Question

Six years ago, Polly Preeti set up a small factory in Invercargill to manufacture jewellery. In the first few years, she attempted to create high

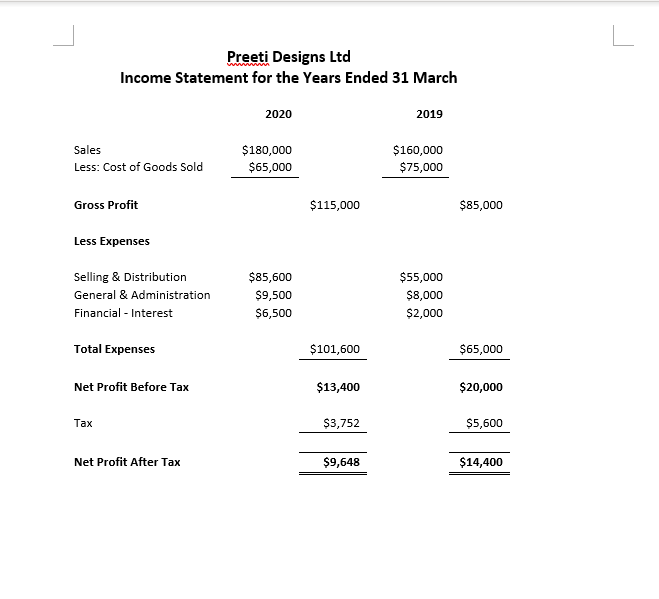

Six years ago, Polly Preeti set up a small factory in Invercargill to manufacture jewellery. In the first few years, she attempted to create high quality jewellery that would sell at a premium. Last year, she experimented with a new business strategy that focussed on two things: 1) lowering manufacturing costs by investing in robotic machinery and using lower quality materials, and 2) increasing sales volume by increasing the advertising budget.

The Business Bank of Southland declined her application for an additional loan, so Polly decided to take a loan from one of her suppliers, Gold Supply (Southland) Ltd.

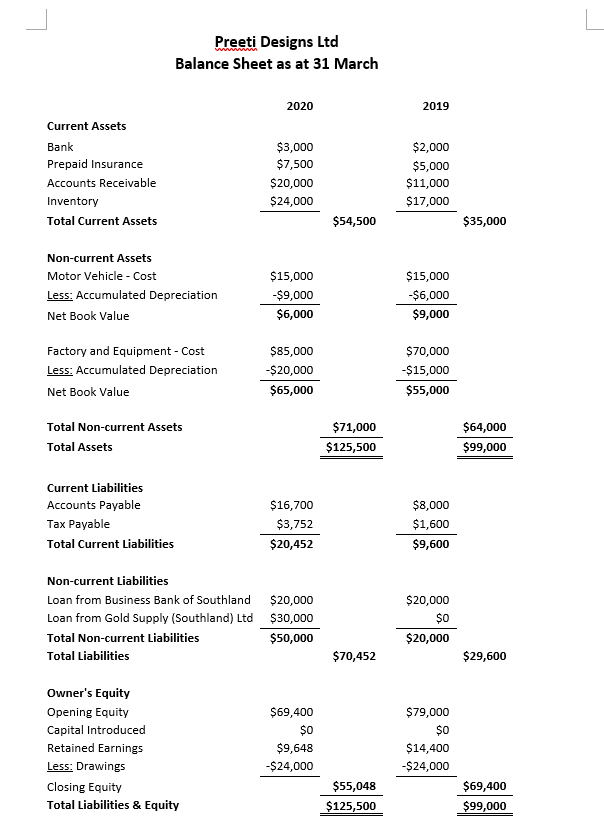

In order to get your advice, she has provided you with her financial statements for 2020 and 2019. Her balance date is 31 March.

Required:

- Report back to Polly on the current financial state of her business. The report should contain the following items:

- A overview and interpretation of the key findings from your ratio analysis in these areas:

- Profitability and expenses of operations (4 marks)

- Financial stability and liquidity (4 marks)

- Asset utilisation and efficiency (4 marks)

- Two suggestions for Polly to improve her business. The suggestions must be specific and contain sufficient details to be implemented. (4 marks each; 8 marks total)

- Two limitations of your analysis. (1 mark each; 2 marks total)

- A overview and interpretation of the key findings from your ratio analysis in these areas:

Word guide for report: Approximately 20-30 words per mark.

All information are here, and there is only one question need to be answered

Preeti Designs Ltd Balance Sheet as at 31 March 2020 2019 Current Assets Bank Prepaid Insurance Accounts Receivable Inventory Total Current Assets $3,000 $7,500 $20,000 $24,000 $2,000 $5,000 $11,000 $17,000 $54,500 $35,000 Non-current Assets Motor Vehicle - Cost Less: Accumulated Depreciation Net Book Value $15,000 -$9,000 $6,000 $15,000 -$6,000 $9,000 Factory and Equipment - Cost Less: Accumulated Depreciation Net Book Value $85,000 -$20,000 $65,000 $70,000 $15,000 $55,000 Total Non-current Assets Total Assets $71,000 $125,500 $64,000 $99,000 Current Liabilities Accounts Payable Tax Payable Total Current Liabilities $16,700 $3,752 $20,452 $8,000 $1,600 $9,600 $20,000 Non-current Liabilities Loan from Business Bank of Southland Loan from Gold Supply (Southland) Ltd Total Non-current Liabilities Total Liabilities $20,000 $30,000 $50,000 SO $20,000 $70,452 $29,600 $69,400 $79,000 $0 Owner's Equity Opening Equity Capital Introduced Retained Earnings Less: Drawings Closing Equity Total Liabilities & Equity $9,648 -$24,000 $14,400 $24,000 $55,048 $125,500 $69,400 $99,000 Preeti Designs Ltd Income Statement for the Years Ended 31 March 2020 2019 Sales Less: Cost of Goods Sold $180,000 $65,000 $160,000 $75,000 Gross Profit $115,000 $85,000 Less Expenses Selling & Distribution General & Administration Financial - Interest $85,600 $9,500 $6,500 $55,000 $8,000 $2,000 Total Expenses $101,600 $65,000 Net Profit Before Tax $13,400 $20,000 Tax $3,752 $5,600 Net Profit After Tax $9,648 $14,400 Preeti Designs Ltd Balance Sheet as at 31 March 2020 2019 Current Assets Bank Prepaid Insurance Accounts Receivable Inventory Total Current Assets $3,000 $7,500 $20,000 $24,000 $2,000 $5,000 $11,000 $17,000 $54,500 $35,000 Non-current Assets Motor Vehicle - Cost Less: Accumulated Depreciation Net Book Value $15,000 -$9,000 $6,000 $15,000 -$6,000 $9,000 Factory and Equipment - Cost Less: Accumulated Depreciation Net Book Value $85,000 -$20,000 $65,000 $70,000 $15,000 $55,000 Total Non-current Assets Total Assets $71,000 $125,500 $64,000 $99,000 Current Liabilities Accounts Payable Tax Payable Total Current Liabilities $16,700 $3,752 $20,452 $8,000 $1,600 $9,600 $20,000 Non-current Liabilities Loan from Business Bank of Southland Loan from Gold Supply (Southland) Ltd Total Non-current Liabilities Total Liabilities $20,000 $30,000 $50,000 SO $20,000 $70,452 $29,600 $69,400 $79,000 $0 Owner's Equity Opening Equity Capital Introduced Retained Earnings Less: Drawings Closing Equity Total Liabilities & Equity $9,648 -$24,000 $14,400 $24,000 $55,048 $125,500 $69,400 $99,000 Preeti Designs Ltd Income Statement for the Years Ended 31 March 2020 2019 Sales Less: Cost of Goods Sold $180,000 $65,000 $160,000 $75,000 Gross Profit $115,000 $85,000 Less Expenses Selling & Distribution General & Administration Financial - Interest $85,600 $9,500 $6,500 $55,000 $8,000 $2,000 Total Expenses $101,600 $65,000 Net Profit Before Tax $13,400 $20,000 Tax $3,752 $5,600 Net Profit After Tax $9,648 $14,400Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started