Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ski Inc. (SI) is a public company that has been in business since the 1980s. It owns and operates over 20 ski clubs across

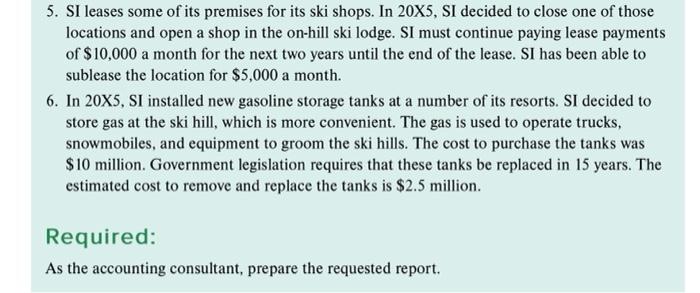

Ski Inc. (SI) is a public company that has been in business since the 1980s. It owns and operates over 20 ski clubs across Canada. SI also owns and operates ski shops where customers can rent or buy ski equipment. SI has a bonus plan based on net income. SI started operations with one ski club and continued to expand through purchasing existing ski clubs. SI has a bank loan with Canadian Bank. SI had a tough year last year in 20X5 with its first-ever taxable loss of $400,000 due to low snowfalls and lower than normal guest revenues. SI needed to increase its financing with the bank and now the bank requires a minimum current ratio be maintained. You have recently been hired as an accounting consultant to assist SI's board of directors. You have been asked to develop appropriate accounting policies for events that have occurred during 20X5. The board has asked that you explain fully your analysis for your recommendations. SI has a December 31 year-end. The incremental borrowing rate for SI is 8%. 1. SI's ski clubs are very popular and have a wait list for memberships. Potential members can pay a $500 nonrefundable fee to obtain a spot on the wait list for a membership. The average time on the wait list is three to five years. Once a membership spot becomes available, the $500 is deducted from the initiation fee. Members are required to pay a $10,000 initiation fee to join the club. In addition, they pay an annual fee of $2,000, which is due September 1 for the following ski season. Members can bring guests to the club. They make a reservation for the guest. The guests pay by credit card on the day they ski. If a guest does not show up, the member is charged the fee. 2. In the summer of 20X5, SI offered two special promotions to try to increase guest revenue. The first was that guests can buy a special pass for a flat fee of $100, which includes a ski pass for the day and a free lesson for any time within the next year. The cost of the ski pass on its own is $80 and the cost of the lesson is $50 on its own. The second is that SI distributed 200 coupons in the surrounding area for $5 of a lift pass. 3. SI purchased a new high-speed chair lift in 20X5. The manufacturer of the ski lift offered a 0% loan as an incentive to purchase. The chair lift cost $2.5 million and the loan is due in two years. 4. In 20X5, a guest slipped on ice and was injured in the parking lot of the ski club. The guest sued SI for damages. Lawyers for SI say the case has no merit based on past lawsuits. The board has decided to settle the lawsuit to avoid negative publicity. The estimated range for the payment is between $200,000 and $300,000. 5. SI leases some of its premises for its ski shops. In 20X5, SI decided to close one of those locations and open a shop in the on-hill ski lodge. SI must continue paying lease payments of $10,000 a month for the next two years until the end of the lease. SI has been able to sublease the location for $5,000 a month. 6. In 20X5, SI installed new gasoline storage tanks at a number of its resorts. SI decided to store gas at the ski hill, which is more convenient. The gas is used to operate trucks, snowmobiles, and equipment to groom the ski hills. The cost to purchase the tanks was $10 million. Government legislation requires that these tanks be replaced in 15 years. The estimated cost to remove and replace the tanks is $2.5 million. Required: As the accounting consultant, prepare the requested report.

Step by Step Solution

★★★★★

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

The ski club is a Canadianbased public company that is involved in the business of selling and renti...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started