Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Skiles Coporation is a manufacturer of classic rocking chairs. The company has been using a particular sanding and finishing machine for over 10 years and

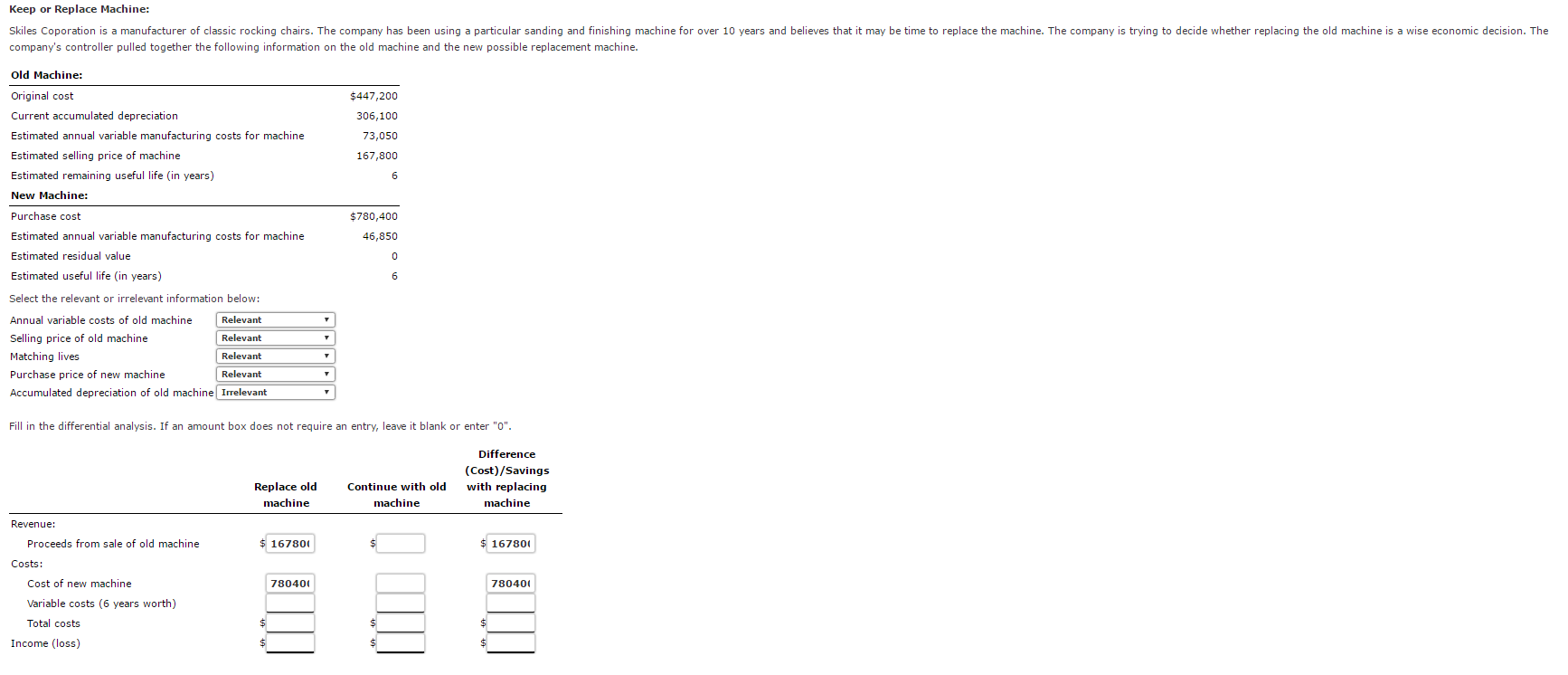

Skiles Coporation is a manufacturer of classic rocking chairs. The company has been using a particular sanding and finishing machine for over 10 years and believes that it may be time to replace the machine. The company is trying to decide whether replacing the old machine is a wise economic decision. The company's controller pulled together the following information on the old machine and the new possible replacement machine.

I'm missing from variable costs (all three columns) and down. I'm sstuck in this one. Please Help!

Keep or Replace Machine: Skiles Coporation is a manufacturer of classic rocking chairs. The company has been using a particular sanding and finishing machine for over 10 years and believes that it may be time to replace the machine. The company is trying to decide whether replacing the old machine is a wise economic decision. The company's controller pulled together the following information on the old machine and the new possible replacement machine. Old Machine: Original cost Current accumulated depreciation Estimated annual variable manufacturing costs for machine Estimated selling price of machine Estimated remaining useful life (in years) New Machine: Purchase cost Estimated annual variable manufacturing costs for machine Estimated residual value Estimated useful life (in years) Select the relevant or irrelevant information below: Annual variable costs of old machine Selling price of old machine Matching lives Purchase price of new machine Accumulated depreciation of old machine Irrelevant $447,200 306,100 73,050 167,800 $780,400 46,850 Relevant Relevant Relevant Relevant Fill in the differential analysis. If an amount box does not require an entry, leave it blank or enter "O". Difference (Cost)/Savings with replacing machine Replace old machine Continue with old machine Revenue: Proceeds from sale of old machine 16780 16780 Costs: Cost of new machine Variable costs (6 years worth) Total costs 78040 78040 ncome (loSSStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started