Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Siyabakulisa (Pty) Ltd (Siyabakulisa) is a small manufacturing company. The accounting staff consisting of the accountant, Zandile Zulu, and two clerical assistants, Mlungisi Dube and

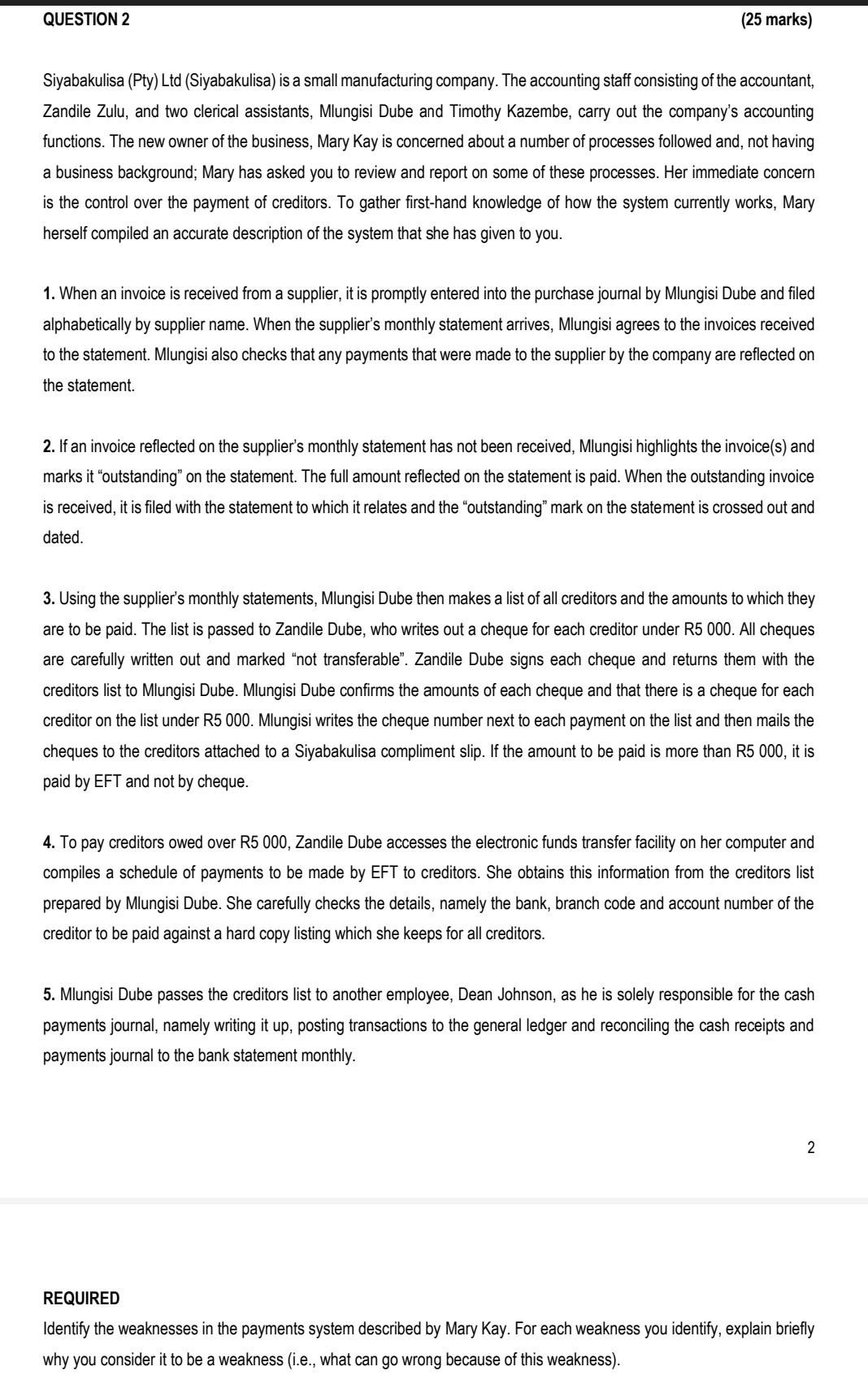

Siyabakulisa (Pty) Ltd (Siyabakulisa) is a small manufacturing company. The accounting staff consisting of the accountant, Zandile Zulu, and two clerical assistants, Mlungisi Dube and Timothy Kazembe, carry out the company's accounting functions. The new owner of the business, Mary Kay is concerned about a number of processes followed and, not having a business background; Mary has asked you to review and report on some of these processes. Her immediate concern is the control over the payment of creditors. To gather first-hand knowledge of how the system currently works, Mary herself compiled an accurate description of the system that she has given to you. 1. When an invoice is received from a supplier, it is promptly entered into the purchase journal by Mlungisi Dube and filed alphabetically by supplier name. When the supplier's monthly statement arrives, Mlungisi agrees to the invoices received to the statement. Mlungisi also checks that any payments that were made to the supplier by the company are reflected on the statement. 2. If an invoice reflected on the supplier's monthly statement has not been received, Mlungisi highlights the invoice(s) and marks it "outstanding" on the statement. The full amount reflected on the statement is paid. When the outstanding invoice is received, it is filed with the statement to which it relates and the "outstanding" mark on the statement is crossed out and dated. 3. Using the supplier's monthly statements, Mlungisi Dube then makes a list of all creditors and the amounts to which they are to be paid. The list is passed to Zandile Dube, who writes out a cheque for each creditor under R5 000 . All cheques are carefully written out and marked "not transferable". Zandile Dube signs each cheque and returns them with the creditors list to Mlungisi Dube. Mlungisi Dube confirms the amounts of each cheque and that there is a cheque for each creditor on the list under R5 000. Mlungisi writes the cheque number next to each payment on the list and then mails the cheques to the creditors attached to a Siyabakulisa compliment slip. If the amount to be paid is more than R5 000, it is paid by EFT and not by cheque. 4. To pay creditors owed over R5 000, Zandile Dube accesses the electronic funds transfer facility on her computer and compiles a schedule of payments to be made by EFT to creditors. She obtains this information from the creditors list prepared by Mlungisi Dube. She carefully checks the details, namely the bank, branch code and account number of the creditor to be paid against a hard copy listing which she keeps for all creditors. 5. Mlungisi Dube passes the creditors list to another employee, Dean Johnson, as he is solely responsible for the cash payments journal, namely writing it up, posting transactions to the general ledger and reconciling the cash receipts and payments journal to the bank statement monthly. REQUIRED Identify the weaknesses in the payments system described by Mary Kay. For each weakness you identify, explain briefly why you consider it to be a weakness (i.e., what can go wrong because of this weakness)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started