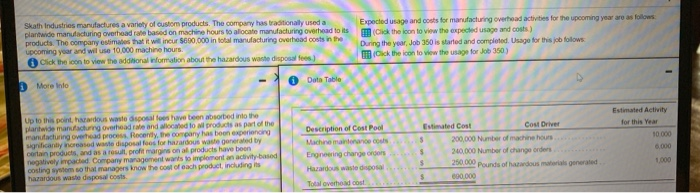

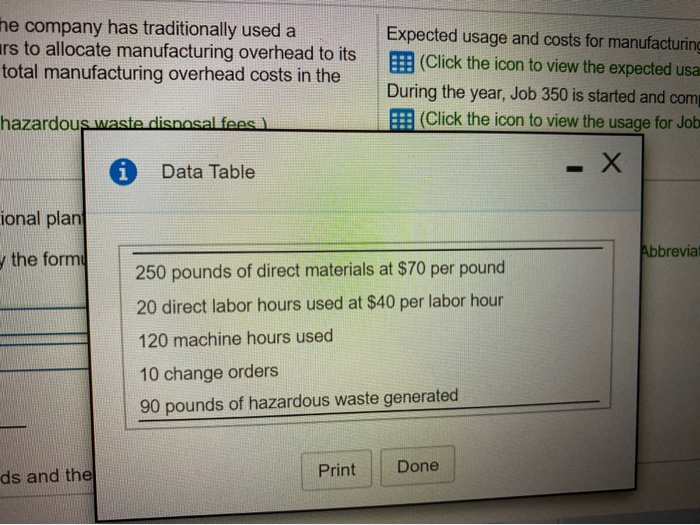

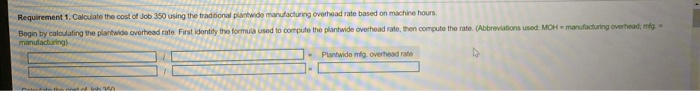

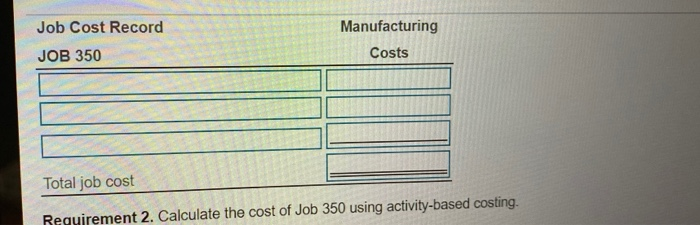

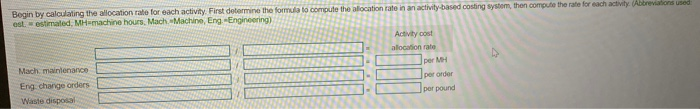

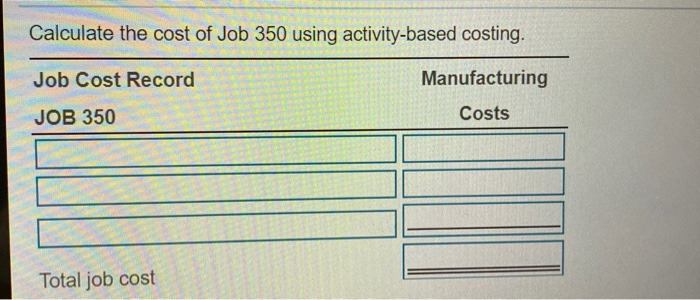

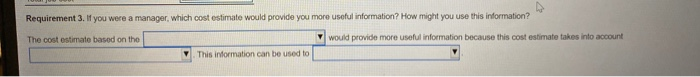

Skath Industries manufactures a variety of custom products. The company has traditionally used a plantwido manufacturing overhead rate based on machine hours to allocate manufacturing overhead to its products. The company estimates that it will incur $600,000 in total manufacturing overhead costs in the upcoming year and will use 10.000 machine hours Click the icon to view the additional information about the hazardous waste disposal fees) Expected usage and costs for manufacturing overhead activities for the upcoming year are as follows Chok the icon to view the expected usage and costs) During the year, Job 350 is started and completed Usage for this job folows Click the icon to view the usage for Job 350) 0 Data Table 1 More Indo Estimated Activity for this year 10 000 up to this point, hardous waste disposal to have been absorbed into the planta de manufacturing overhead role and allocated to products as part of the manufacturing overhead process. Recently, the company has been experiencing significantly increased waste disposal fees for hazardous waste generated by certain products, and as a result, profit margins on al products have been negatively impacted Company management wants to implement an activity based costing systems that managers know the cost of each product, including its hazardous waste disposal costs Description of Cost Pool Machine maintenance cos Engineering change orders Hazardous waste disposal Total overhead cost Estimated Cost Cost Driver s 200,000 Number of machine hours 240,000 Number of change orders 5 250.000 Pounds of hazardous was generated 5 800.000 the company has traditionally used a ars to allocate manufacturing overhead to its total manufacturing overhead costs in the Expected usage and costs for manufacturing (Click the icon to view the expected usa During the year, Job 350 is started and com (Click the icon to view the usage for Job hazardous waste disnosal fees i Data Table .X ional plan Abbrevia the formy 250 pounds of direct materials at $70 per pound 20 direct labor hours used at $40 per labor hour 120 machine hours used 10 change orders 90 pounds of hazardous waste generated Print Done ds and the Requirement 1. Calculate the cost of Job 350 using the traditional plantwido manufacturing overhead rate based on machine hours Begin by calculating the plantwide overhead rate. First identity the formula used to compute the plantwide overhead rate, then compute the rate. (Abbreviations used MOH = manufacturing overhead, mig manufacturing Plantwide mig overhead rate hthu Job Cost Record Manufacturing Costs JOB 350 Total job cost Requirement 2. Calculate the cost of Job 350 using activity-based costing. Begin by calculating the allocation rate for each activity. First determine the formula to compute the allocation rate in an activity based costing system, then compute the rate for each activity. (Abbreviations used: est estimated, MH machine hours. Mach Machine Eng Engineering) Activity cost alocation rate Mach maintenance per MM Eng. change orders per order Waste disposal per pound Calculate the cost of Job 350 using activity-based costing. Job Cost Record Manufacturing JOB 350 Costs Total job cost Requirement 3. If you were a manager, which cost estimate would provide you more useful information? How might you use this information? The cost estimate based on the would provide more useful information because this cost estimate takes into account This information can be used to