $ & 2,045,000 \end{tabular} Long-Term Assets Property, Plant \& Equipment Less: Depreciation Net Long-Term Assets Total Current and long-Term Assets Liabilities and Owners' Equity Current Liabilities A/P Accounts payable Notes payable Accruals Total current liabilities Long-term bonds & notes payable Total liabilities Common stock Retained earnings Total equity Total liabilities and equity \begin{tabular}{rrrrrrr} $ & 677,000 & $ & 710,000 & $ & 780,000 \\ & 120,000 & & 185,000 & & 110,000 \\ & 505,000 & & 575,000 & & 610,000 \\ \hline$ & 1,302,000 & $ & 1,470,000 & $ & 1,500,000 \\ & 3,850,000 & & 4,100,000 & & 4,850,000 \\ \hline$ & 5,152,000 & $ & 5,570,000 & $ & 6,350,000 \\ & 4,100,000 & & 4,100,000 & & 4,100,000 \\ & 170,000 & & 240,000 & & 285,000 \\ \hline$ & 4,270,000 & $ & 4,340,000 & $ & 4,385,000 \\ \hline$ & 9,422,000 & $ & 9,910,000 & $ & 10,735,000 \\ \hline \hline \end{tabular} Your Company's 3 Years of Common Size Balance Sheets As of December 31 for each year Current Assets Cash ( & cash equivalents) Marketable securities/short-term investments A/R Accounts receivable Inventory Total current assets Long-Term assets Property, Plant \& Equipment Less: Depreciation Net Long-Term Assets Liabilities and Owners' Equity Current Liabilities A/P Accounts payable Notes payable Accruals Total current liabilities Long-term bonds \& notes payable Total liabilities Common stock Retained earnings Total equity Total liabilities and equity Your Company's 3 Years of Income Statements For the Year ending on December 31 for each Year Study Question \#1 - Now that you have prepared three years of common size income statements for your company, what do the trends tell you about the company's sales, EBIT, and net income? Are they growing sales, EBIT and net income? Your Answer: The trends within the companies sale's, EBIT, and net income is that in the beginning and ending of the three years the company was doing based off profitablility, however, in the middle of the three years in 2020 the company was faced will tremendously low income margins. Even though there was an impact on EBIT and net income, the overall net sales stood steady based off consumers. Study Question \#2 - Looking again at the three years of common size income statements for your company, what do the trends tell you about the company's cost of goods sold, and other costs and expenses? Are they controlling COGS, and other costs and expenses? Your Answer: Study Question \#3 - Looking again at the three years of common size income statements for your company, give at least three (3) recommendations that would help improve your company's financial performance. Your Answer: Study Question \#4 - Now that you have prepared three years of common size balance sheets for your company, what do the trends tell you about the company's current assets? Are they holding the right amount of current assets, too much, or too little? Study Question \#6 - Looking again at the three years of common size balance sheets for your company, what do the trends tell you about the company's current liabilities? Are they holding the right amount of current liabilities, too much, or too little? Your Answer: Study Question \#7 - Looking again at the three years of common size balance sheets for your company, what do the trends tell you about the company's longterm debt (bonds and notes payable)? Are they holding the right amount of debt, too much, or too little? Your Answer: Study Question \#8 - Looking again at the three years of common size balance sheets for your company, what do the trends tell you about the company's common stock and retained earnings? Are they holding the right amount of common stock and retained earnings? How could the company increase its retained earnings? Your Answer: Study Question \#9 - List at least two recommendations to improve your company's asset side of the balance sheet. Tip: try to think of at least two of the accounts/items on the asset side of the balance that could be improved. Your Answer: Study Question \#10 - List at least two recommendations to improve your company's liability and equity side of the balance sheet. Tip: try to think of at least two of the accounts/items on the liability and equity side of the balance that could be improved. Your Answer: Situation \& Set-up Your ability to analyze financial statements is growing. In this Mini Case you are tasked with addititional analysis of your company's income statement and balance sheet and to make a few recommendations to improve the financial condition of the company. Now that you have learned a few things about reading, analyzing, and interpreting the financial statements using Ratio Analysis, the CFO has asked you to prepare a Common Size income statement and balance sheet and then conduct a trend analysis. You have been given two tasks: - Task \#1: Use three year's of your company's balance sheet and income statement (see below), and prepare the Common Size statements for both using what you learned in this chapter. - Task \#2: Then after you have prepared the Common Size income statement and balance sheet, apply what you have learned about interpeting the percentages and the trends and make some recommendations to improve the financial condition of the company by answering the 10 study questions highlighted below. Instructions for Task \#1 1. Convert each dollar amount on the income statement and balance sheet into a percentage for each year. 2. Compare each percentage over time (years in this case), and observe the trends to determine whether the trends of each income statement and balance sheet item is improving or getting worse. Instructions for Task \#2 Answer each of the study questions below by using what you have learned about Common Size financial statements: 1) Observe the trends over time to determine whether the trends of each income statement and balance sheet item are improving or getting worse. 2) Use what you have learned to determine whether the trend is going in the right direction, wrong direction, or somewhere in between. 3) Make recommendations: Based on your answer to the trends you observed above, make one, two or three recommendations of what can be done to improve the financial condition of the company. Use this mini case to continue practicing your analytical skills! Your Company's 3 Years of Balance Sheets As of December 31 of each Year Current Assets \begin{tabular}{lll} 2019 & 2020 & 2021 \\ \hline \end{tabular} Cash ( & cash equivalents) Marketable securities/short-term investments A/R Accounts Receivable Inventory Total current assets \begin{tabular}{rrrrrr} & 750,000 & 880,000 & 950,000 \\ \hline$ & 1,610,000 & $ & 1,865,000 & $ & 2,045,000 \end{tabular} Long-Term Assets Property, Plant \& Equipment Less: Depreciation Net Long-Term Assets Total Current and long-Term Assets Liabilities and Owners' Equity Current Liabilities A/P Accounts payable Notes payable Accruals Total current liabilities Long-term bonds & notes payable Total liabilities Common stock Retained earnings Total equity Total liabilities and equity \begin{tabular}{rrrrrrr} $ & 677,000 & $ & 710,000 & $ & 780,000 \\ & 120,000 & & 185,000 & & 110,000 \\ & 505,000 & & 575,000 & & 610,000 \\ \hline$ & 1,302,000 & $ & 1,470,000 & $ & 1,500,000 \\ & 3,850,000 & & 4,100,000 & & 4,850,000 \\ \hline$ & 5,152,000 & $ & 5,570,000 & $ & 6,350,000 \\ & 4,100,000 & & 4,100,000 & & 4,100,000 \\ & 170,000 & & 240,000 & & 285,000 \\ \hline$ & 4,270,000 & $ & 4,340,000 & $ & 4,385,000 \\ \hline$ & 9,422,000 & $ & 9,910,000 & $ & 10,735,000 \\ \hline \hline \end{tabular} Your Company's 3 Years of Common Size Balance Sheets As of December 31 for each year Current Assets Cash ( & cash equivalents) Marketable securities/short-term investments A/R Accounts receivable Inventory Total current assets Long-Term assets Property, Plant \& Equipment Less: Depreciation Net Long-Term Assets Liabilities and Owners' Equity Current Liabilities A/P Accounts payable Notes payable Accruals Total current liabilities Long-term bonds \& notes payable Total liabilities Common stock Retained earnings Total equity Total liabilities and equity Your Company's 3 Years of Income Statements For the Year ending on December 31 for each Year Study Question \#1 - Now that you have prepared three years of common size income statements for your company, what do the trends tell you about the company's sales, EBIT, and net income? Are they growing sales, EBIT and net income? Your Answer: The trends within the companies sale's, EBIT, and net income is that in the beginning and ending of the three years the company was doing based off profitablility, however, in the middle of the three years in 2020 the company was faced will tremendously low income margins. Even though there was an impact on EBIT and net income, the overall net sales stood steady based off consumers. Study Question \#2 - Looking again at the three years of common size income statements for your company, what do the trends tell you about the company's cost of goods sold, and other costs and expenses? Are they controlling COGS, and other costs and expenses? Your Answer: Study Question \#3 - Looking again at the three years of common size income statements for your company, give at least three (3) recommendations that would help improve your company's financial performance. Your Answer: Study Question \#4 - Now that you have prepared three years of common size balance sheets for your company, what do the trends tell you about the company's current assets? Are they holding the right amount of current assets, too much, or too little? Study Question \#6 - Looking again at the three years of common size balance sheets for your company, what do the trends tell you about the company's current liabilities? Are they holding the right amount of current liabilities, too much, or too little? Your Answer: Study Question \#7 - Looking again at the three years of common size balance sheets for your company, what do the trends tell you about the company's longterm debt (bonds and notes payable)? Are they holding the right amount of debt, too much, or too little? Your Answer: Study Question \#8 - Looking again at the three years of common size balance sheets for your company, what do the trends tell you about the company's common stock and retained earnings? Are they holding the right amount of common stock and retained earnings? How could the company increase its retained earnings? Your Answer: Study Question \#9 - List at least two recommendations to improve your company's asset side of the balance sheet. Tip: try to think of at least two of the accounts/items on the asset side of the balance that could be improved. Your Answer: Study Question \#10 - List at least two recommendations to improve your company's liability and equity side of the balance sheet. Tip: try to think of at least two of the accounts/items on the liability and equity side of the balance that could be improved. Your