Answered step by step

Verified Expert Solution

Question

1 Approved Answer

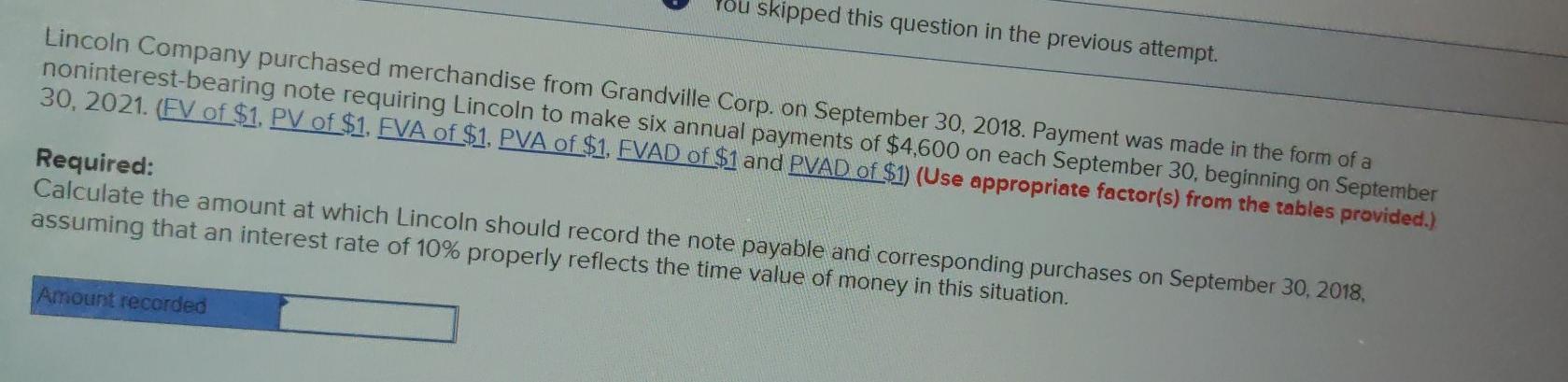

skipped this question in the previous attempt. Lincoln Company purchased merchandise from Grandville Corp. on September 30, 2018. Payment was made in the form of

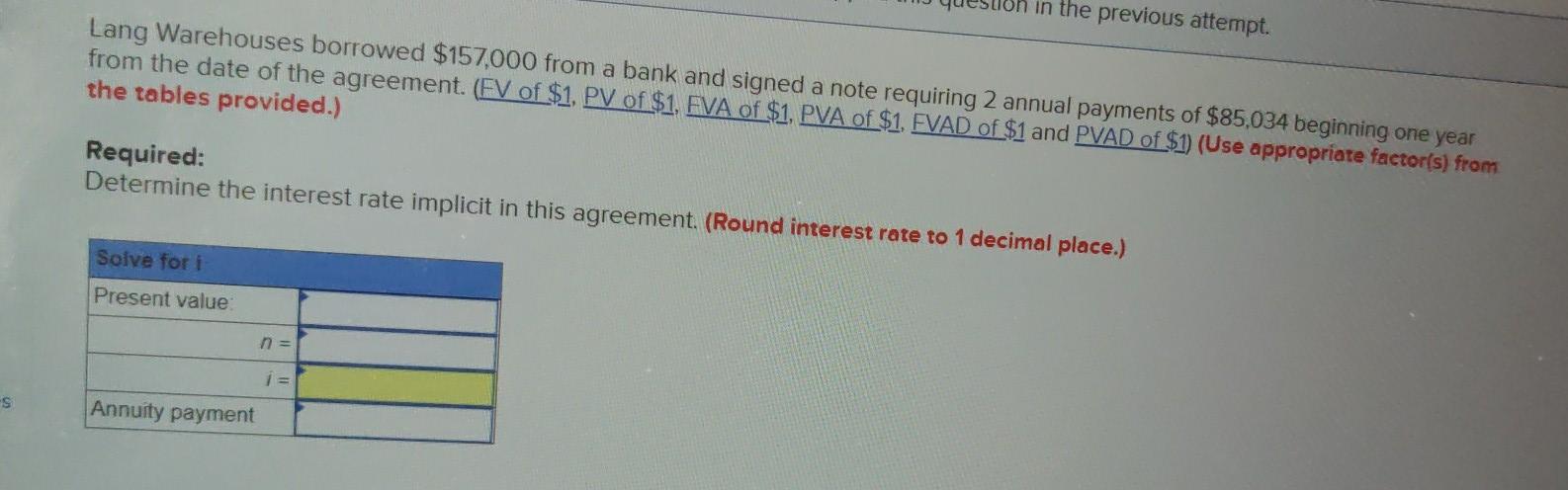

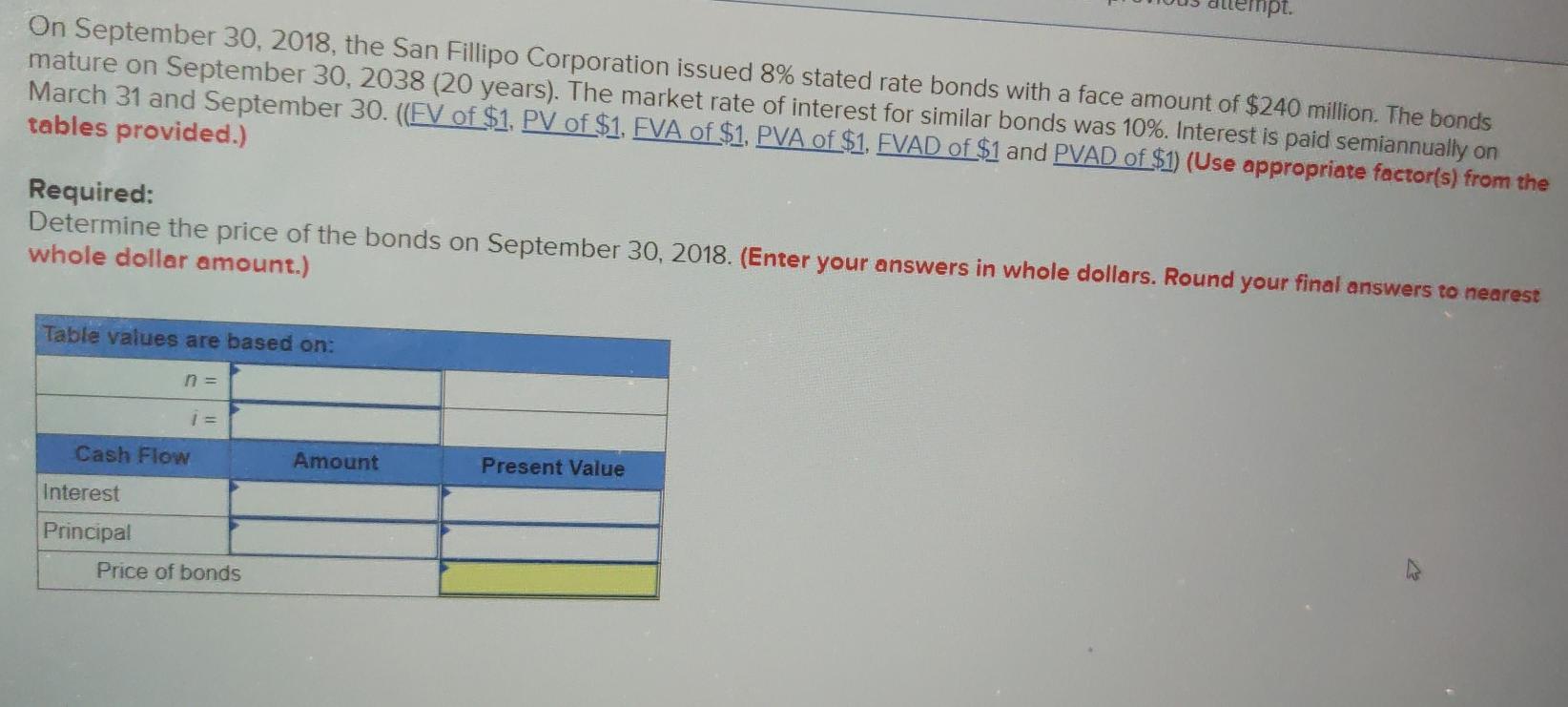

skipped this question in the previous attempt. Lincoln Company purchased merchandise from Grandville Corp. on September 30, 2018. Payment was made in the form of a noninterest-bearing note requiring Lincoln to make six annual payments of $4,600 on each September 30, beginning on September 30, 2021. (FV of $1. PV of $1, FVA of $1. PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: Calculate the amount at which Lincoln should record the note payable and corresponding purchases on September 30, 2018, assuming that an interest rate of 10% properly reflects the time value of money in this situation. Amount recorded in the previous attempt. Lang Warehouses borrowed $157,000 from a bank and signed a note requiring 2 annual payments of $85,034 beginning one year from the date of the agreement. (FV of $1. PV of $1. FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: Determine the interest rate implicit in this agreement. (Round interest rate to 1 decimal place.) Solve for i Present value n = -S Annuity payment mpt. On September 30, 2018, the San Fillipo Corporation issued 8% stated rate bonds with a face amount of $240 million. The bonds mature on September 30, 2038 (20 years). The market rate of interest for similar bonds was 10%. Interest is paid semiannually on March 31 and September 30. ((EV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: Determine the price of the bonds on September 30, 2018. (Enter your answers in whole dollars. Round your final answers to nearest whole dollar amount.) Table values are based on: n = 1 = Cash Flow Amount Present Value Interest Principal Price of bonds

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started